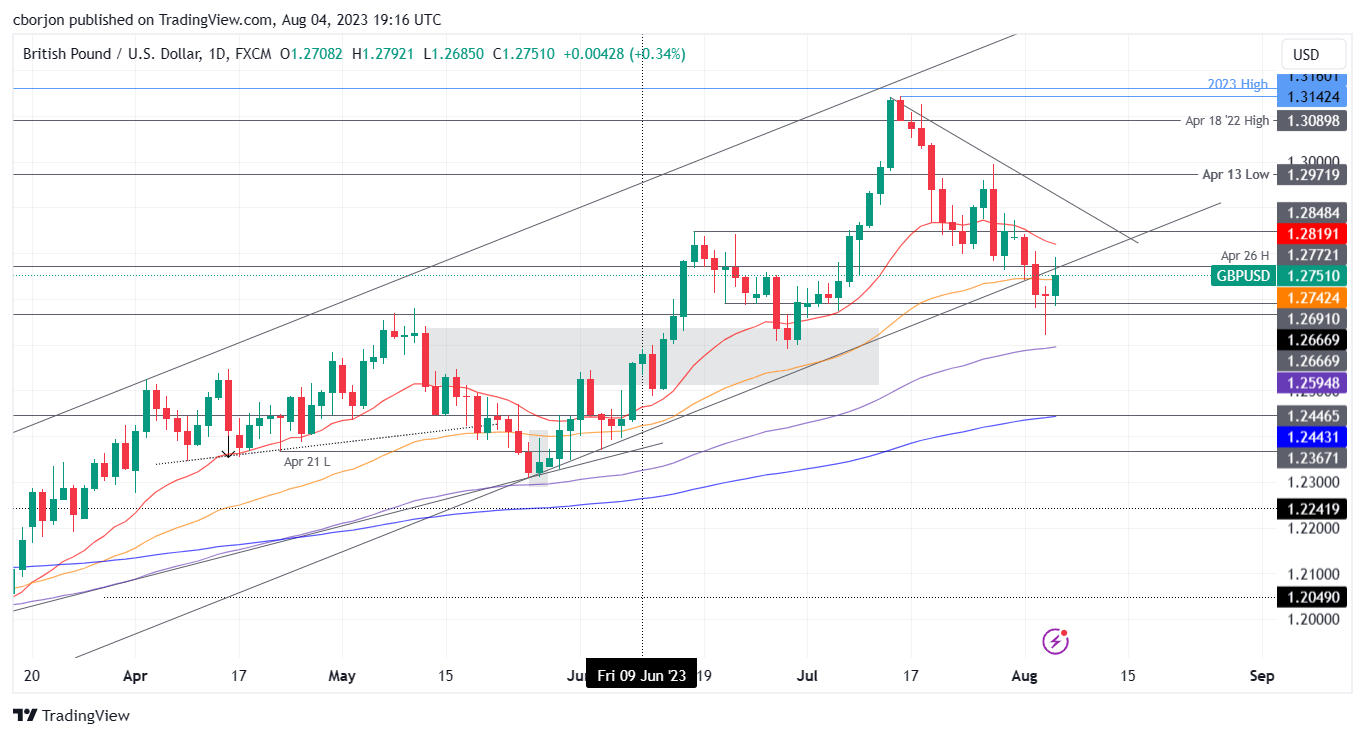

Pound Sterling Price News and Forecast: GBP/USD: Bounces after printing a doji, as morning-star looms

GBP/USD Price Analysis: Bounces after printing a doji, as morning-star looms

Pound Sterling soars amid mixed US Employment report, Bailey's hawkish guidance

The Pound Sterling (GBP) climbs sharply near 1.2750, capitalizing on the recovery move, as the market mood starts reviving and the Bank of England (BoE) delivers a hawkish interest rate decision. The GBP/USD pair eyes more gains as the BoE raises interest rates by 25 basis points (bps) to 5.25%, the highest in the past 15 years. The central bank leaves the door open for further policy tightening as inflation is extremely far from the desired rate of 2%. Read More...

GBP/USD risks a probable drop to 1.2580 – UOB

Author

FXStreet Team

FXStreet