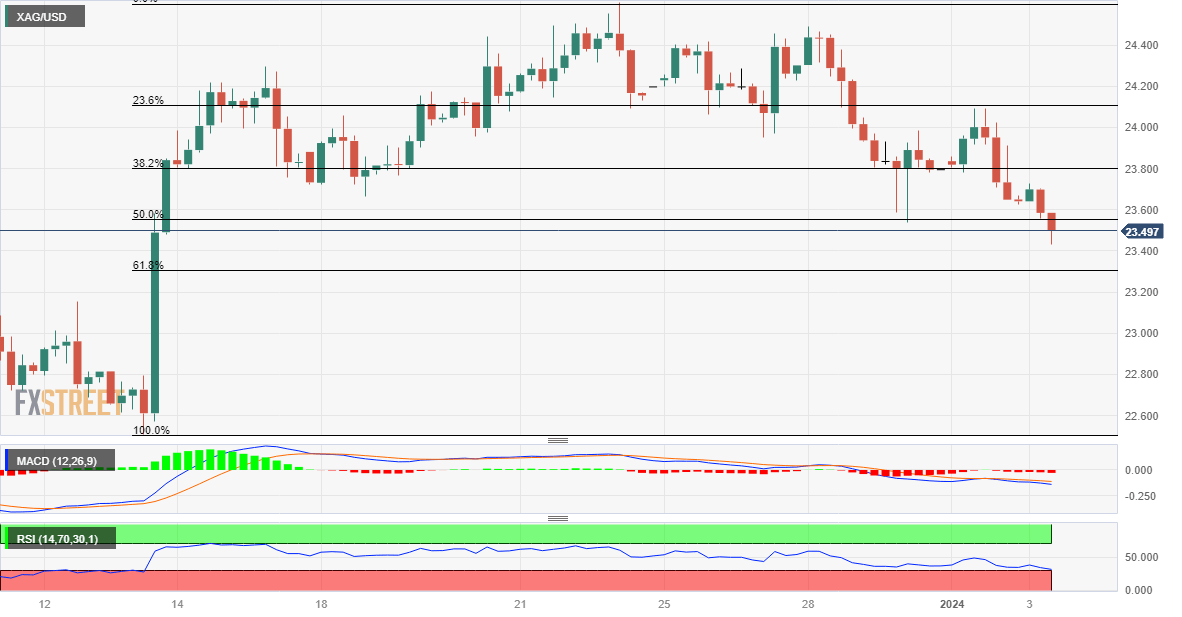

Silver Price Analysis: XAG/USD hits multi-week low, seems vulnerable below 50% Fibo.

- Silver drifts lower for the fourth straight day and touches a near three-week trough.

- The technical set-up favours bearish traders and supports prospects for further losses.

- A sustained strength beyond the $24.00 mark is needed to negate the negative outlook.

Silver (XAG/USD) remains under some selling pressure for the fourth successive day on Wednesday and drops to a near three-week low, below mid-$23.00s during the first half of the European session.

With the latest leg down, the XAG/USD confirms a breakdown through the 50% Fibonacci retracement level of the $22.51-$24.61 move up and seems vulnerable to decline further. The negative outlook is reinforced by the fact that technical indicators on the daily chart have again started gaining negative traction and are holding deep in the negative territory on hourly charts. This, in turn, suggests that the path of least resistance for the white metal is to the downside.

Any subsequent slide, however, is likely to find some support near the 61.8% Fibo. level, around the $23.30 region, ahead of the $23.15 zone, representing a multi-month-old ascending trend-line support, and the $23.00 round-figure mark. The latter should act as a key pivotal point, which if broken decisively will be seen as a fresh trigger for bearish traders and pave the way for an extension of the recent downfall witnessed over the past week or so.

The XAG/USD might then accelerate the downfall further towards the December monthly swing low, around mid-$22.00s, before dropping to the $22.25 support and the $22.00 round-figure mark.

On the flip side, recovery back above the $23.55 region (50% Fibo. level) might now be seen as a selling opportunity near the $23.75-$23.80 area, or the 38.2% Fibo. level. This is closely followed by the $24.00 mark, which if cleared decisively will suggest that the recent corrective slide has run its course and push the XAG/USD further towards the $24.60 area (December 22 high). Bulls might eventually aim to reclaim the $25.00 psychological mark.

Silver 4-hour chart

Technical levels to watch

(This story was corrected on January 3 at 09:55 GMT to say, in the third bullet point, that a move beyond $24.00 mark is needed to negate the negative outlook, not positive outlook.)

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.