Silver Price Analysis: XAG/USD hovers around $21.70s below the 200-DMA

- XAG/USD clings to Wednesday’s gains of 0.36%, despite overall US Dollar strength.

- Silver dropped below the 200-day EMAs after reaching a daily high of $22.37.

- XAG/USD Price Analysis: Silver remains downward biased.

Silver price retraced some of its earlier gains after hitting a daily high of $22.37; a slight improvement in market sentiment strengthened the US Dollar (USD). Therefore, the XAG/USD is trading at $21.75, above its opening price by 0.36%, below the 200-day Exponential Moving Average (EMA).

XAG/USD Price action

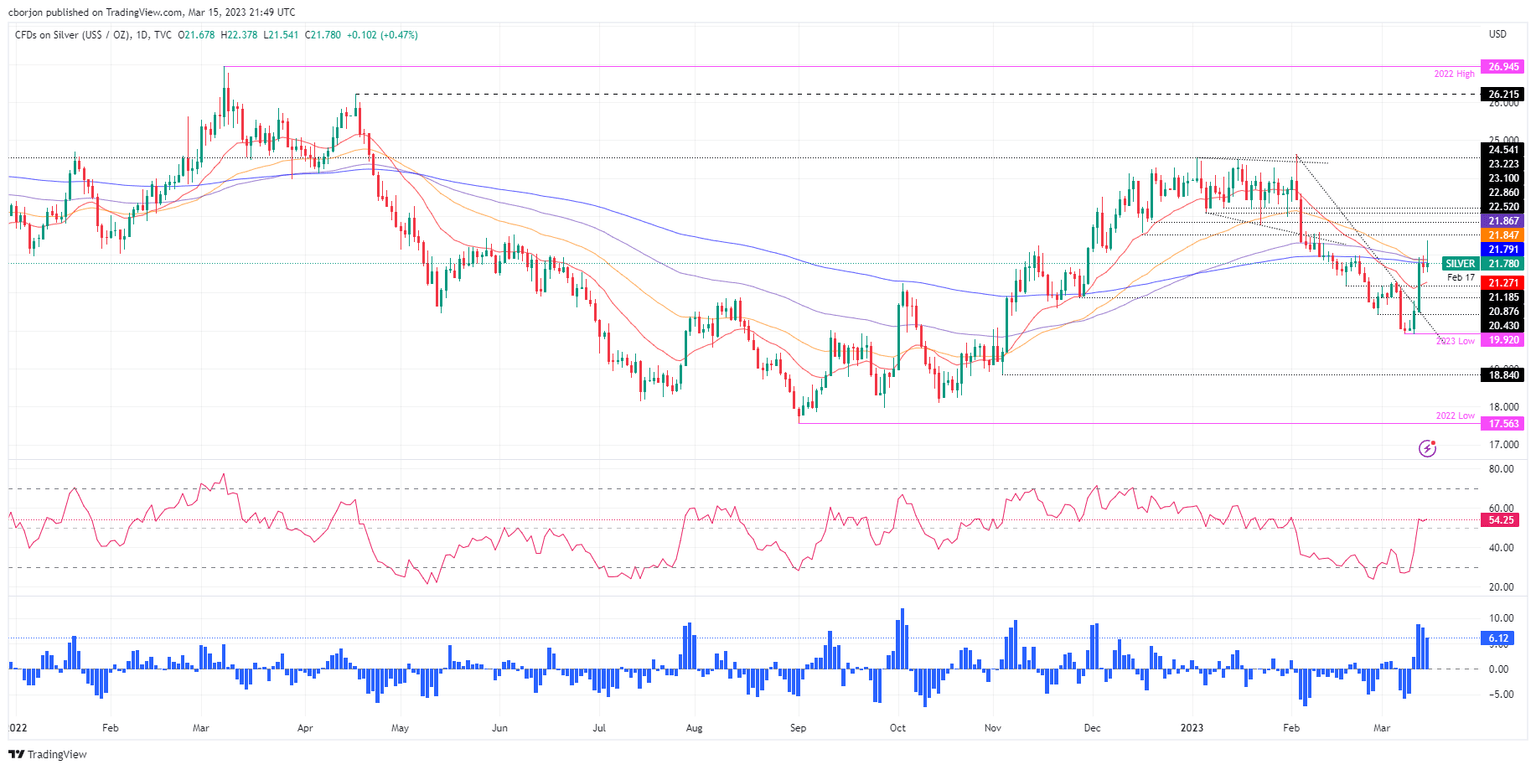

After reaching a daily high, the XAG/USD retreated from levels around $22.30s and cleared the confluence of the 50, 100, and 200-day EMAs at around $21.79-86. Therefore, the bearish bias remains intact, as the XAG/USD is set to achieve a daily close below the 200-day EMA.

Although oscillators shifted bullish, price action is the leading indicator. The Relative Strength Index (RSI) turned flat in bullish territory, while the Rate of Change (RoC) portrays buying pressure is waning. Therefore, the XAG/USD would remain trading sideways in the near term.

For a bearish resumption, the XAG/USD needs to crack the March 14 low of $21.50. A breach of the latter will expose the February 17 daily low at $21.18, followed by the November 28 swing low at 20.87. Once those two areas are reclaimed, the YTD low would be for grabs.

In an alternate scenario, the XAG/USD first resistance would be the confluence of the 200/100/50-day EMAs, around $21.79-86. Once buyers reclaim that area, the $22.00 figure would be up for grabs, before testing the weekly high of $22.37.

XAG/USD Daily chart

XAG/USD Technical levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.