Silver Price Analysis: XAG/USD losses momentum near $24.00, points to further losses

- XAG/USD retreats after hitting a one-week high at $23.94.

- Metals correct lower amid a stronger US dollar and a decline in equity prices.

Silver is falling 0.75% on Tuesday amid a rally of the US dollar. The greenback continues to recover after Friday’s sell-off. XAG/USD Peaked on Asian hours at $23.94 before turning to the downside.

Near the $24.00 area, the metal lost momentum and started to pullback. It accelerated after weaker-than-expected US economic data. It bottomed at $23.55 and then trimmed losses, rising to $23.66.

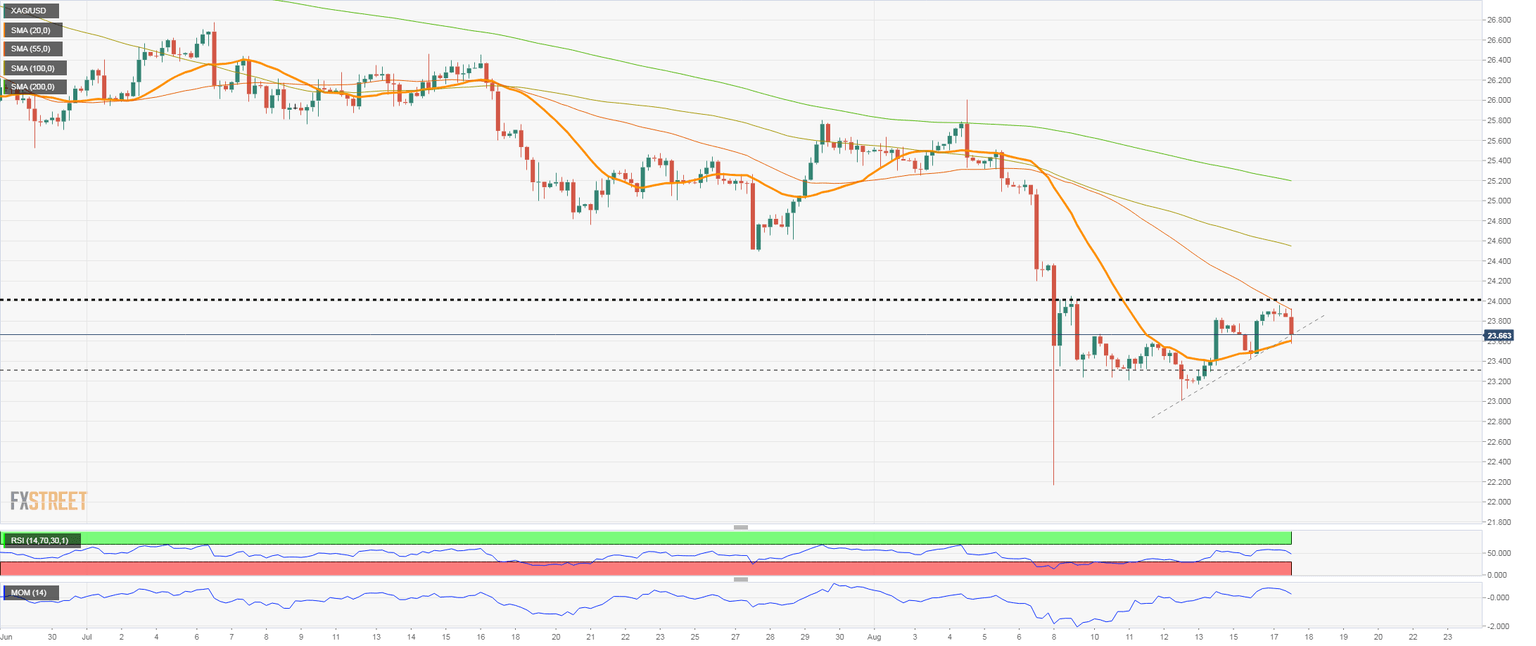

Very short-term technical indicators are biased to the downside. The RSI and momentum in the four-hour chart are moving south. XAG/USD is testing an uptrend line and the 20-SMA. A break under $23.55 would expose the next support at $23.40 (Aug 16 low).

If XAG/USD holds above $23.65 it could recover strength. To clear the way for a bullish extension it needs to break above the strong barrier of $24.00.

Silver 4-hour chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.