Pound Sterling rallies as sluggish US wage data improves market mood

The Pound Sterling (GBP) strengthens in Friday’s early American session as the risk appetite of market participants improves. The appeal for risk-sensitive assets firms after the

United States Bureau of Labor Statistics (BLS) reported that wage growth remains soft and the Unemployment Rate rises sharply in February.

Read More...

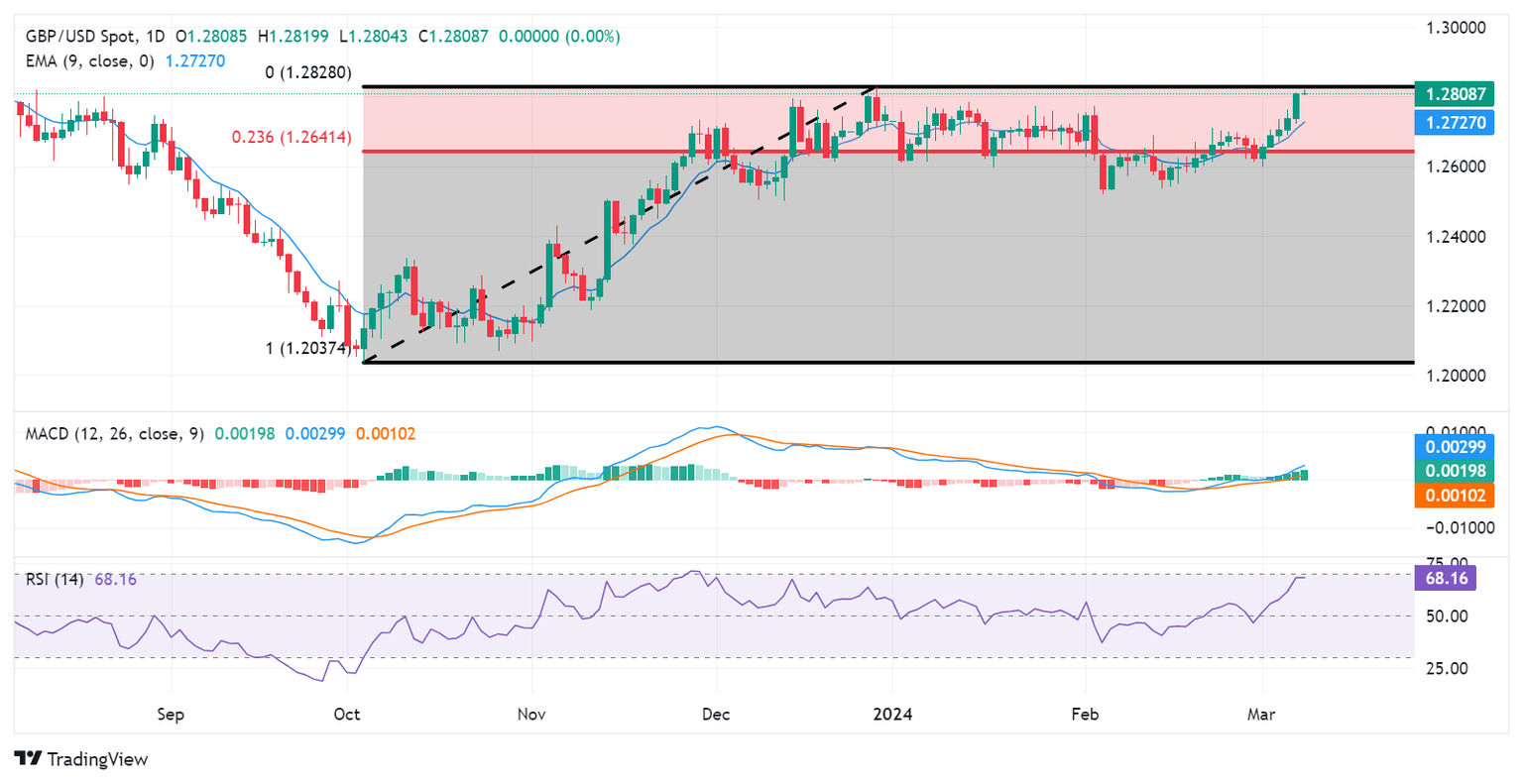

GBP/USD Price Analysis: Appreciates to near 1.2810 followed by December’s high

GBP/USD seems to continue its winning streak that began on March 1, hovering around 1.2810 during the Asian session on Friday. The GBP/USD pair receives upward support as the

US Dollar (USD) faces challenges on improved risk appetite amid lower US Treasury yields.

Read More...

GBP/USD clinches fresh 2024 highs above 1.2800 ahead of US NFP data

The GBP/USD pair holds ground above the 1.2800 psychological barrier during the early Asian trading hours on Friday. The selling pressure in the

US Dollar (USD) provides some support to the major pair. The highlight on Friday will be the US labor market data for February. GBP/USD currently trades around 1.2810, up 0.01% on the day.

Read More...