Pound Sterling Price News and Forecast GBP/USD: Weekly M-formation playing out

UK Inflation Preview: Another hit to British households, and to the pound?

GBP/USD has stalled its recovery momentum from the 2022 lows, as the driving theme of central bank divergence comes back to the fore. The Bank of England (BOE) delivered a cautious rate hike at its March policy meeting while Jerome Powell and Co. remain on course for aggressive tightening. UK inflation is foreseen at 5.9% YoY in February, refreshing a 30-year high. BOE expects inflation to be “several percentage points” higher than its 7.25% previous forecast. Soaring inflation to accentuate BOE’s dilemma, posing downside risks to the GBP. Read more...

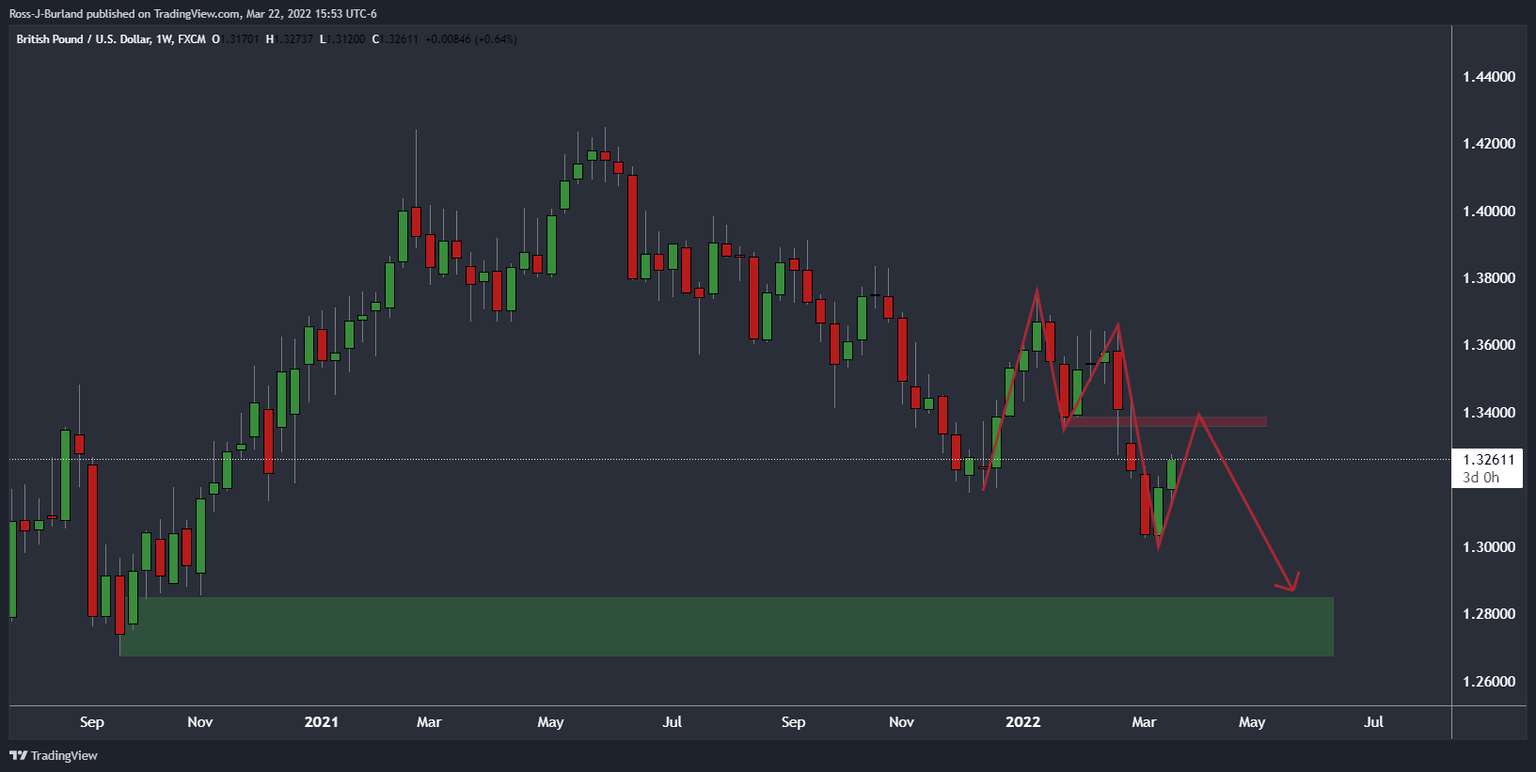

GBP/USD Price Analysis: Weekly M-formation playing out

The M-formation is a compelling pattern that is playing out with the price reverting towards the neckline of the pattern near 1.3350. This comes in towards a 61.8% golden ratio and 1.34 the figure. Should the area hold, the price would be expected to continue on its southerly trajectory with 1.28 the figure in focus. Hawkish comments from Fed Chair Jerome Powell yesterday have injected another wave of re-pricing into US rates markets. However, the pound has continued higher in a technical move towards a weekly resistance level as per the following chart. Read more...

GBP/USD Forecast: Pound bulls to take action above 1.3200

GBP/USD has turned north following a decline toward 1.3100 earlier in the day. The positive shift witnessed in market mood seems to be helping the British pound hold its ground against the greenback in the early European session. The pair is closing in on key 1.3200 resistance and additional gains could be witnessed if sellers fail to defend that level. Ukrainian President Volodymyr Zelenskyy said on Tuesday that they were ready to discuss commitment not to join NATO and added that they could also discuss the status of Crimea and Donbass after the ceasefire. Although it's too early to say whether or not these remarks could be taken as convincing signs toward a diplomatic solution, risk-sensitive assets are gathering interest. Read more...

Author

FXStreet Team

FXStreet