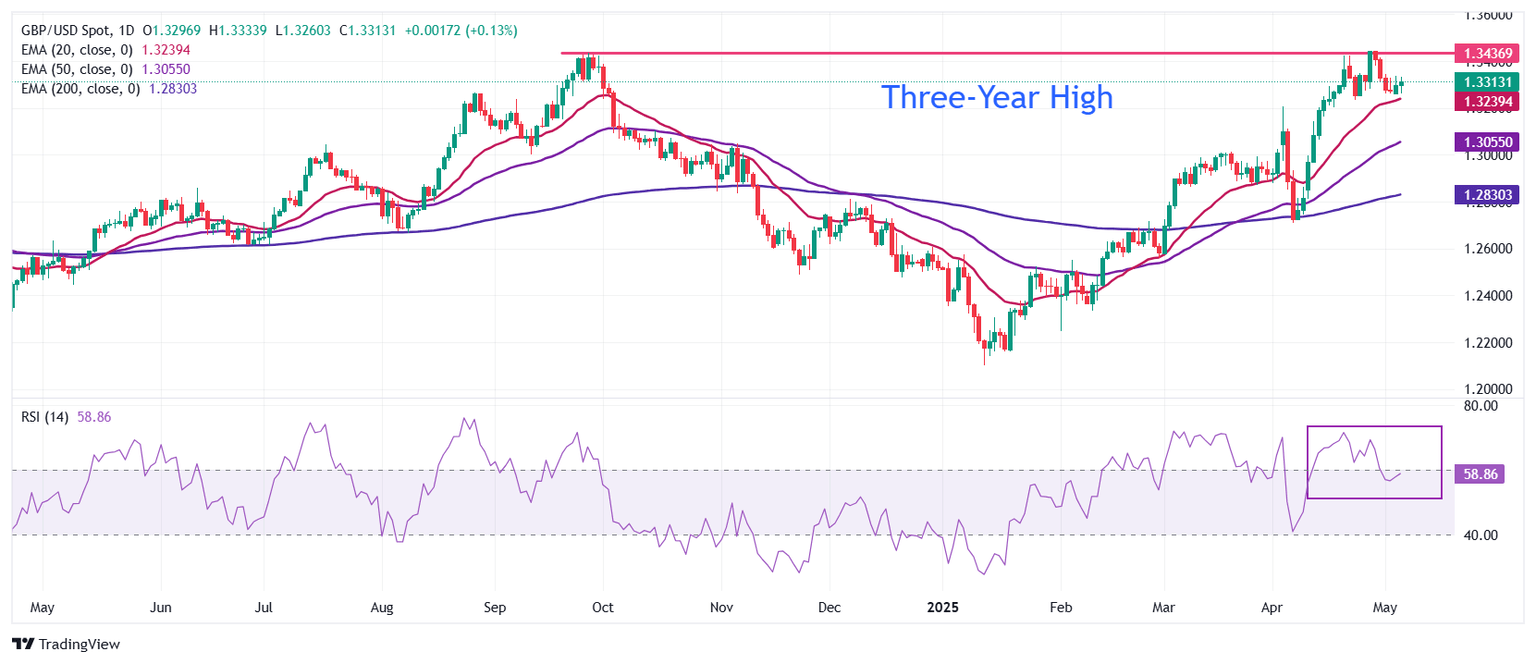

Pound Sterling Price News and Forecast: GBP/USD rises past 1.3350 as traders brace for Fed, BoE rate decisions

GBP/USD rises past 1.3350 as traders brace for Fed, BoE rate decisions

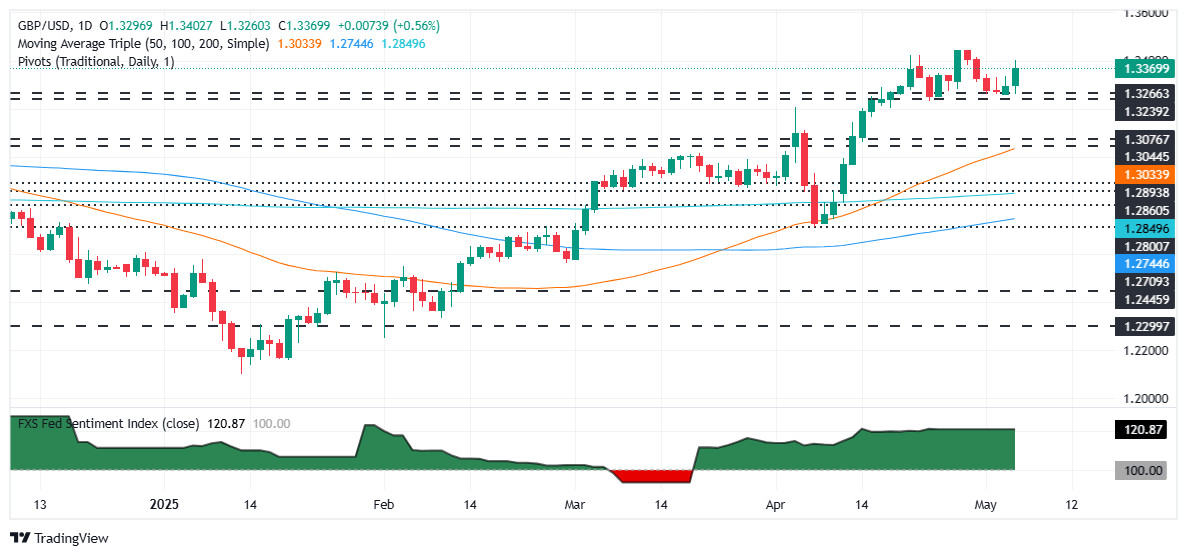

The Pound Sterling advanced for the second consecutive day, gaining over 0.65% against the US Dollar amid a scarce economic docket on both sides of the Atlantic. Major central banks like the Federal Reserve and the Bank of England (BoE) are preparing for their policy meetings. At the time of writing, the GBP/USD trades at 1.3381 shy of the 1.34 mark. Read More...

Pound Sterling rallies against US Dollar ahead of Fed-BoE monetary policy

The Pound Sterling (GBP) surges to near 1.3390 against the US Dollar (USD) during North American trading hours on Tuesday. The GBP/USD pair strengthens as the US Dollar declines, while investors await the monetary policy decision from the Federal Reserve (Fed), which will be announced on Wednesday. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, falls below 99.50. Read More...

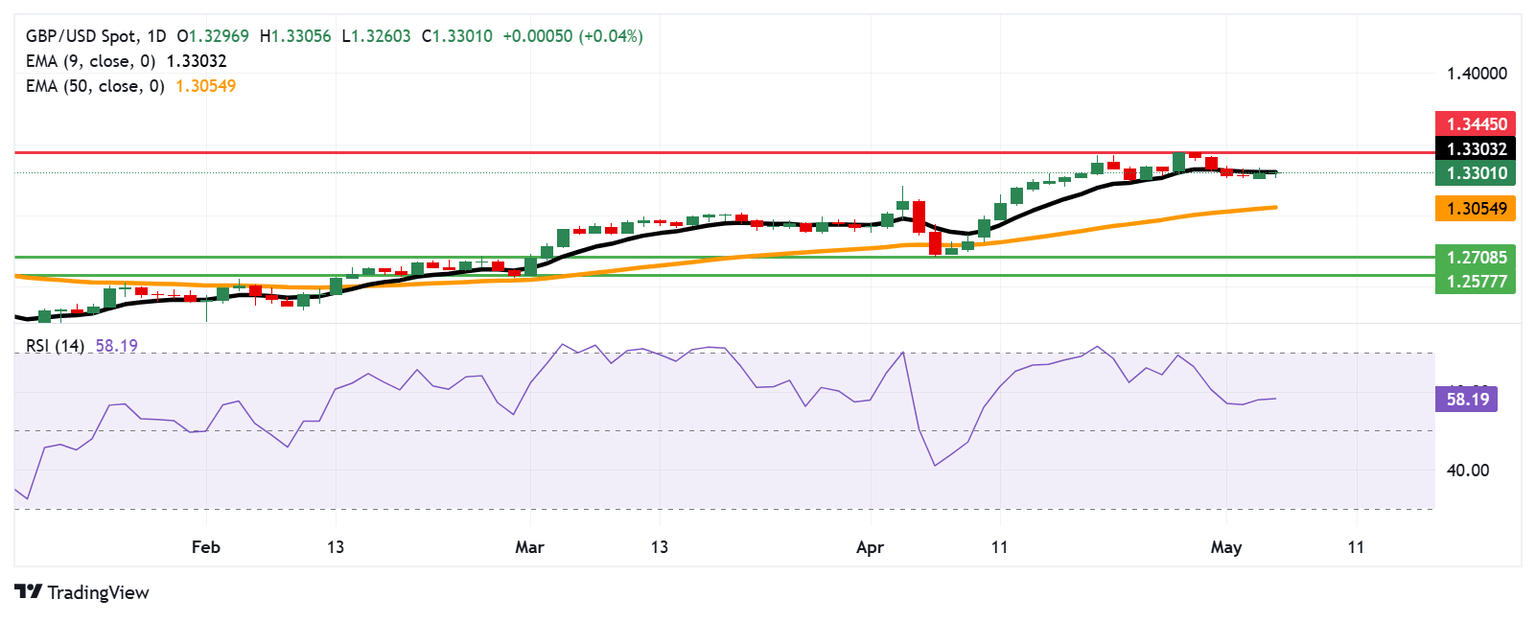

GBP/USD Price Forecast: Hovers around 1.3300 as nine-day EMA caps upside

The GBP/USD pair attempts to maintain its position after registering gains in the previous session, trading around 1.3300 during the Asian trading hours on Tuesday. Technical analysis on the daily chart suggests a neutral short-term price momentum, as the pair is hovering around the nine-day Exponential Moving Average (EMA). Read More...

Author

FXStreet Team

FXStreet