S&P 500 Index renews record high above 3,680 despite disappointing NFP data

- Wall Street's main indexes post small gains after the opening bell.

- Nonfarm Payrolls in the US rose less than expected in November.

- S&P 500 Energy Index is up nearly 3% on Friday.

Major equity indexes started the last day of the week in the positive territory as investors largely ignored the disappointing November labor market report. As of writing, The Dow Jones Industrial Average was up 0.36% on the day at 30,075, the S&P 500 was gaining 0.35% at 3,683 (new record high) and the Nasdaq Composite was advancing 0.05% at 12,473.

The monthly data published by the US Bureau of Labor Statistics showed on Friday that Nonfarm Payrolls in November rose by 245,000, compared to analysts estimate of 469,000. Additionally, the Labor Force Participation Rate declined to 61.5% from 61.7% and the annual wage inflation remained unchanged at +4.4%.

Among the 11 major S&P 500 sectors, the Energy Index is up nearly 3% after the opening bell supported by a moderate increase in crude oil prices. On the other hand, the Communication Services Index is the only sector that is in the negative territory.

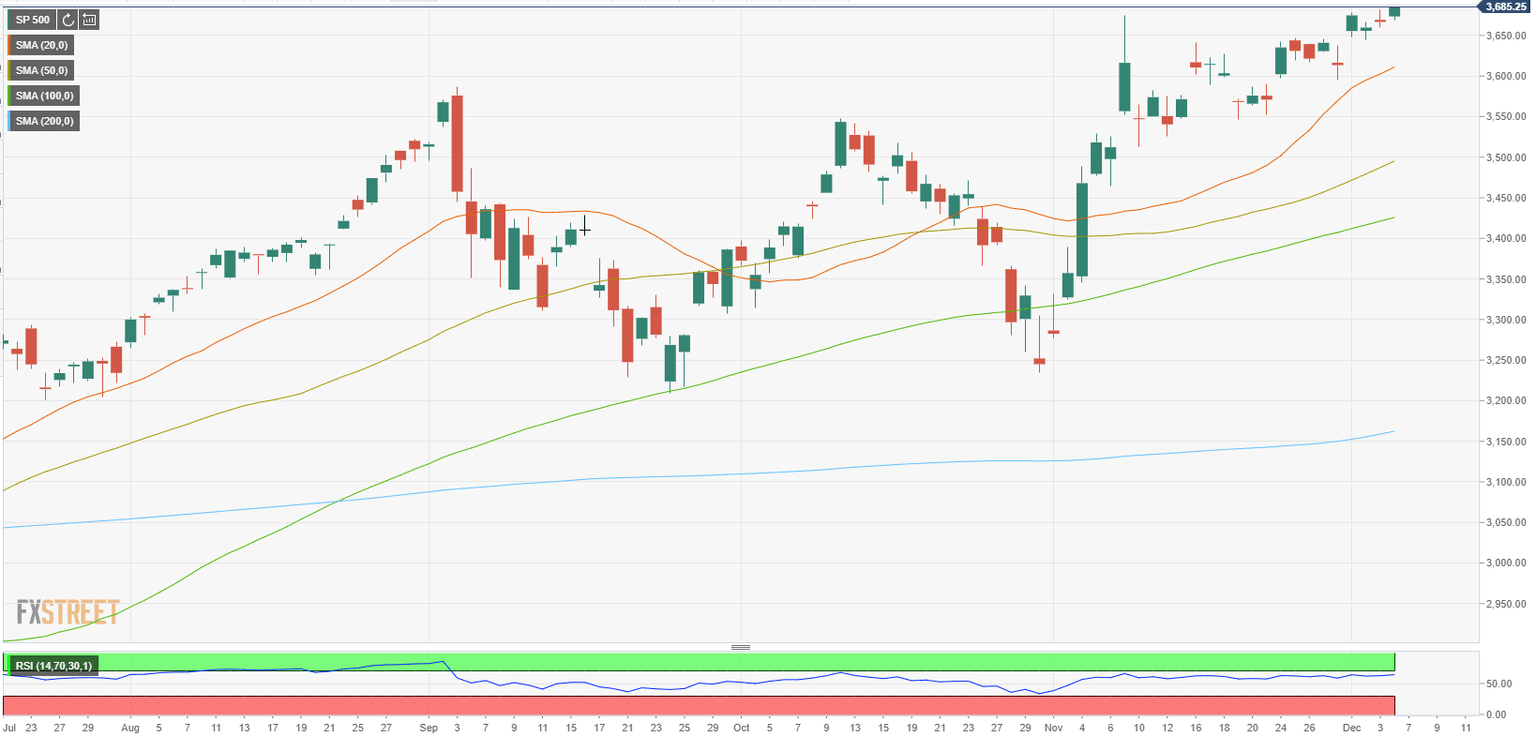

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.