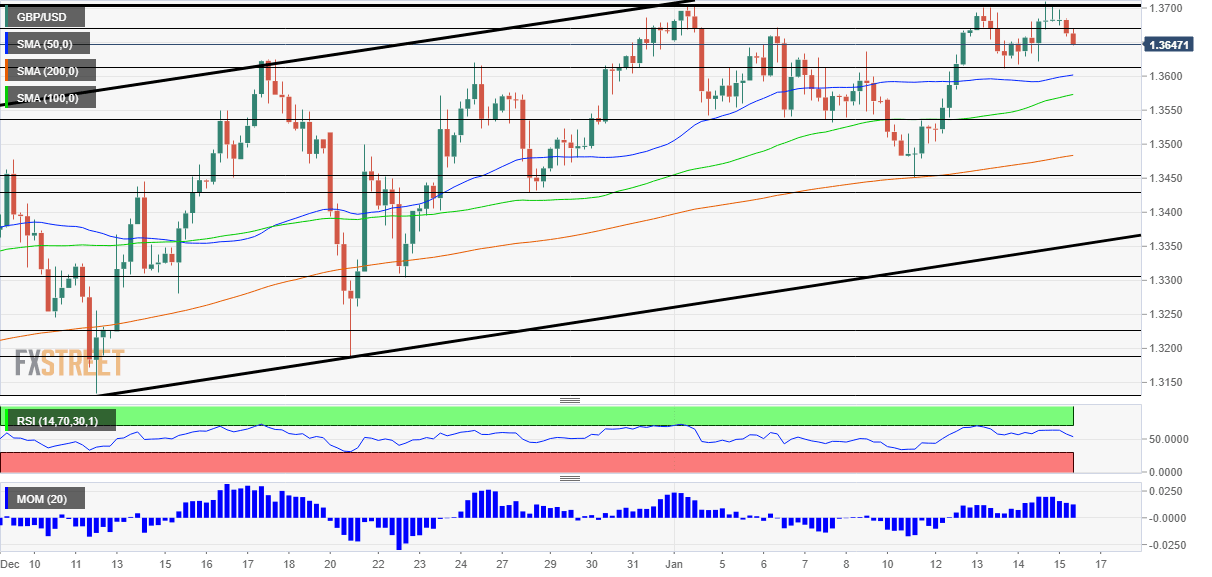

Pound Sterling Price News and Forecast: Will the fourth attack on 1.37 succeed?

GBP/USD analysis: Could trade upwards

Yesterday, the GBP/USD exchange rate bounced off the psychological level at 1.3700. It is likely that the currency pair could gain support from the 55-hour moving average near 1.3680 and extend gains within the following trading session. The pair could target the weekly R2 at 1.3776.

Meanwhile, note that the exchange rate would have to exceed the weekly R1 at 1.3676. If the predetermined resistance holds, the rate could decline to the psychological level at 1.3550 in the short term. Read more...

GBP/USD Forecast: Will the fourth attack on 1.37 succeed? US data may provide a shot in the arm

Is President-elect Joe Biden going to raise taxes as his first move? That is highly unlikely, but markets are focusing on his comment that "everybody must pay their fair share" rather than the massive $1.9 trillion stimulus – news that had already been out earlier. The risk-off mood in markets is weighing on the safe-haven dollar.

Investors may have a rethink at Biden's speech and also on one delivered by Jerome Powell, Chairman of the Federal Reserve. The world's most powerful central banker put to rest speculation of an early reduction of the Fed's bond-buying scheme. Prospects of early tightening pushed the greenback higher earlier in the week. On Friday, US ten-year bond yields continue their decline and may push the dollar lower. Read more...

GBP/USD to run higher above critical resistance at 1.37

GBP/USD has been hovering below 1.37 as markets digest Biden and Powell's speeches. The UK's vaccination campaign and weak US data may push cable above the strong 1.37 resistance as Friday's 4-hour chart is painting a bullish picture, Yohay Elam, an Analyst at FXStreet, informs.

“It is highly unlikely that President-elect Joe Biden raises taxes as his first move but markets are focusing on his comment that ‘everybody must pay their fair share’ rather than the massive $1.9 trillion stimulus. The risk-off mood in markets is weighing on the safe-haven dollar.” Read more...

Author

FXStreet Team

FXStreet