US Dollar Index: Climbs above 104.00 as Powell’s hawkish tone reverberates through markets

- DXY climbed 0.18% to 104.197 after Powell’s hawkish remarks, signaling a stronger dollar against a basket of six major currencies.

- CME FedWatch Tool indicates a 46.7% chance of a 25 bps rate hike in November, challenging previous estimates of the Fed holding rates steady.

- Mixed signals from the Treasury yield curve and diverging views from Fed officials like Harker and Mester add complexity to rate hike expectations.

The US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, advances 0.18% and exchanges hands at 104.197 following a hawkish speech from the US Federal Reserve Chair Jerome Powell at Jackson Hole.

Wall Street defies gravity while US Treasury yields are mixed; market eyes upcoming economic data

Despite Powell’s remarks, Wall Street trades in the green, gaining between 0.10% and 0.34%. US Treasury bond yields rise in the short-end of the curve, reflecting a hike in interest rates, while the belly and long-end drop between 0.05% and 0.30%.

The US 2-year Treasury note yield, the most sensitive to interest rate shifts, edges up three basis points, while the CME FedWatch Tool shows the market is pricing a 25 bps at the November meeting, with odds at 46.7%, above estimates for the Fed to hold rates unchanged.

The US Federal Reserve Chair Jerome Powell highlighted the ongoing concerns of the central bank regarding elevated inflation. He indicated that further rate hikes could be considered “appropriate” but stressed that these decisions would continue to rely on incoming data. Powell mentioned that while two consecutive months of positive inflation data are a positive sign, he underscored the significance of staying aligned with the Fed’s 2% inflation target, indicating that there is still a considerable journey ahead.

In light of robust economic expansion and a constrained labor market, Federal Reserve Chair Powell emphasized the need for continued tightening measures. He stated that additional rate hikes would be warranted if these positive economic indicators do not exhibit signs of relaxation. Powell acknowledged the potential risks associated with excessive and insufficient tightening while projecting the July Personal Consumption Expenditure (PCE) at 3.3% and the core PCE at 4.3%.

Recently, Philadelphia Fed’s Patrick Harker remarked that current interest rates are already at a restrictive level, and in the event inflation falters, there might be a necessity for additional rate hikes. Conversely, Cleveland Fed President Loretta Mester acknowledged that the economy has gained momentum, as evidenced by GDP and labor market indicators. She highlighted that a lower growth rate would be necessary to temper inflation while emphasizing the ongoing debate revolves around whether the present rates are sufficiently restrictive to attain the inflation target.

Next week, the US economic docket will feature the CB Consumer Confidence, JOLTs report, preliminary GDP data, inflation figures, ISM PMI and further Fed speakers.

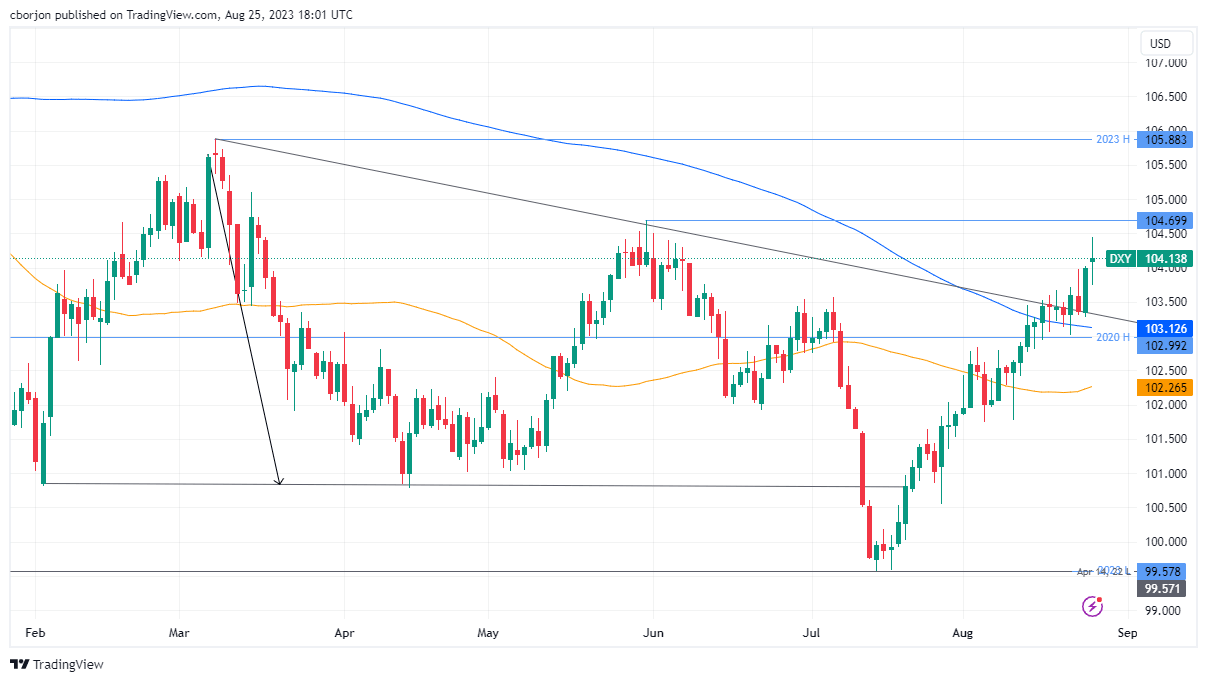

USD Dollar Index Price Analysis: Technical outlook

From a technical standpoint, the DXY shifted upward bias, as it crossed the 200-day Moving Average (DMA) on August 16, showing signs of consolidation but not of retracing below the 200-DMA. A breach of the 104.699 level and the 105.000 mark would be up for grabs. Conversely, dropping below the 200-DMA would send the DXY diving towards the 50-DMA at 102.265.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.