Pound Sterling gains ahead of key UK GDP data

- The Pound Sterling outperforms its major peers ahead of the UK monthly GDP data on Thursday.

- BoE’s Taylor expects monetary policy to normalise at neutral levels soon.

- The US Dollar gains ground as US inflation remained steady in December.

The Pound Sterling (GBP) gains against its major peers, except antipodeans, on Wednesday. The British currency trades higher ahead of the United Kingdom (UK) monthly Gross Domestic Product (GDP) and factory data, which will be released on Thursday.

The UK Office for National Statistics (ONS) is expected to show that the economy expanded 0.1% in November. Meanwhile, month-on-month (MoM) Manufacturing Production is estimated to have grown steadily by 0.5%, with Industrial Production remaining broadly flat.

Investors will pay close attention to the UK GDP growth data to get cues on the current state of the economy. The UK GDP declined by 0.1% in both September and October after remaining flat in August.

The data will also drive market expectations for the Bank of England’s (BoE) monetary policy outlook. In the December policy meeting, the BoE guided that monetary policy will remain on a gradual downward path.

During European trading hours, BoE policymaker Alan Taylor said in a summit in Singapore that he expects interest rates to fall to their neutral levels soon, citing that price pressures could return to target by mid of 2026.

Daily digest market movers: US Dollar remains broadly firm

- The Pound Sterling trades 0.2% higher to near 1.3445 against the US Dollar (USD) during the European trading session on Wednesday. The GBP/USD pair rises amid Sterling’s outperformance, while the US Dollar ticks lower.

- As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, edges down to near 99.10, but is still close to its monthly high near 99.26.

- The US Dollar gained sharply on Tuesday after the release of the US Consumer Price Index (CPI) data for December. The CPI report showed that both headline and core inflation remained steady at 2.7% and 2.6% year-on-year (YoY), respectively, firming expectations that the Federal Reserve (Fed) will not cut interest rates in its policy meeting later this month.

- However, US President Donald continued to increase the pressure on Fed Chair Jerome Powell to cut interest rates further, while praising steady inflation figures. “We have very low inflation. That would give ’too late Powell’ the chance to give us a nice beautiful big rate cut," Trump said, according to a Reuters report.

- For more cues on inflation, investors will focus on the United States (US) Producer Price Index (PPI) data for October and November, which will be published at 13:30 GMT.

- Meanwhile, chiefs of global central banks have shown support towards Fed Chair Jerome Powell over his criminal charges, which he called a “pretext” for refraining from follow the president’s preferences. Chiefs from the European Central Bank (ECB), the BoE, and nine other central banks said collectively that “independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve”, and “we stand in full solidarity with the Fed System and its Chair Jerome H. Powell”.

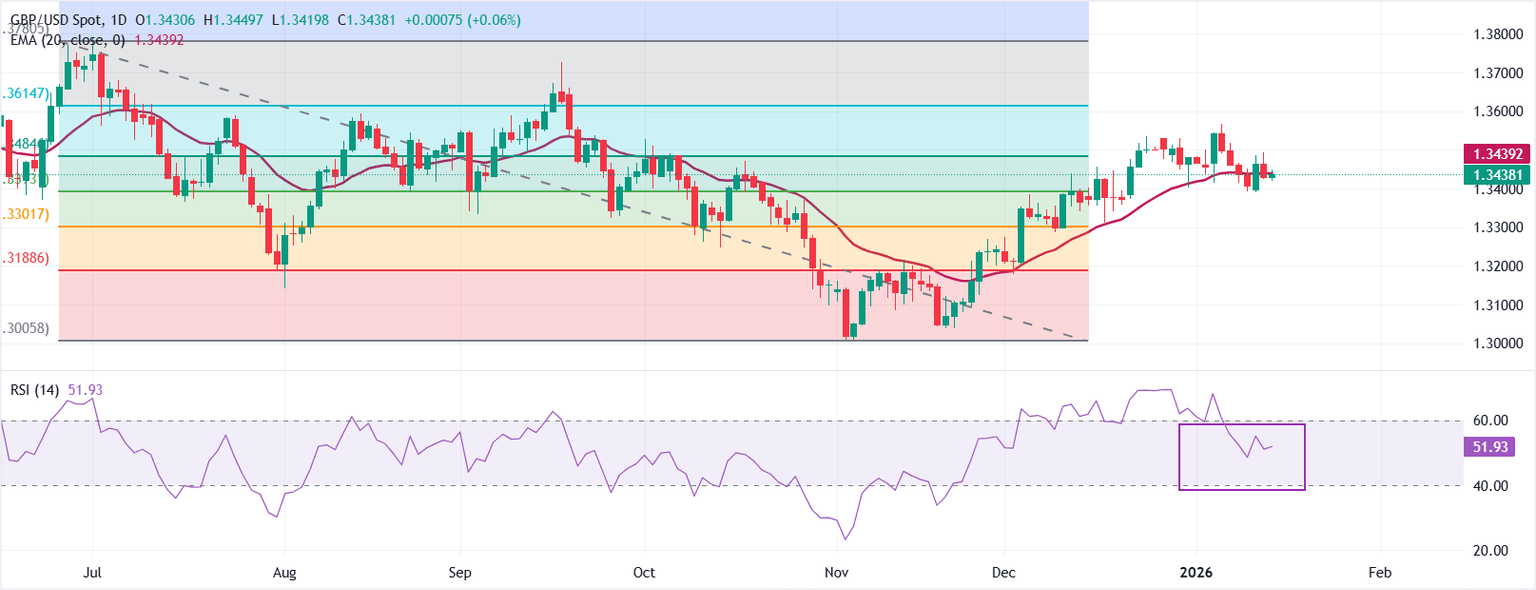

Technical Analysis: GBP/USD remains close to 20-day EMA

GBP/USD trades at 1.3437 as of writing. The 20-day Exponential Moving Average has stalled around 1.3439, with price testing this dynamic cap. A close above the average would improve near-term traction. The RSI at 52 (neutral) edges higher, but still reflects balanced momentum.

Measured from the 1.3780 high to the 1.3006 low, the 50% Fibonacci retracement at 1.3393 acts as resistance on rebounds, while the 61.8% retracement at 1.3485 caps the upside. A close above the latter would signal the bearish trend is fading and could extend the recovery, while failure there would keep the pair range-bound.

(The technical analysis of this story was written with the help of an AI tool.)

Economic Indicator

Gross Domestic Product (MoM)

The Gross Domestic Product (GDP), released by the Office for National Statistics on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in the UK during a given period. The GDP is considered as the main measure of UK economic activity. The MoM reading compares economic activity in the reference month to the previous month. Generally, a rise in this indicator is bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Thu Jan 15, 2026 07:00

Frequency: Monthly

Consensus: 0.1%

Previous: -0.1%

Source: Office for National Statistics

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.