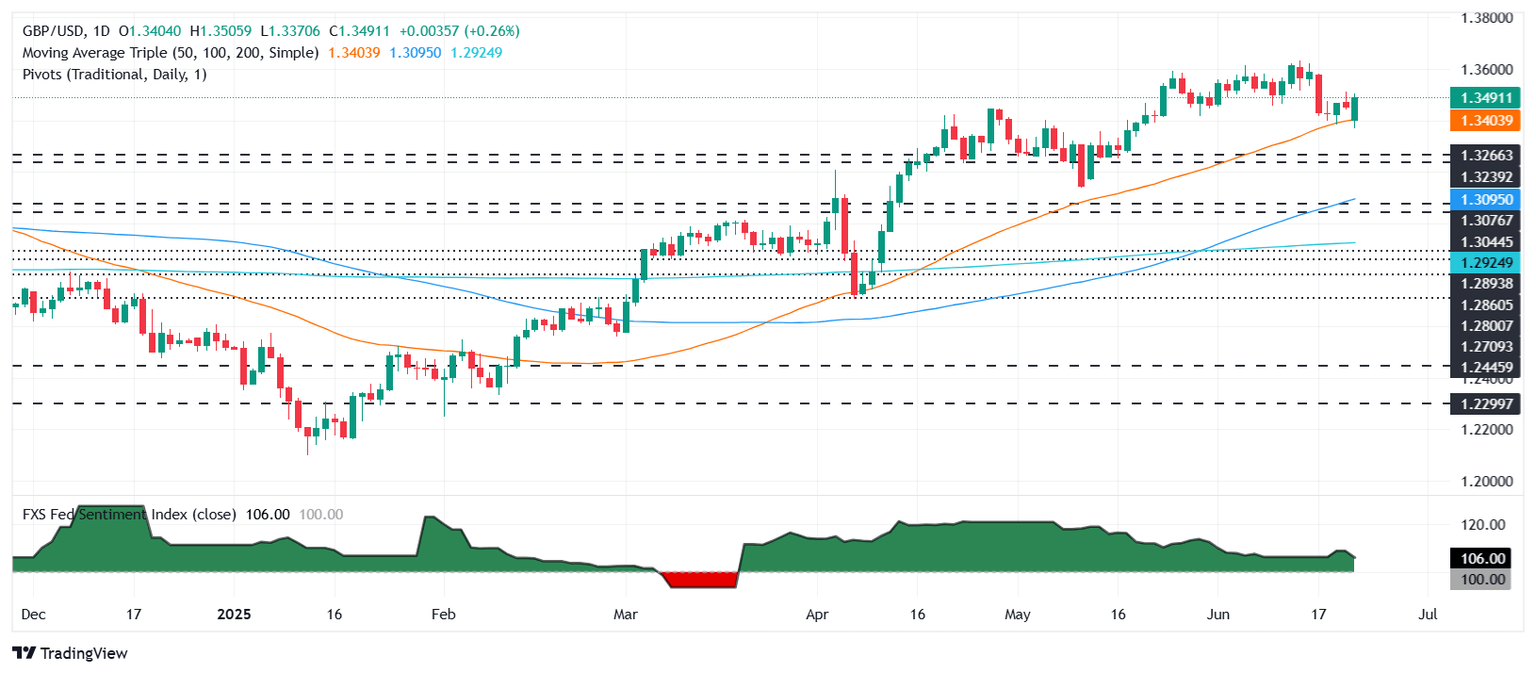

Pound Sterling Price News and Forecast: GBP/USD rebounds to 1.3500 as Fed’s Bowman backs July cut

GBP/USD rebounds to 1.3500 as Fed’s Bowman backs July cut, Iran tensions flare

The Pound Sterling (GBP) advances during the North American session, up 0.37% against the US Dollar, as risk appetite improved amid developments in the Middle East. At the time of writing, GBP/USD trades at 1.3500. Read More...

Pound Sterling declines against US Dollar as Greenback gains of US-Iran tensions

The Pound Sterling (GBP) slumps to near 1.3370 against the US Dollar (USD) during European trading hours on Monday. The GBP/USD pair weakens as investors rush to safe-haven assets, following the escalation of tensions between the United States (US) and Iran. Read More...

UK Preliminary Services PMI rises to 51.3 in June vs. 51.3 expected

The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) improved to 47.7 in June from 46.4 in May. The data better the market forecast of 46.6 in the reported period.

Meanwhile, the Preliminary UK Services Business Activity Index advanced to 51.3 in June versus May’s 50.9 while meeting the expected 51.3 figure. Read More...

Author

FXStreet Team

FXStreet