S&P 500 enters correction territory, ending Friday just shy of $4,100

- The S&P 500 is extending declines into a two-week stretch, down over 5% for the period.

- S&P index down over 10% from the July peak at $4,600, enters correction territory.

- US Equities mixed on Friday as recession fears, lopsided earnings reports drag on stocks.

The Standard & Poor's index marked in the second losing week in a row, entering correction territory after falling 10% from July's high near $4,600.

The S&P 500 index closed Friday down around 20 points, shedding half a percent close out at $4,117.37, with the Dow Jones Industrial Average sinking over 366 points to shed 1.12%, closing Friday at $32417.59.

The NASDAQ Composite index bucked the bearish trend for Friday, closing up 47.41 points to end the day up almost 0.4%, closing at $12,643 plus one penny.

Equities got pushed broadly lower as inflation continues to remain a sticky problem for the Federal Reserve (Fed), with the US Personal Consumption Expenditure (PCE) Index showed consumer price spending rise by its fastest month-on-month pace since May, with the annual PCE cooling slightly into September, bringing "higher for longer" interest rate concerns back to the forefront.

The Fed is slated for another rate call next Wednesday, and while money markets are pricing in an expected rate hold next week, odds of an additional rate hike at December are steadily rising as the US economy remains firm compared to global competitors and inflation remains stubbornly higher than expected.

S&P Technical Outlook

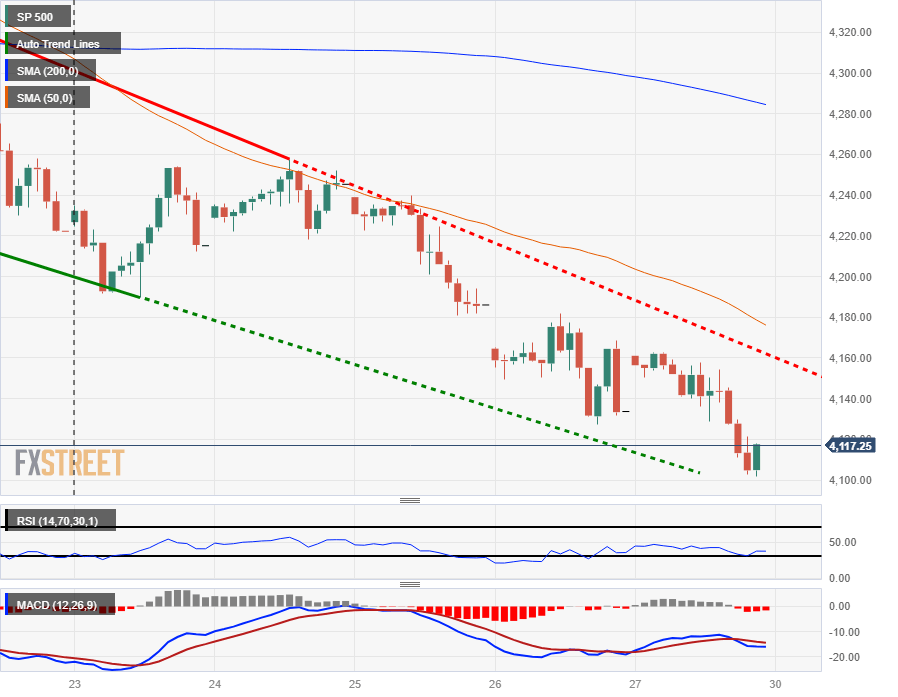

The S&P stopped just short of slipping back into $4,100 in Friday's mostly bearish trading, and the major equity index continues to backslide, entering correction territory from July's peaks, and the S&P has locked in two consecutive weeks of red on the charts.

Daily candlesticks have tumbled past the 200-day Simple Moving Average (SMA) as bearish momentum firms up on the chart paper, and the last swing high into $4,400 sees added technical resistance from the 50-day SMA, currently settling into $4,350.

S&P Hourly Chart

S&P Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.