Stock of the day: Intesa Sanpaolo (ISP Stock)

In this piece, we will analyze Intesa Sanpaolo (ISP), a company in the Italian banking sector. The European banking sector has had its own ups and downs. We can say that European banks have been of interest for a long time. Covid and the post covid recovery have just added some additional spice to the mix.

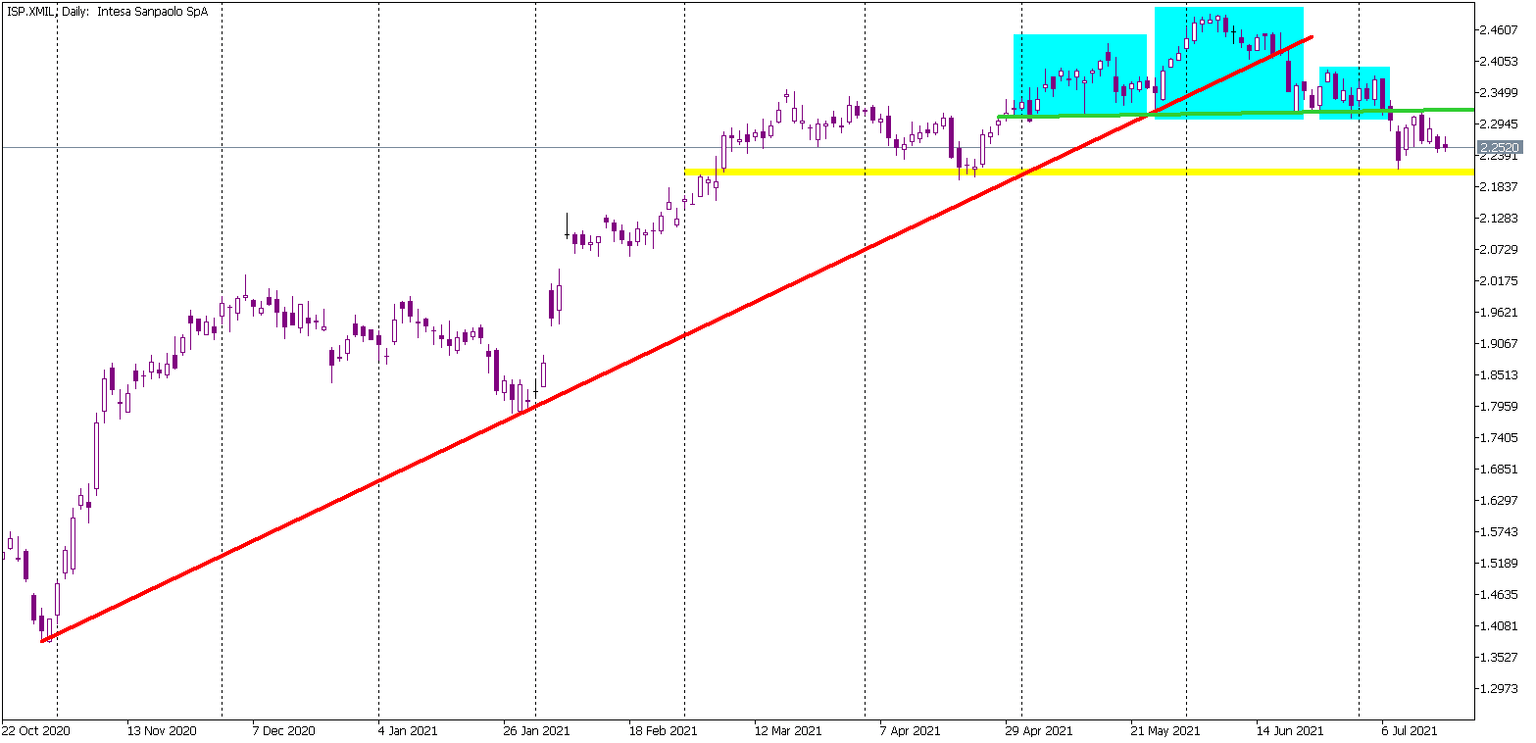

Currently, ISP is not doing particularly well. Since the beginning of June, the price has been going down. We can also spot a few technical aspects that are making a further decline more probable.

The first one is the head and shoulders pattern (blue), which is already active as the price broke its neckline (green). We’ve also already tested the neckline as resistance and bounced from it, which is definitely a bearish sign. What’s more, is that we’re below the mid-term uptrend line (red) and I don’t think we have to explain what that means.

Currently, the closest support is on the 2.21 EUR (yellow), and in my opinion, we should get there relatively soon. What will happen next, depends on the price action there. The breakout will give us another sell signal and the bounce will give buyers hope and an occasion for a bullish correction. With the current price movements, the second scenario seems a little bit less probable.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.