Pound Sterling plummets as soaring UK gilt yields raise fiscal concerns

- The Pound Sterling plunges below 1.3400 against the US Dollar as the Greenback gains ahead of the US opening.

- Investors await the US ISM Manufacturing PMI data, which is expected to have declined again.

- The BoE is unlikely to cut interest rates in the monetary policy meeting this month.

The Pound Sterling (GBP) underperforms its major peers in a light United Kingdom (UK) economic calendar week. The British currency has tumbled as soaring UK long-term gilt yeilds have raised fiscal concerns. 30-year UK gilt yields surge to near 5.68%, the highest level seen since 1998.

UK bond yields have soared after Prime Minister Keir Starmer announced a reshuffle in cabinet, which he called as a transition "to the second phase" of his government, BBC News reported.

In the near term, the major trigger for the British currency will be market expectations about whether the Bank of England (BoE) will cut interest rates in the policy meeting this month.

Last week, BoE Monetary Policy Committee (MPC) member Catherine Mann stated that interest rates should remain restrictive for a longer period until downside economic risks get materialized. Mann argued against loosening monetary conditions as inflation in the UK region is proving to be persistent.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.63% | 1.23% | 1.00% | 0.30% | 0.67% | 0.82% | 0.56% | |

| EUR | -0.63% | 0.58% | 0.40% | -0.33% | 0.07% | 0.19% | -0.06% | |

| GBP | -1.23% | -0.58% | -0.20% | -0.90% | -0.52% | -0.38% | -0.66% | |

| JPY | -1.00% | -0.40% | 0.20% | -0.70% | -0.34% | -0.17% | -0.41% | |

| CAD | -0.30% | 0.33% | 0.90% | 0.70% | 0.34% | 0.55% | 0.25% | |

| AUD | -0.67% | -0.07% | 0.52% | 0.34% | -0.34% | 0.13% | -0.12% | |

| NZD | -0.82% | -0.19% | 0.38% | 0.17% | -0.55% | -0.13% | -0.27% | |

| CHF | -0.56% | 0.06% | 0.66% | 0.41% | -0.25% | 0.12% | 0.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Pound Sterling tumbles against US Dollar ahead of US PMI data

- The Pound Sterling declines sharply to near 1.3380 against the US Dollar (USD) during the European trading session on Tuesday. The GBP/USD pair tumbles as the US Dollar recovers strongly ahead of the United States (US) opening after an extended weekend, due to Labor Day holiday on Monday, with investors awaiting the ISM and S&P Global Manufacturing Purchasing Managers’ Index (PMI) data for August due later in the North American session.

- During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, surges to near 98.45. The DXY bounces back strongly after posting a fresh monthly low near 97.50 on Monday.

- Economists expect the US ISM Manufacturing PMI to have contracted again, but at a moderate pace. The Manufacturing PMI is seen at 49.0, higher from the prior reading of 48.0. A figure below the 50.0 threshold is considered a contraction in the business activity.

- Investors will also monitor other indices of PMI data, such as Prices Paid, and Employment to gauge the impact of US President Donald Trump's tariffs on inflation and the labor market.

- Going forward, a slew of US labor market-related data, JOLTS Job Openings for July, ADP Employment Change and the Nonfarm Payrolls (NFP) data for August, will influence the GBP/USD pair.

- Investors will closely monitor the US employment figures to get the current status of labor demand in the wake of tariffs imposed by Washington on its trading partners.

- Also, market expectations for the Fed to cut interest rates at the September meeting intensified after the release of the NFP report for July, which revealed a sharp downward revision in job numbers of May and June.

Technical Analysis: Pound Sterling slides below 1.3400

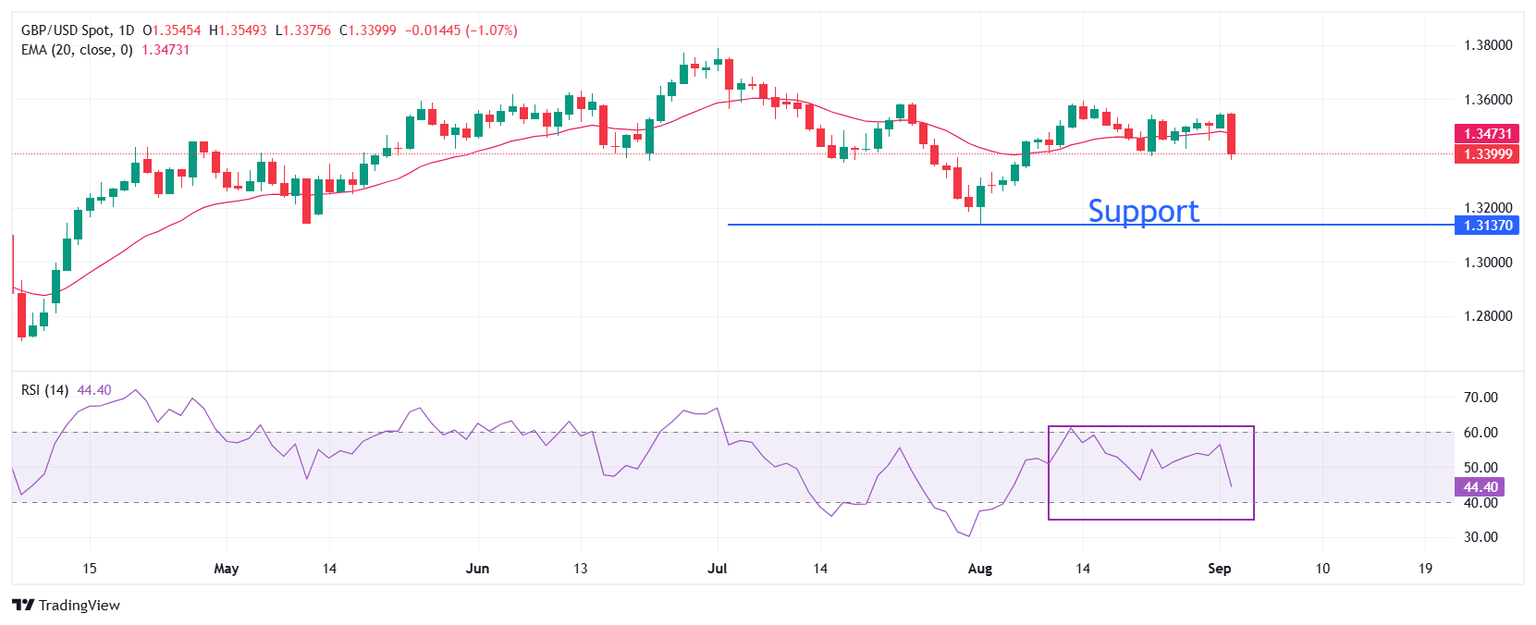

The Pound Sterling slides below 1.3400 against the US Dollar on Tuesday. The near-term trend of the GBP/USD pair turns bearish as it declines below the 20-day Exponential Moving Average (EMA), which trades around 1.3468.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sharp volatility contraction.

Looking down, the August 11 low of 1.3400 will act as a key support zone. On the upside, the July 1 high near 1.3790 will act as a key barrier.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.