Pound Sterling Price News and Forecast: GBP/USD under pressure amid coronavirus-related concerns

GBP/USD Forecast: Sell opportunity? Brexit is back, and not in a good way

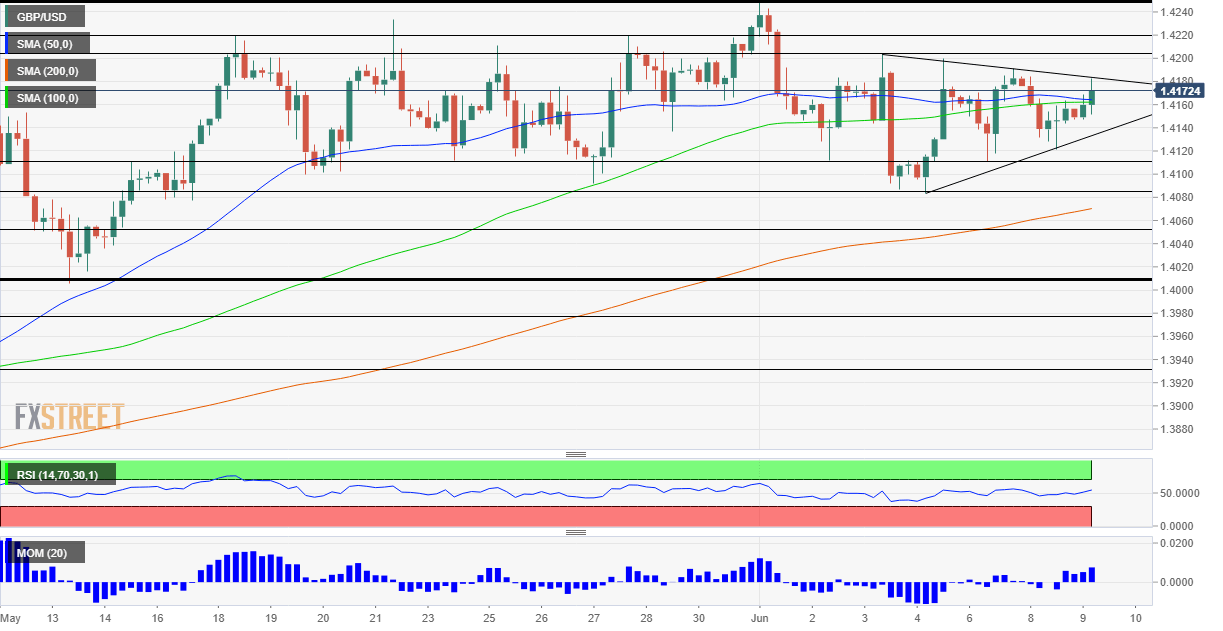

GBP/USD has bounced after the BOE's Haldane called on removing stimulus. Brexit and also reopening and inflation worries could push the pound back down. Wednesday's four-hour chart is painting a mixed picture. We could start tightening the tap on QE – Andy Haldane, Chief Economist at the Bank of England, has single-handedly knocked sterling from its sleep and has sent it higher. He has also said that the UK economy is going "gangbusters" and that he is already seeing price pressures. Read more...

GBP/USD Forecast: Under pressure amid coronavirus-related concerns

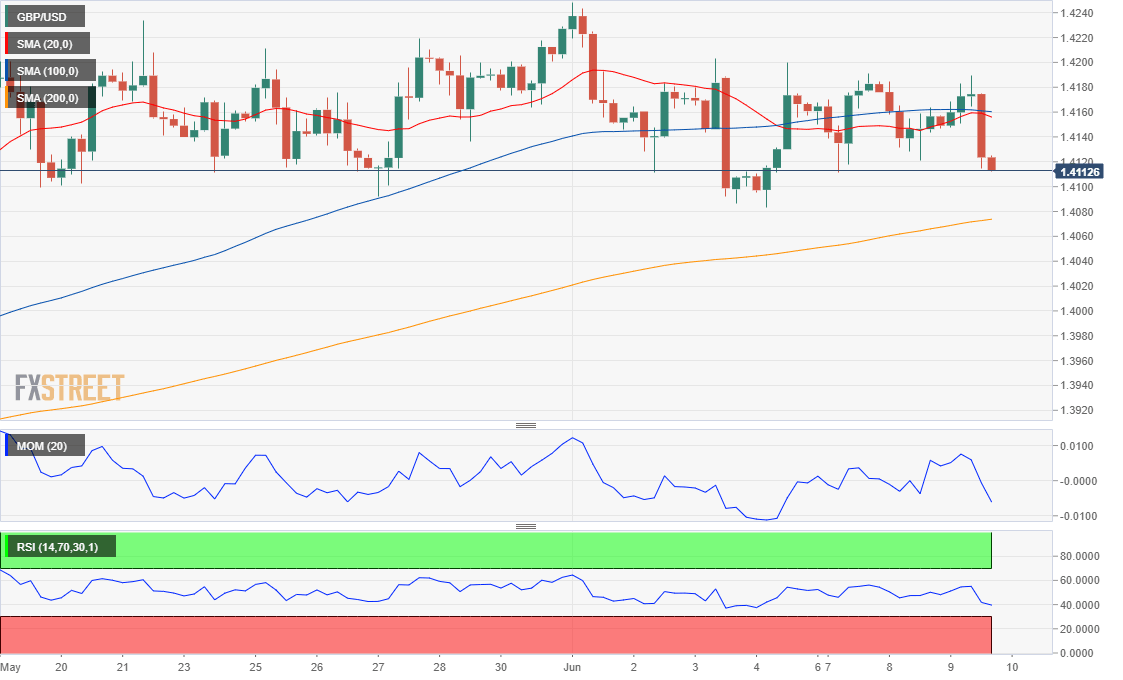

The GBP/USD pair neared the 1.4200 figure but took a turn to the worse during the American session, now trading a few pips above the 1.4100 level, with the decline exacerbated by coronavirus-related concerns. UK epidemiologist Neil Ferguson said that the UK could see a third wave comparable to the second one in terms of hospitalizations, if not deaths. Read more...

GBP/USD turns south following latest Brexit headlines, drops toward 1.4130

UK and EU struggle to find a solution on N. Ireland Protocol. GBP loses strength against its rivals in the second half of the day. Broad-based USD weakness limits GBP/USD's downside for the time being. The GBP/USD pair came under renewed bearish pressure during the American trading hours on Wednesday with the latest Brexit headlines weighing on the British pound. As of writing, the pair was losing 0.16% on a daily basis at 1.4133. Read more...

Author

FXStreet Team

FXStreet