GBP/USD Forecast: Pound Sterling slumps as gilts selloff picks up steam

- GBP/USD declined below 1.3400 in the European session.

- Selloff seen in British government bonds weighs heavily on Pound Sterling.

- US ISM Manufacturing PMI data for August will be released later in the day.

After posting modest gains on Monday, GBP/USD turned south and dropped to its lowest level since early August below 1.3380. Although the pair managed to rose back toward 1.3400, it finds it difficult to gather recovery momentum.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.64% | 1.12% | 0.95% | 0.18% | 0.66% | 0.84% | 0.56% | |

| EUR | -0.64% | 0.46% | 0.29% | -0.46% | 0.07% | 0.20% | -0.09% | |

| GBP | -1.12% | -0.46% | -0.16% | -0.92% | -0.41% | -0.26% | -0.55% | |

| JPY | -0.95% | -0.29% | 0.16% | -0.77% | -0.29% | -0.09% | -0.34% | |

| CAD | -0.18% | 0.46% | 0.92% | 0.77% | 0.46% | 0.69% | 0.38% | |

| AUD | -0.66% | -0.07% | 0.41% | 0.29% | -0.46% | 0.15% | -0.13% | |

| NZD | -0.84% | -0.20% | 0.26% | 0.09% | -0.69% | -0.15% | -0.28% | |

| CHF | -0.56% | 0.09% | 0.55% | 0.34% | -0.38% | 0.13% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

The broad-based selling pressure surrounding the US Dollar (USD) on growing concerns over the Federal Reserve's independency and the heightened uncertainty surrounding the trade regime allowed GBP/USD to edge higher on Monday.

Early Tuesday, however, Pound Sterling weakened against its rivals, pressured by the intense selloff seen in long-term British government bonds, known as gilts. The yield on the 30-year gilt rose to its highest level since 1998 on Tuesday, reflecting market fears over the UK's fiscal outlook. Similarly, the borrowing cost on 10-year gilts was last seen holding at its highest level since May near 4.8%, rising more than 1% on a daily basis.

Reflecting the Pound Sterling weakness, EUR/GBP is up about 0.5% on the day.

In the second half of the day, the US economic calendar will feature the Institute for Supply Management's (ISM) Manufacturing Purchasing Managers' Index (PMI) data for August. The headline PMI is forecast to edge higher to 49 from 48 in July. A reading above 50 could support the USD with the immediate reaction. On the other hand, a disappointing PMI print, combined with a noticeable decline in the Employment subindex of the PMI survey, could hurt the USD and help GBP/USD limit its losses in the short term.

Nevertheless, investors could refrain from placing themselves in position for a steady recovery in Pound Sterling unless there is a relief in gilt markets.

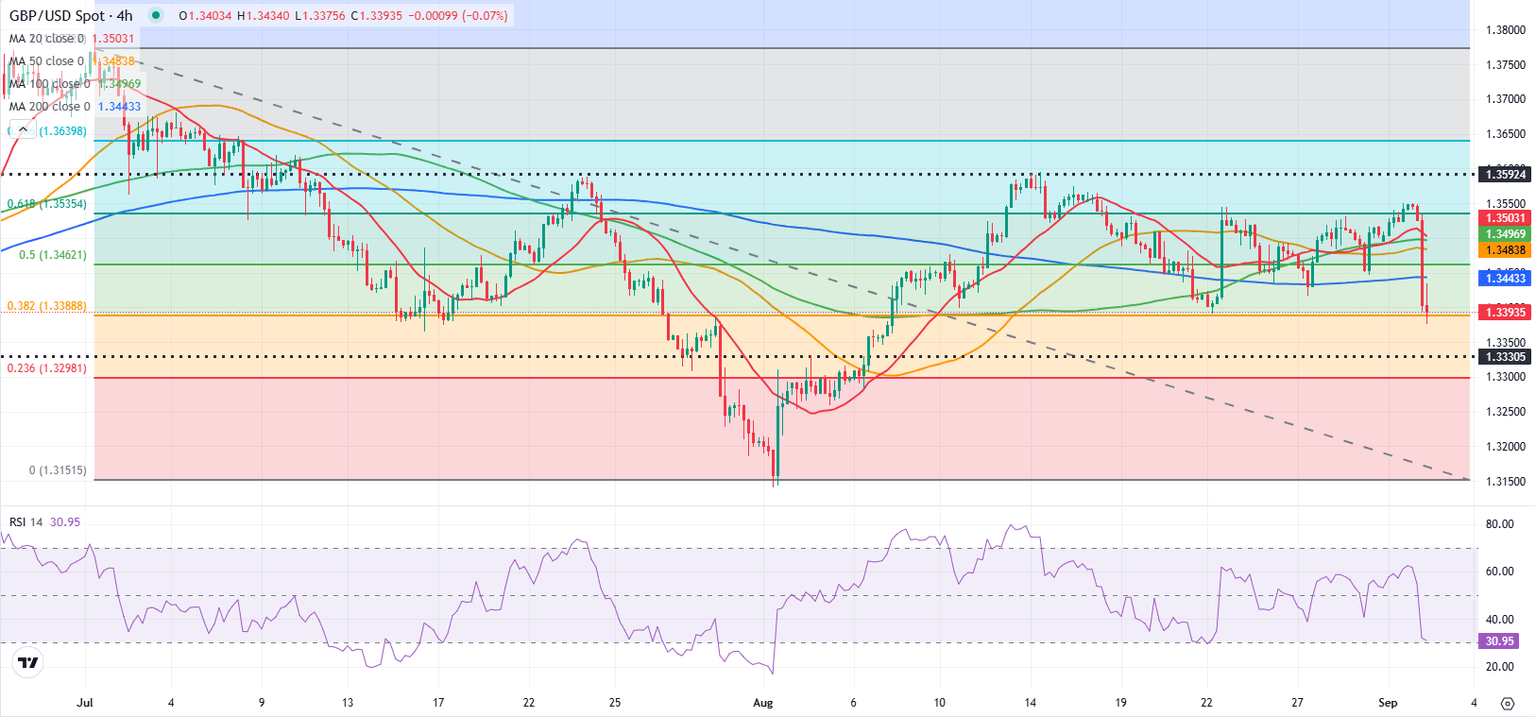

GBP/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart drops toward 30, reflecting a buildup of bearish momentum. On the downside, 1.3390 (Fibonacci 38.2% retracement of the latest downtrend) aligns as the immediate support level. In case GBP/USD falls below this level and starts using it as resistance, 1.3330 (static level) could be seen as the next support level before 1.3300 (Fibonacci 23.6% retracement).

Looking north, resistance levels could be spotted at 1.3440 (200-period Simple Moving Average), 1.3460 (Fibonacci 50% retracement) and 13500 (round level, 100-period SMA).

UK gilt yields FAQs

UK Gilt Yields measure the annual return an investor can expect from holding UK government bonds, or Gilts. Like other bonds, Gilts pay interest to holders at regular intervals, the ‘coupon’, followed by the full value of the bond at maturity. The coupon is fixed but the Yield varies as it takes into account changes in the bond's price. For example, a Gilt worth 100 Pounds Sterling might have a coupon of 5.0%. If the Gilt's price were to fall to 98 Pounds, the coupon would still be 5.0%, but the Gilt Yield would rise to 5.102% to reflect the decline in price.

Many factors influence Gilt yields, but the main ones are interest rates, the strength of the British economy, the liquidity of the bond market and the value of the Pound Sterling. Rising inflation will generally weaken Gilt prices and lead to higher Gilt yields because Gilts are long-term investments susceptible to inflation, which erodes their value. Higher interest rates impact existing Gilt yields because newly-issued Gilts will carry a higher, more attractive coupon. Liquidity can be a risk when there is a lack of buyers or sellers due to panic or preference for riskier assets.

Probably the most important factor influencing the level of Gilt yields is interest rates. These are set by the Bank of England (BoE) to ensure price stability. Higher interest rates will raise yields and lower the price of Gilts because new Gilts issued will bear a higher, more attractive coupon, reducing demand for older Gilts, which will see a corresponding decline in price.

Inflation is a key factor affecting Gilt yields as it impacts the value of the principal received by the holder at the end of the term, as well as the relative value of the repayments. Higher inflation deteriorates the value of Gilts over time, reflected in a higher yield (lower price). The opposite is true of lower inflation. In rare cases of deflation, a Gilt may rise in price – represented by a negative yield.

Foreign holders of Gilts are exposed to exchange-rate risk since Gilts are denominated in Pound Sterling. If the currency strengthens investors will realize a higher return and vice versa if it weakens. In addition, Gilt yields are highly correlated to the Pound Sterling. This is because yields are a reflection of interest rates and interest rate expectations, a key driver of Pound Sterling. Higher interest rates, raise the coupon on newly-issued Gilts, attracting more global investors. Since they are priced in Pounds, this increases demand for Pound Sterling.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.