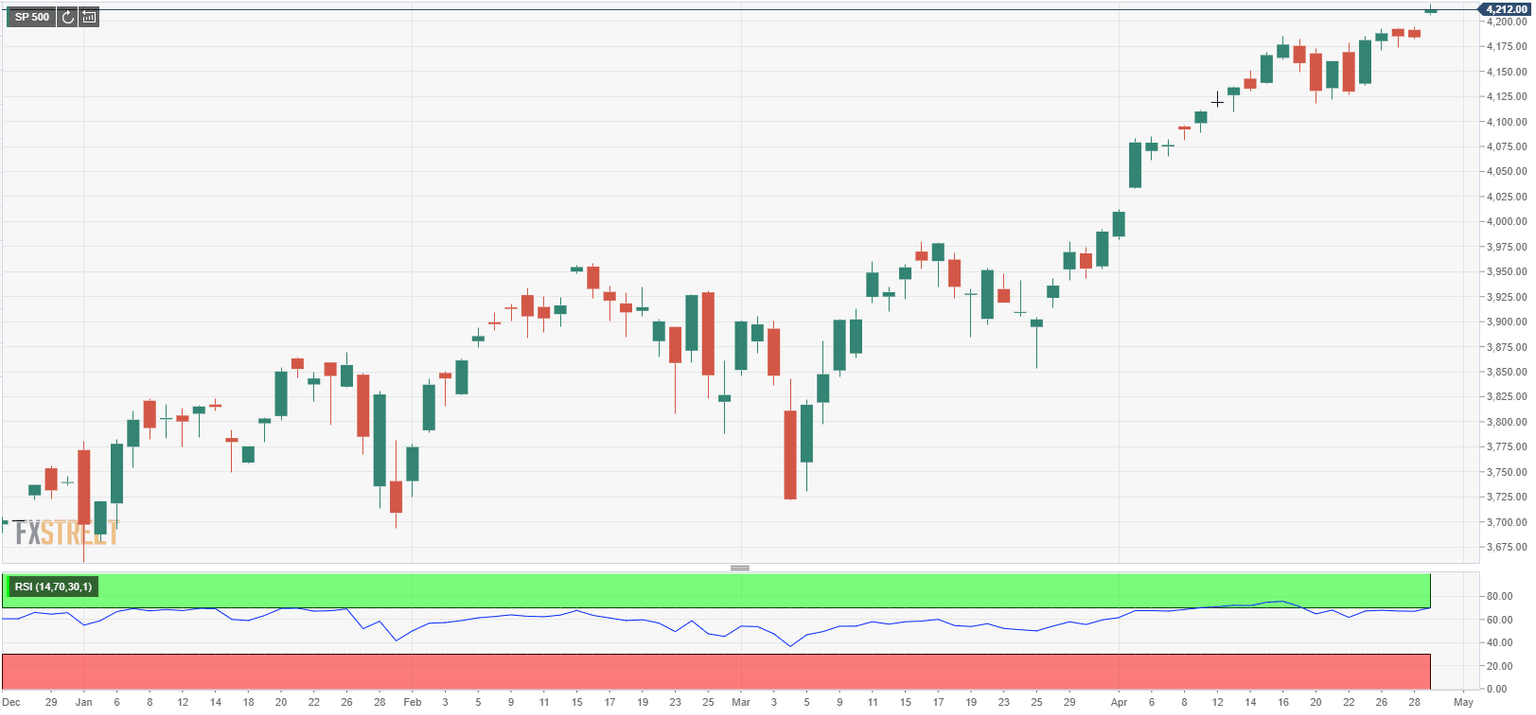

S&P 500 Index notches new all-time high above 4,200

- Wall Street's main indexes opened decisively higher on Thursday.

- US economy grew at a stronger pace than expected in Q1.

- S&P 500 Communication Services Index is up more than 2%.

Major equity indexes in the US opened sharply higher on Thursday as investors cheer the upbeat macroeconomic data releases. As of writing, the S&P 500 Index was up 0.73% at 4,213, a fresh record high, the Nasdaq Composite was rising nearly 1% at 14,036 and the Dow Jones Industrial Average was gaining 0.4% at 33,956.

In its first estimate, the US Bureau of Economic Analysis reported that the Real GDP expanded at an annual rate of 6.4% in the first quarter of 2021. This reading came in better than analysts' estimate of 6.1%. Moreover, the weekly Initial Jobless Claims declined by 13,000 to 553,000.

Among the 11 major S&P 500 sectors, the Communication Services Index is up more than 2% as the top performer after the opening bell. On the other hand, the Healthcare Index is losing 0.3% as the only major sector trading in the negative territory.

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.