Silver Price Forecast: $30.0 appears a tough nut to crack for XAG/USD

- Silver price edges higher near $29.40 Wednesday’s Asian session, up 0.40% on the day.

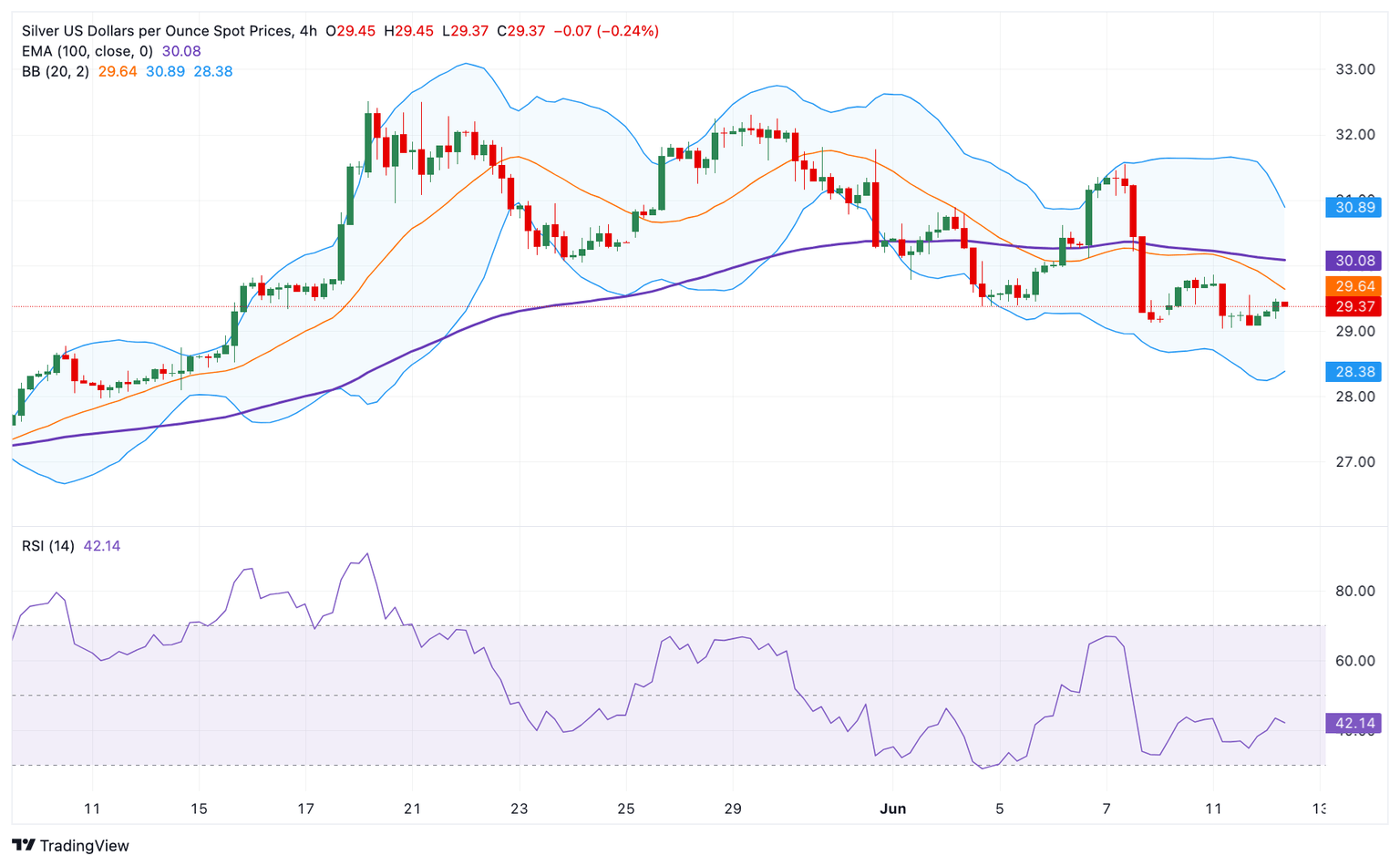

- The negative stance of Silver remains intact below the 100-period EMA, with a bearish RSI indicator.

- The crucial resistance level is seen at the $30.0 psychological mark; the initial support level is located at $29.04.

The Silver price (XAG/USD) recovers to $29.40 on Wednesday despite the stronger Greenback. However, the upside for white metal might be limited by the speculation of delayed rate cuts by the US Federal Reserve (Fed). The market could turn cautious later in the day ahead of the release of the US Consumer Price Index (CPI) and the Fed interest rate decision.

Technically, Silver keeps the bearish vibe unchanged on the 4-hour chart as the white metal holds below the key 100-period Exponential Moving Average (EMA). Furthermore, the downward momentum is supported by the Relative Strength Index (RSI), which stands in the bearish zone near 43.0, suggesting the path of least resistance is to the downside.

The key upside barrier for silver will emerge at $30.0, the psychological mark and 100-period EMA. A decisive break above the latter will see a rally to $30.90, the upper boundary of the Bollinger Band. The additional upside filter to watch is a high of June 7 at $31.55, and finally a high of May 29 at $32.31.

On the flip side, a low of June 11 at $29.04 acts as an initial support level for XAG/USD. Any follow-through selling below this level will see a drop to the lower limit of the Bollinger Band at $28.40. Further south, the next contention level is located at the $28.00 round figure.

Silver (XAG/USD) 4-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.