Procter & gamble (nyse: pg) next investment opportunity

Procter & Gamble (NYSE: PG) continues to capture investor attention following our previous video blog that illuminated a promising bullish trajectory for the company. Building upon those insights, this article delves deeper into PG’s mid-term prospects. By examining two Elliott Wave potential scenarios that could shape its near future, we aim to offer readers a comprehensive view of potential investment opportunities.

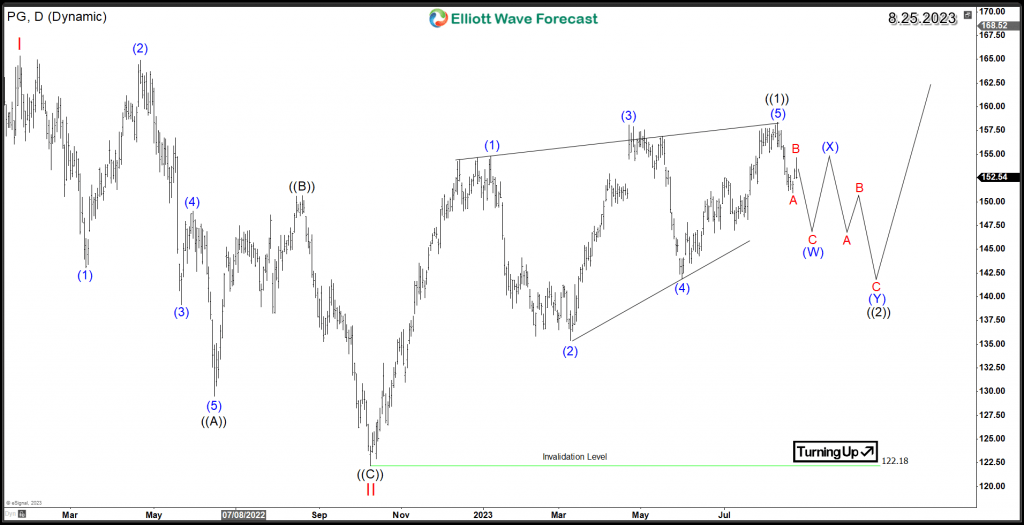

Since October 2022, the ongoing rally forms a 5-wave structure, creating a Leading Diagonal with overlapping patterns. Investors should view the current correction as a potential opportunity, as per Elliott Wave Theory. A 5-wave advance typically precedes a corrective structure, followed by another 5-wave trend.

At Elliott Wave Forecast, our consistent advice is to seek corrective structures in 3, 7, or 11 swings. The initial pullback, typically within the first 3 swings, will ideally form a ZigZag structure based on the recent decline from the August 10th peak. Potential support lies at the equal legs area of $147.2 – $142.6, a zone where buyers are likely to step in, either for the stock’s trend resumption or a minimum 3-wave bounce.

PG ZigZag Correction 8.25.2023

However, if the reaction from the mentioned area fails to breach new highs, the stock is likely to undergo a 7-swing correction, forming a double three structure. In such a scenario, PG would target levels near the 50% – 61.8% Fibonacci retracement zone at $140 – $135. This area could attract buyers for a potential upward reaction.

PG Double Three Correction 8.25.2023

In conclusion, the structure of Procter & Gamble within its daily cycle is poised to sustain its foundation above the crucial threshold of $122. As the stock progresses, astute investors are encouraged to exercise patience and monitor for the emergence of the subsequent extreme area during the ongoing corrective pullback. This strategic approach could potentially provide an advantageous vantage point for an upward response, as the stock gears up to recommence its bullish trajectory, setting its sights on the pursuit of new all-time highs.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com