Pound Sterling weakens despite UK GDP reutrns to growth strongly

- The Pound Sterling weakens against its peers despite stronger-than-expected UK GDP data for November.

- UK monthly GDP expanded 0.3%, beating estimates of 0.1% and the previous reading of -0.1%.

- The US Dollar gains on expectations that the Fed will hold interest rates steady in the meeting later this month.

The Pound Sterling (GBP) trades lower against its major currency peers, falls 0.2% to near 1.3420 against the US Dollar (US) on Thursday, following the release of the United Kingdom (UK) monthly Gross Domestic Product (GDP) data for November.

The Office for National Statistics (ONS) has reported that the economy is back in the black strongly. The data showed that GDP growth was 0.3%, faster than estimates of 0.1%. In September and October, the UK economy declined by 0.1% after remaining flat in August.

A strong UK GDP figure is expected to impact the Bank of England (BoE) dovish expectations negatively. At the December meeting, the BoE guided that the monetary policy will remain on a gradual downward path.

On Wednesday, BoE policymaker Alan Taylor stated that he expects “monetary policy to normalise at neutral sooner rather than later,” and “at-target inflation from mid-2026 is likely to be sustainable”.

Meanwhile, UK factory data has also come in stronger than projected. Month-on-month (MoM) Manufacturing Production grew at a robust pace of 2.1% against estimates of 0.5% and the October reading of 0.4%, revised lower from 0.5%. In the same period, Industrial Production rose 1.1%, stronger than expectations of 0.1%, but slower than the prior reading of 1.3%. On an annualized basis, both Manufacturing and Industrial Production unexpectedly gained at a strong pace.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.06% | 0.08% | -0.11% | 0.12% | -0.22% | -0.06% | -0.02% | |

| EUR | -0.06% | 0.03% | -0.17% | 0.06% | -0.28% | -0.12% | -0.07% | |

| GBP | -0.08% | -0.03% | -0.17% | 0.04% | -0.30% | -0.15% | -0.10% | |

| JPY | 0.11% | 0.17% | 0.17% | 0.21% | -0.12% | 0.00% | 0.08% | |

| CAD | -0.12% | -0.06% | -0.04% | -0.21% | -0.33% | -0.19% | -0.13% | |

| AUD | 0.22% | 0.28% | 0.30% | 0.12% | 0.33% | 0.15% | 0.20% | |

| NZD | 0.06% | 0.12% | 0.15% | -0.00% | 0.19% | -0.15% | 0.05% | |

| CHF | 0.02% | 0.07% | 0.10% | -0.08% | 0.13% | -0.20% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily Digest Market Movers: Pound Sterling trades lower against US Dollar

- Earlier in the day, the Pound Sterling was under pressure as market sentiment remained risk-off due to renewed tariff tensions. On Wednesday, United States (US) President Donald Trump imposed 25% tariffs on imports of some advanced computing chips by the White House, which include the Nvidia H200 AI processor and a similar semiconductor from AMD called the MI325X.

- Still, Sterling trades lower against the US Dollar around 1.3425 during the European trading session on Thursday as the US Dollar strengthens on expectations that the Federal Reserve (Fed) will hold interest rates steady in the next meeting.

- During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.15% higher to near the monthly high of 99.26.

- According to the CME FedWatch tool, the Fed is certain to leave interest rates unchanged in the range of 3.50%-3.75% at the January policy meeting, indicating a pause in the monetary-easing campaign. In the last three meetings, the Fed delivered three consecutive 25-basis-point interest rate cuts (bps) amid weak job market conditions.

- The speculation that the Fed will leave interest rates steady is backed by expectations that the impact of the latest cuts is yet to be seen in the economy. Also, the US Consumer Price Index (CPI) data for December showed on Tuesday that price pressures grew steadily.

- On Wednesday, Atlanta Fed Bank President Raphael Bostic emphasized the need to maintain a restrictive monetary policy stance in the near term, citing that the “inflation challenge has not been won yet".

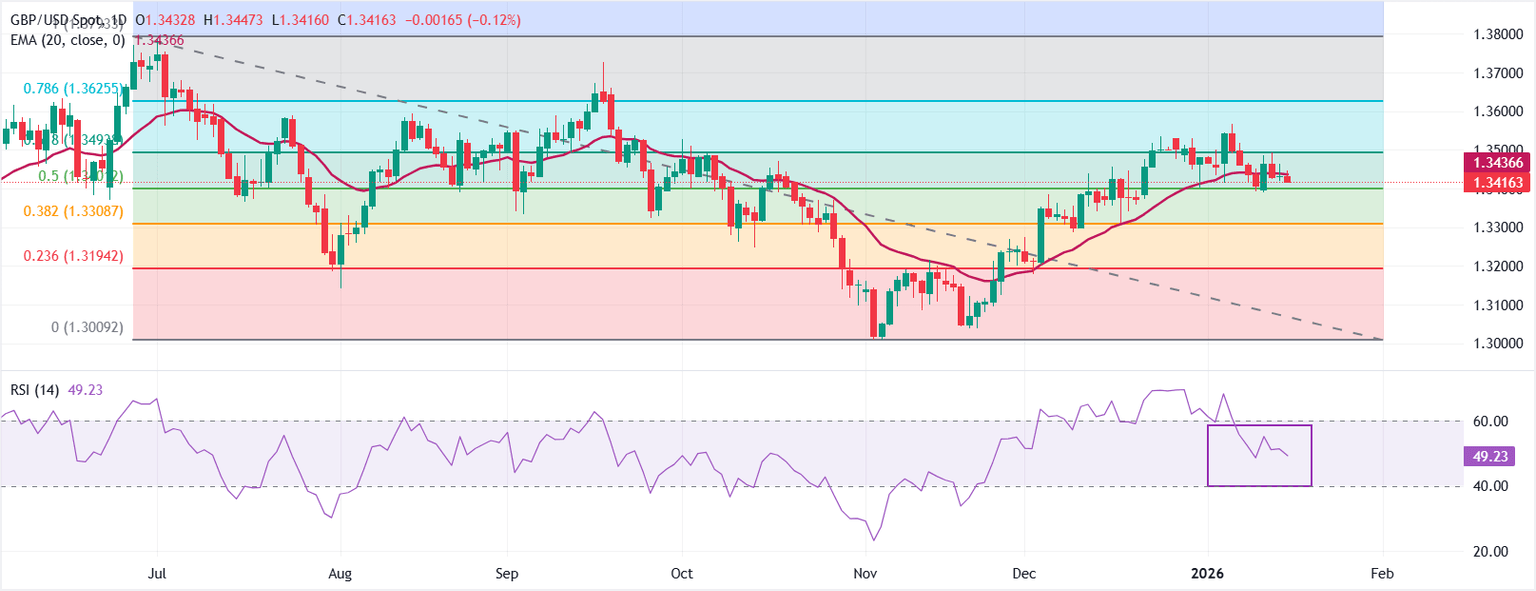

Technical Analysis: GBP/USD holds 50% Fibonacci retracement at 1.3400

GBP/USD trades lower to near 1.3420 at the time of writing. The 20-day Exponential Moving Average (EMA) at 1.3438 has flattened after a steady ascent, with price hovering around it.

The 14-day Relative Strength Index (RSI) at 49.23 is neutral, indicating balanced momentum.

Measured from the 1.3793 high to the 1.3009 low, the 61.8% Fibonacci retracement at 1.3494 caps the rebound, while the 78.6% Fibonacci retracement at 1.3625 looms overhead. A topside breach could extend the recovery toward the September 2025 high of 1.3726, whereas rejection would keep range-bound trade around the 20-day EMA.

(The technical analysis of this story was written with the help of an AI tool.)

GDP FAQs

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022. Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency. When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.