S&P 500 settles Tuesday at $4,357 as investors hope for a receding Fed

- US equities saw mild lift on Tuesday, with broader indexes rising across the board.

- Investors are leaning into expectations of no more rate hikes from the Fed.

- With US inflation figures due later this week, investors will get the chance to readjust their expectations.

The Standard & Poor's 500 major equity index climbed on Tuesday, reaching an intraday peak of $4,382.92 before settling back slightly into $4,357, gaining 22.58 points, or 0.52%.

The other major equity boards saw similar gains for the day, with the Dow Jones Industrial Average (DJIA) climbing 134.65 points to $33,739.30, gaining 0.40%, and the NASDAQ Composite index rising 78.60 point to close up 0.58% at $13,562.84.

Federal Reserve (Fed) officials came in mixed on Tuesday, but mostly on-brand for the US central bank; inflation remains elevated, but the Fed sees price growth pressures subsiding into the future, and if inflation figures continue to waft softly lower, it's unlikely that the Fed will see additional rate hikes to close out 2023.

Fed officials cool inflation expectations, but warn that policy room remains

Fed's Bostic: We don't need to increase rates any more

NY Fed's Perli: No sign yet Fed needs to change balance sheet plans

Fed's Kashkari: We may have to raises rates further if the economy stays too strong

The weekend's geopolitical escalation of the long-running Israel-Hamas conflict saw concerns about stability in the Middle East on the rise, but equities have absorbed the escalation, and investors will be keeping an eye out for an escalation of combative rhetoric from the US against Iran or Saudi Arabia.

The US, an ardent supporter of Israel, has a finger on the trigger if Iran makes any moves to prop up the Palestinian Hamas, but despite the risks, equity markets have shrugged off the potential for escalation until more evidence presents itself.

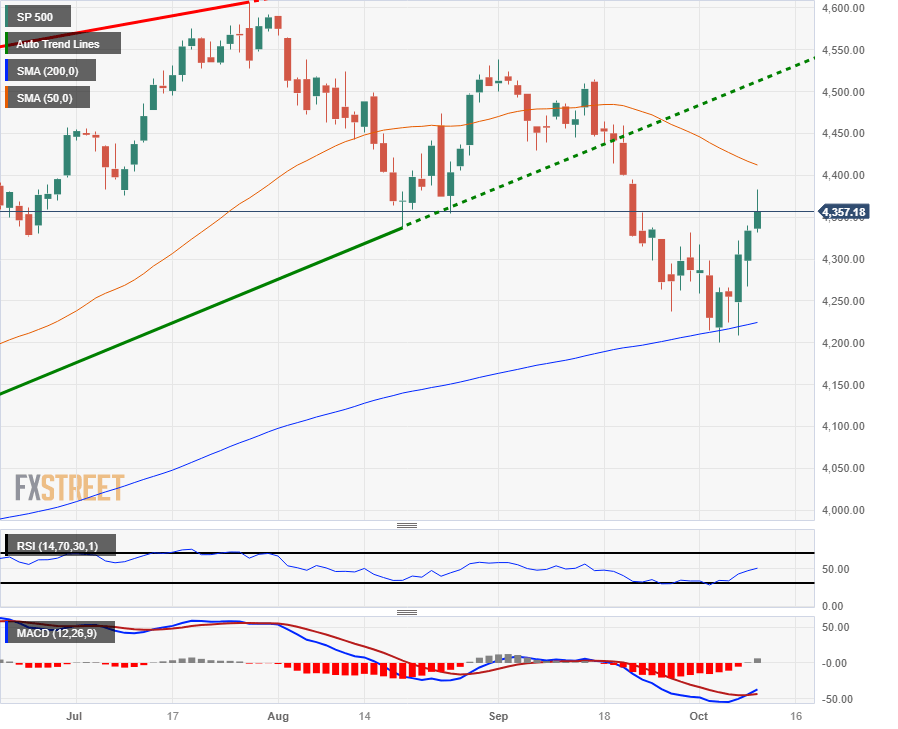

S&P 500 Technical Outlook

Tuesday's gains see the S&P 500 edge higher and close in the green for the third consecutive trading day, and the index has closed higher for four of the last five market sessions.

The S&P 500 recently rebounded from the 200-day Simple Moving Average (SMA) near $4,225, but a continuation of bullish momentum will need to overcome a bearish 50-day SMA, currently descending into $4,400.

S&P 500 Daily Chart

S&P 500 Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.