Record daily US COVID-19 cases are a serious problem for the US dollar

- The US dollar is consolidating at a critical level while a focus shifts to serious US COVID-19 problems.

- Eyes on key risk events for the US dollar in the week ahead.

The US dollar will be a major focus into the quarter's end, having picked up and carried a safe-haven bid since June 10th, albeit in the face of serious problems in the US pertaining to COVID-19 cases.

The US infectious disease chief Dr Anthony Fauci said on Friday that the nation has a "serious problem" as 16 states reel from a spike in cases of the virus.

US health experts have said more must be done to slow the spread following the reports of more than 40,000 new cases were recorded across the US on Friday.

US prints highest daily COVID-19 total so far

With 2.4 million confirmed infections and more than 125,000 deaths nationwide, more than any other country, the total of 40,173, given by Johns Hopkins University, was the highest daily total so far, exceeding the record set only the previous day.

In fact, the virus cases rose 1.7%, which was above the 1.5% 7-day average.

However, health officials in the US estimate the true number of cases is likely to be 10 times higher than the reported figure.

In Texas, Florida and Arizona, reopening plans have been paused due to the spike.

It could be argued that the renewed lockdowns stand to delay the US dollar's recovery as investors start to identify the second wave as a problem unique to the US.

The DXY closed Friday at 97.50 following scoring a high of 97.74 printed mid-week, moving with a negative correlation to US stocks which lost traction on the week with profit-taking a likely factor on the back of a good quarter for risk, (S&P 500 +20%).

Meanwhile, the week ahead contains a number of key economic events, including Nonfarm Payrolls at the start of the new month as well as manufacturing ISM and consumer confidence.

However, markets may derive more impetus from key speakers in the likes of the Federal Reserve's Jerome Powell and Williams as well as Steven Mnuchin who is testifying before the House on Tuesday.

Bid from trend-line support, 98.30s in focus

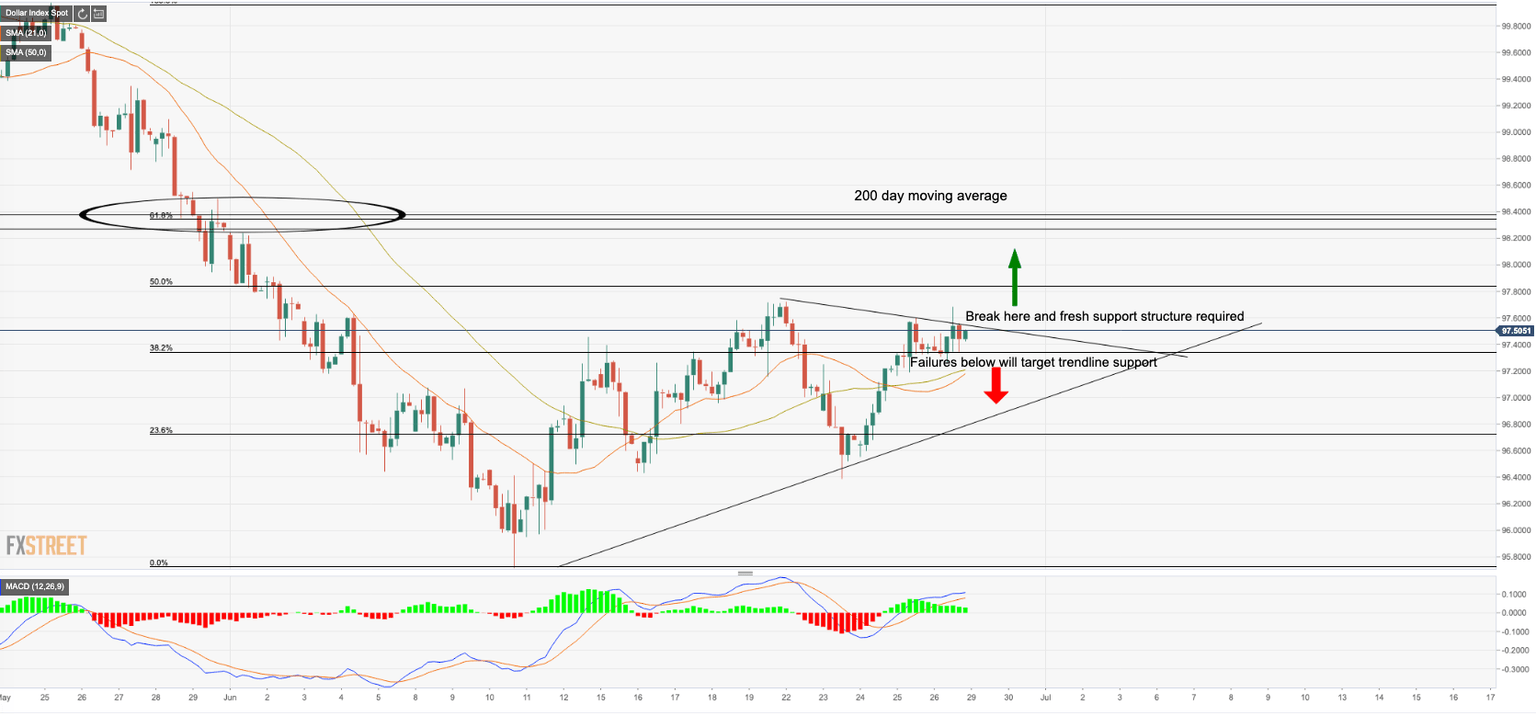

Moving to the charts, the DXY is making tracks from trendline support towards a 50% retracement of the prior bearish impulse from the 18th May weekly highs.

The 98.30s structure is a compelling supply zone and a resistance area. There is also a confluence with the 200-day moving average and a 61.8% Fibonacci.

4HR chart

Failures to extend at this point and to create a fresh support structure could well result in a re-test of the trendline support as illustrated in the 4HR chart.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.