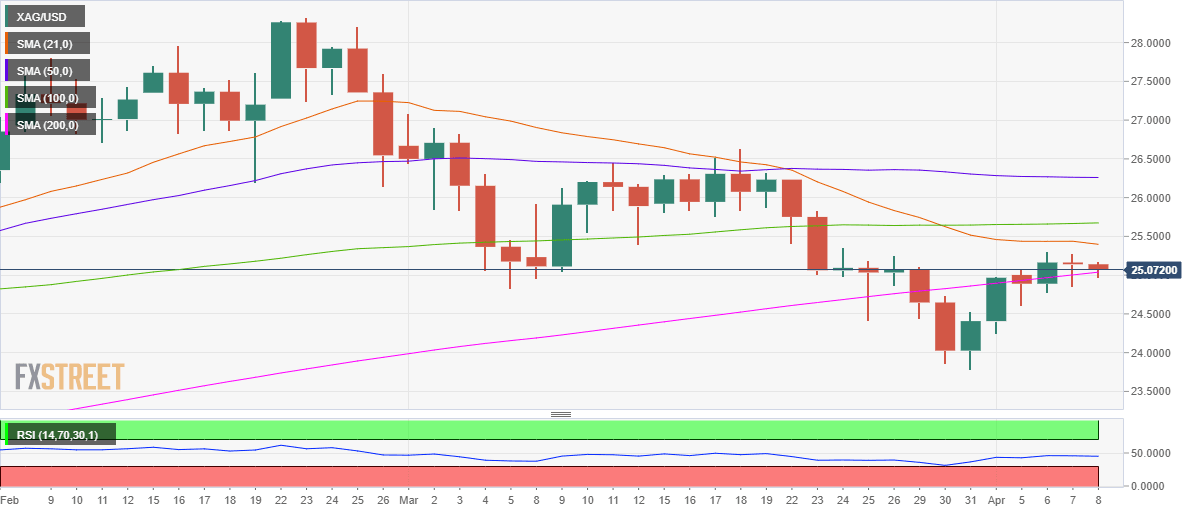

Silver Price Analysis: XAG/USD clinging onto 200-DMA support, downside favored

- Silver’s path of least resistance appears down, per the daily chart.

- Acceptance below 200-DMA support to trigger a fresh sell-off.

- RSI stays bearish, with 21-DMA acting as a strong upside hurdle.

Silver (XAG/USD) extends weakness into the second straight day on Thursday, as the critical 200-daily moving average (DMA) support at $25.03 is now put to test.

The white metal managed to close Wednesday above that level, although the upside break lacked conviction, as the sellers return on Thursday.

The 14-day Relative Strength Index (RSI) trades listless below the midline, the bearish territory, allowing room for declines.

The XAG bears are now looking for a strong foothold below 200-DMA, below which a steep drop towards the April 5 low of $24.61 cannot be ruled.

The psychological $24 mark could guard the downside towards the three-month lows of $23.78.

Silver Price Chart: Daily

However, if the bulls retain control above the abovementioned crucial support at $25.03, a bounce towards the horizontal 21-DMA, now at $25.40 can be seen.

The horizontal 100-DMA at $25.67 is a powerful hurdle for the bulls to crack.

Silver Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.