RBA Minutes: Ready to provide yet more policy stimulus

The Reserve Bank of Australia's Minutes has sown that the central bank is ready to provide yet more policy stimulus if needed after cutting rates to record lows, a pledge that may be tested given the latest outbreak of coronavirus in the country.

''Minutes of the Reserve Bank of Australia's (RBA) Nov. 3 policy meeting released on Tuesday showed the bank's Board felt taking interest rates negative was not "sensible" and any further action would involve increased bond purchases,'' Reuters reported.

''The Board had decided to cut its main cash rate by 15 basis points to just 0.1% and launch a new bond buying program that would see the bank scoop up A$100 billion of longer-dated debt in six months.''

"The focus over the period ahead will be the government bond purchase program," the minutes showed. "The Board is prepared to do more if necessary."

Reuters reported that much depended on how the country fared in containing the coronavirus, with its relative success so far leading to a better outlook than feared a few months earlier.

''However, the November policy meeting came before a fresh outbreak of the virus in the state of South Australia which threatened to chill consumer sentiment and spending.''

Further key notes

''The Board emphasised that monetary and fiscal stimulus would be needed for a considerable time and pledged not to raise interest rates for at least three more years.''

''A significant rise in employment and wages growth would be needed to lift inflation back into the RBA's target bank of 2-3%, a distant prospect given the bank expected the unemployment rate to climb further toward 8% by the end of this year.''

''The Board also noted that very low interest rates were a global phenomenon that affected exchange rates and asset prices.''

RBA Governor Philip Lowe on Monday emphasised that Australia had to lower its rates in line with other developed economies or risk an unwelcome appreciation in the local dollar.

Indeed, he noted that were other major central banks to all cut their rates into negative territory, then the RBA might be forced to follow, no matter how reluctantly.

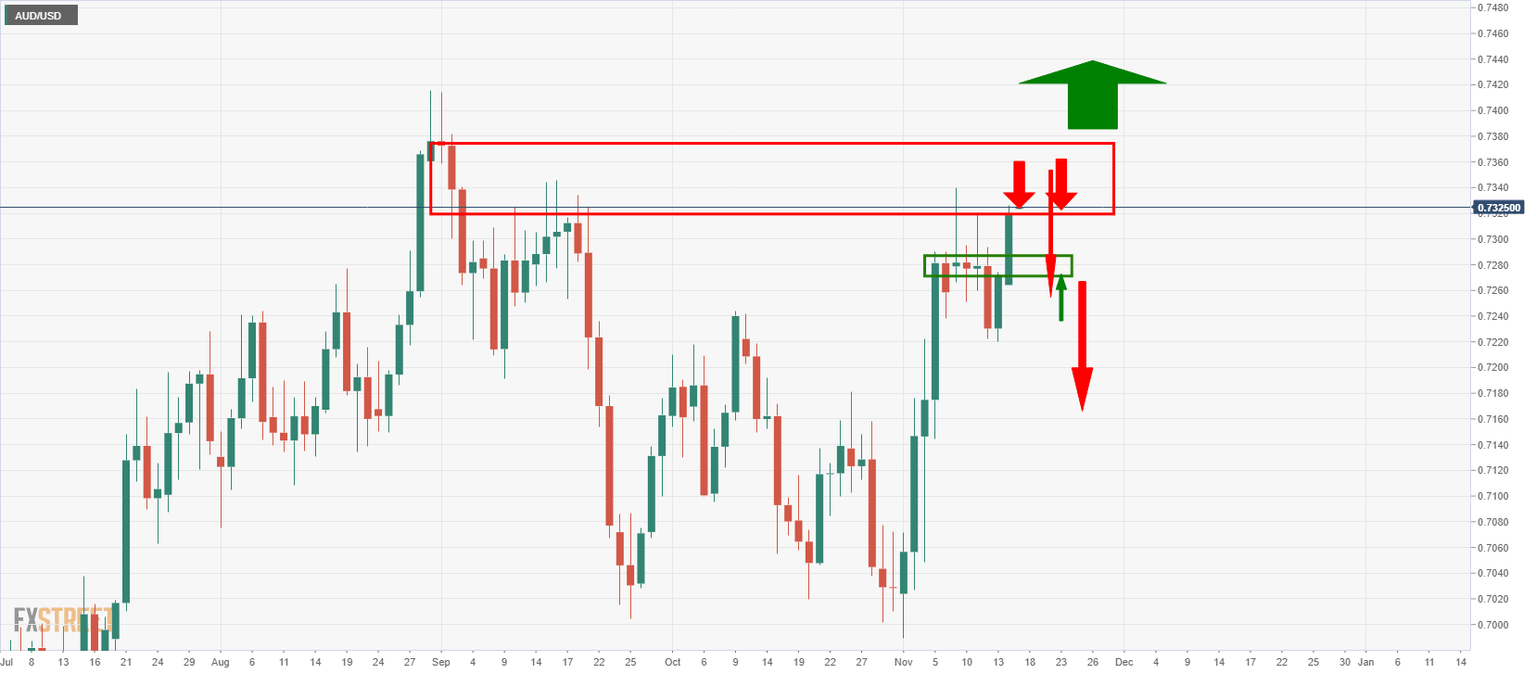

AUD/USD update

AUD was unchanged on the release at 0.7326 and flat in the day so far.

AUD/USD has been a star performer in a risk-on and commodity complex environment, breaking through critical resistance, invalidating bearish trade setups.

Daily chart

The price is taking on a strong supply area where failures open risk back to the downside again.

However, a break beyond the supply zone would be extremely bullish.

Description of RBA Minutes

The minutes of the Reserve Bank of Australia meetings are published two weeks after the interest rate decision.

The minutes give a full account of the policy discussion, including differences of view. They also record the votes of the individual members of the Committee.

Generally speaking, if the RBA is hawkish about the inflationary outlook for the economy, then the markets see a higher possibility of a rate increase, and that is positive for the AUD.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.