RKT Stock Price: Rocket Companies Inc. minor correction keeps it on high ground ahead of Powell

- NYSE:RKT gains for the seventh consecutive session continuing its surge from previous week.

- The mortgage firm is now up over 35% as housing sales continue to rise.

- Jerome Powell, Chairman of the Federal Reserve, may boost the lending market.

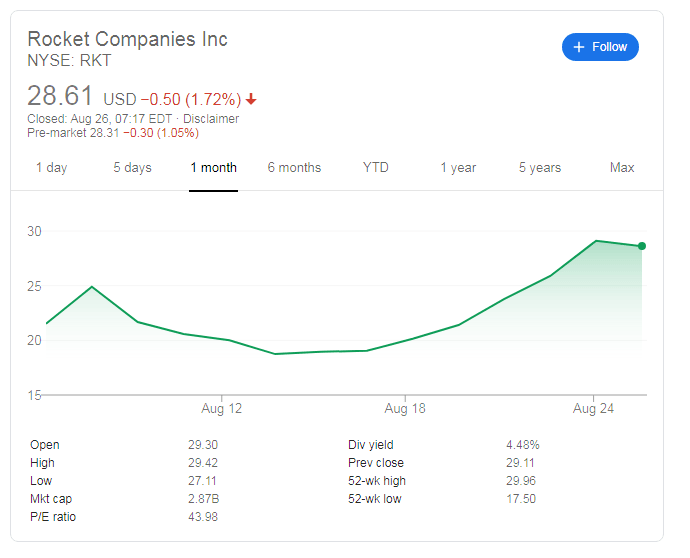

Update: NYSE: RKT is edging lower on Wednesday as investor take profit after the 40% surge from the IPO price. Tension is mounting ahead of the all-important speech by Jerome Powell, Chairman of the Federal Reserve. The Fed may enact a paradigm shift, keeping interest rates lower for longer, to enable inflation some catching up after long years of minor increases. That would make lending more attractive and potentially send Rocket Companies' stock higher.

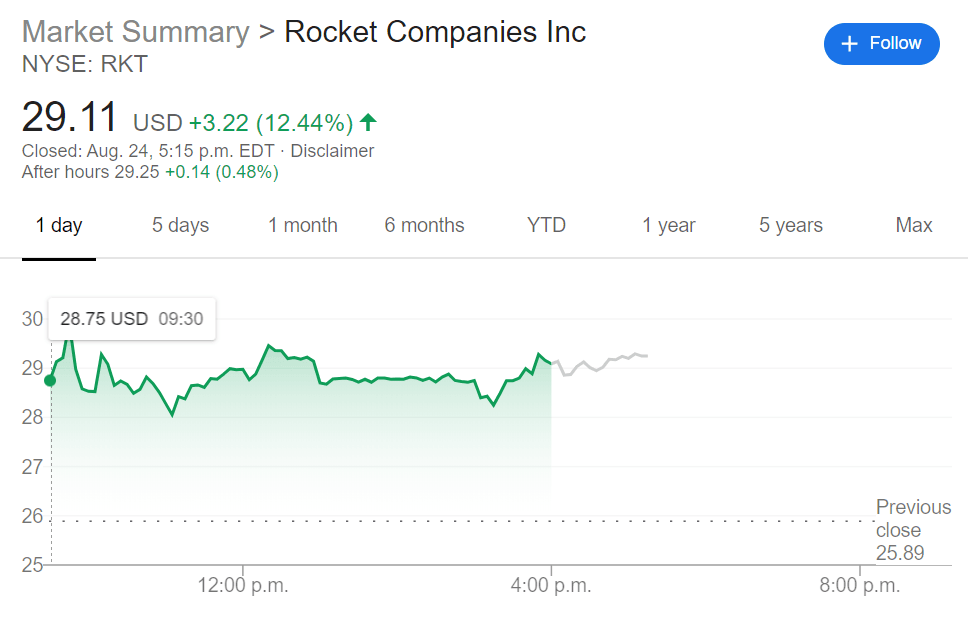

NYSE:RKT has officially hit orbit after its initial offering price of $18.00 per share was quickly snatched up by investors. Shares rose another 12.36% on Monday as Rocket continues its climb towards the $30 price barrier, closing the trading session at $29.09. In total Rocket’s stock has gained well over 40% since its debut and may continue to rise leading up to its first quarterly earnings call on September 2nd. The mortgage company has recently estimated quarterly revenues in the ballpark of $5 billion – a whopping 437% increase year-over-year for the same quarter in 2019.

While Rocket Companies Inc. is new in terms of public stock availability, it has been in operation since 1985 as one of America’s leading mortgage lenders. The fact that Rocket currently owns just short of 10% of all mortgages in the U.S. loan market shows the tremendous growth that could potentially be down the road. Recent figures from the National Association of Realtors show two consecutive months of fairly substantial sales gains in the existing-home sales market – a sign that the coronavirus pandemic has not negatively affected the real estate market as much as we thought it would.

RKT Stock News

RKT may not have had the same fanfare during its IPO as other recent offerings like Lemonade (NYSE:LMND) or BigCommerce (NASDAQ:BIGC), but it could have the steadiest path to profitability for investors. Rocket Companies already has a proven track record for more than 30 years and have shifted much of its mortgage application services to its digital platform called Rocket Mortgages. With a near 10% slice of the U.S. mortgage market that has grown from 1% in 2009 – Rocket Companies is set to continue its upward trajectory without the growing pains of a brand new startup.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet