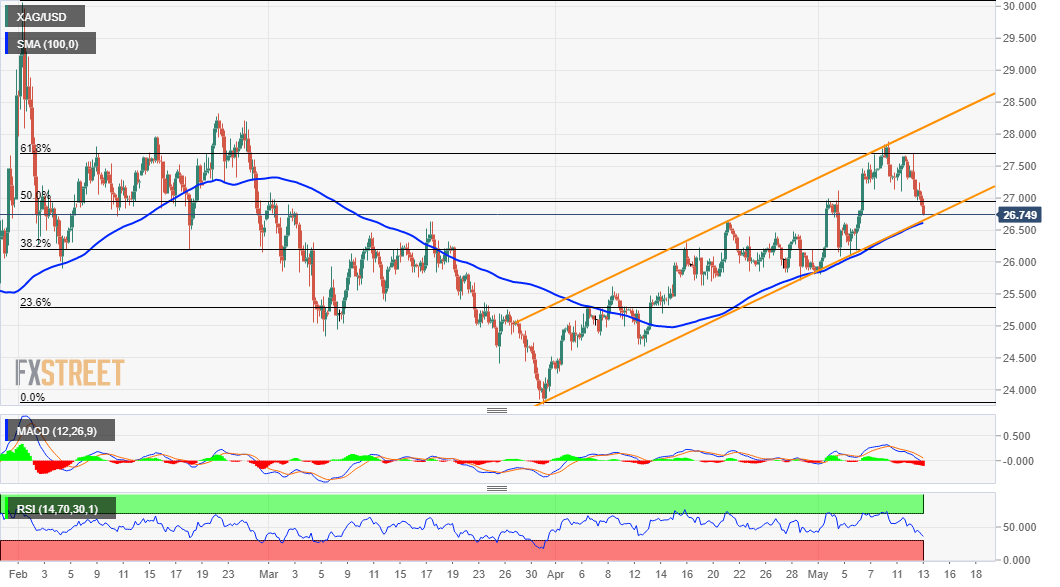

Silver Price Analysis: XAG/USD drops to one-week lows, ascending channel support eyed

- Silver added to the overnight losses and dropped to one-week lows on Thursday.

- A slide below 23.6% Fibo. has set the stage for the test of ascending channel support.

- Move beyond the $27.00 mark might confront resistance near the daily swing highs.

Silver struggled to capitalize on its intraday modest gains, instead met with some fresh supply near the $27.25 region and turned lower for the second straight session on Thursday. The white metal extended its steady decline through the first half of the European session and dropped to one-week lows, around the $26.75 region in the last hour.

The downfall marked the third day of a negative move in the previous four and dragged the XAG/USD further below the 50% Fibonacci level of the $30.07-$23.78 downfall. This comes on the back of this week's repeated failures near the 61.8% Fibo. barrier, around the $27.65-70 region and supports prospects for an extension of the depreciating move.

From current levels, bears might aim to test the lower boundary of a short-term ascending trend-channel extending from YTD lows, around the $23.80-75 region touched on March 31. The mentioned support is pegged near mid-$26.00s, which coincides with 100-period SMA on the 4-hour chart and should act as a key pivotal point for short-term traders.

The next relevant support is pegged near the $26.15-10 area (38.2% Fibo.), which if broken decisively will shift the bias firmly in favour of bearish traders. Some follow-through selling below the $26.00 mark will set the stage for a slide towards the key $25.00 psychological mark, with some intermediate support near the $25.30-25 zone (23.6% Fibo.).

On the flip side, the $27.00 mark now seems to act as an immediate hurdle ahead of the daily swing highs, around the $27.25 region. Any further positive move might continue to confront stiff resistance near the $27.65-70 region, above which the XAG/USD seems all set to surpass the $28.00 mark and climb towards the next major resistance near the $28.25-30 supply zone.

XAG/USD 4-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.