S&P 500 Index notches new all-time high at 3,976

- Wall Street's main indexes trade mixed on Tuesday.

- S&P 500 Index touched a new record high after the opening bell.

- Strong gains witnessed in tech shares help Nasdaq push higher.

Major equity indexes started the day mixed on Tuesday as investors seem to be opting out to stay on the sidelines ahead of the FOMC's policy announcements.

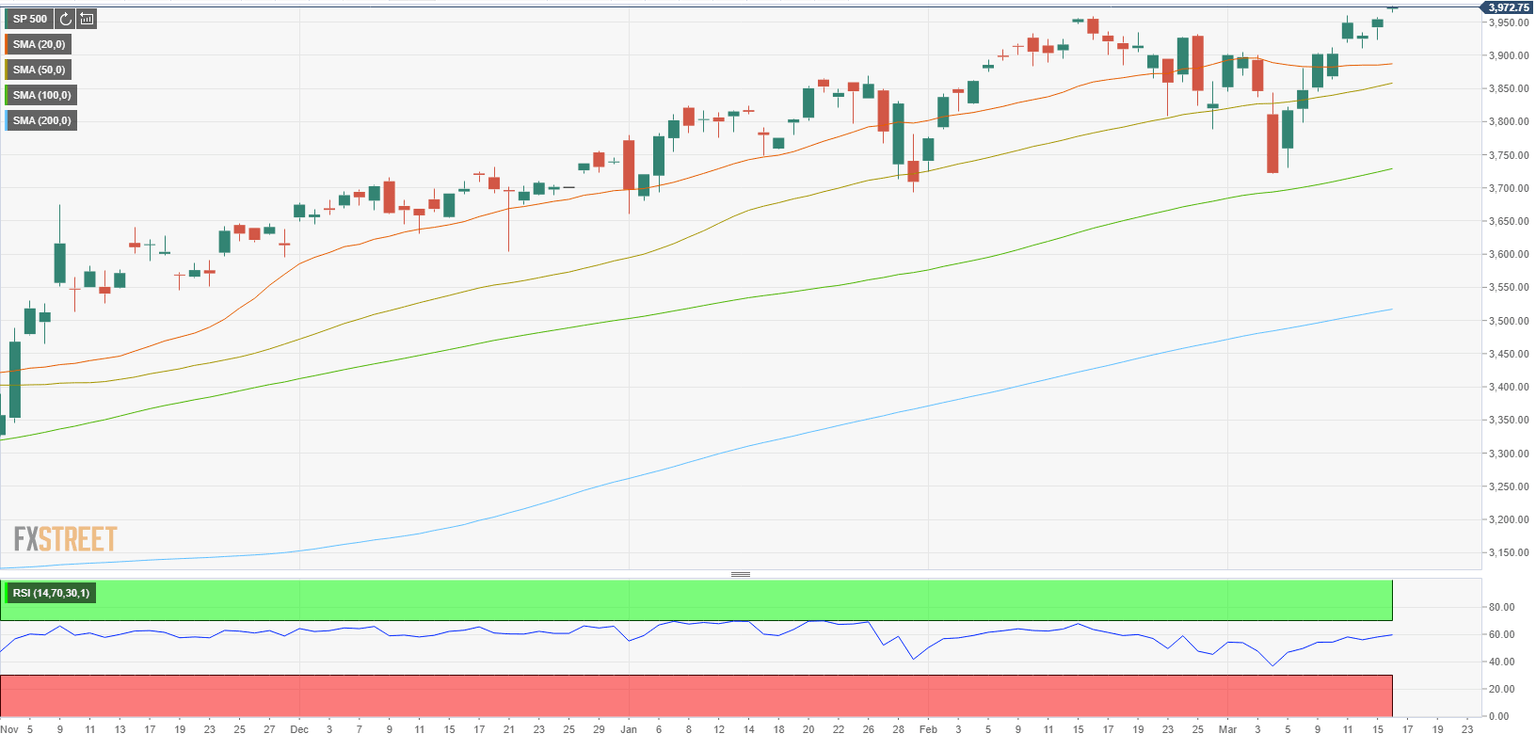

Nevertheless, the S&P 500 Index managed to notch a new record high at 3,976 right after the opening bell and was last seen gaining 0.12% on the day at 3,972. Moreover, the Dow Jones Industrial Average was losing 0.15% at 32,907 and the Nasdaq Composite was rising 0.8% at 13,189.

Financial stocks remain on the back foot on Tuesday as the 10-year US Treasury bond yield is down for the second straight day. Similarly, the Energy Index is losing nearly 2% pressured by a more-than-1% decline in crude oil prices.

On the other hand, the risk-sensitive Communication Services Index and the Technology Index both gain 0.75% as the top performers in the early trade.

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.