GBP/USD rebounds to 1.3500 as Fed’s Bowman backs July cut, Iran tensions flare

- GBP/USD climbs from 1.3369 low as Bowman signals July rate cut could be appropriate.

- US strikes on Iran nuclear sites spark market volatility; Iranian parliament approves closing the Strait of Hormuz.

- UK Flash Services PMI improves to 51.3; US Manufacturing beats, Services dips slightly.

The Pound Sterling (GBP) advances during the North American session, up 0.37% against the US Dollar, as risk appetite improved amid developments in the Middle East. At the time of writing, GBP/USD trades at 1.3500.

Sterling rises 0.37% as dovish Fed comments offset Mideast risk surge and improve risk appetite

On Saturday, the United States (US) attacked Iran’s nuclear facilities, triggering a risk-off open in the current trading week. The Greenback rose, while Oil prices gapped up; however, WTI has recently been facing downward pressure.

Tensions in the Middle East remained high. Iran retaliated, approving the closure of the Strait of Hormuz, and launched missile strikes against Israel. US officials revealed that Iran’s retaliation actions could come as soon as the next day or two. Despite this, the White House is still looking for a diplomatic resolution, according to Reuters sources.

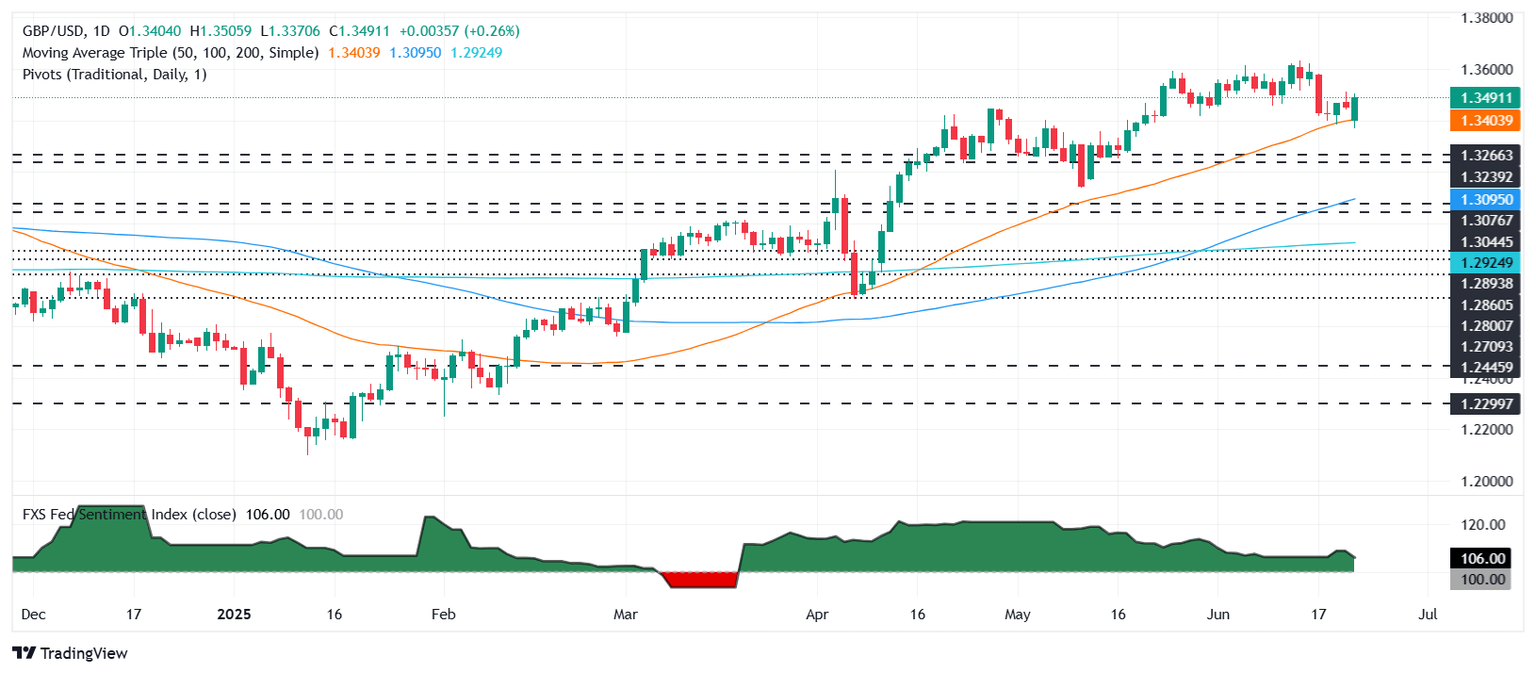

However, dovish comments from Federal Reserve (Fed) Governor Michelle Bowman, favoring a rate cut in July, weighed on the US Dollar. The GBP/USD pair has recovered from daily lows of 1.3399, near the 50-day Simple Moving Average (SMA).

Recently, the US S&P Global Manufacturing PMI for June came in at 52, above expectations of 51 but unchanged compared to the previous reading. The Services PMI dipped from 53.7 to 53.1 in June, above estimates of 52.9.

In the UK, the economy shows signs of recovery as the S&P Global Services Flash PMI increased to 51.3 in June, up from 50.9, matching forecasts. The Manufacturing PMI continued to show contractionary readings of 47.7, up from 46.6 estimates.

GBP/USD Price Forecast: Technical outlook

The GBP/USD uptrend remains in place but faces stiff resistance. Buyers need to push the exchange rate above the 20-day simple moving average (SMA) of 1.3508. This will clear the path to challenge 1.3550, 1.3600, and the year-to-date (YTD) high of 1.3631. Conversely, a daily close below 1.3500 will expose the pair to a pullback, with sellers eyeing the 50-day SMA at 1.3399.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.70% | -0.66% | -0.18% | -0.07% | 0.06% | 0.08% | -0.50% | |

| EUR | 0.70% | 0.02% | 0.57% | 0.65% | 0.73% | 0.80% | 0.16% | |

| GBP | 0.66% | -0.02% | 0.59% | 0.63% | 0.70% | 0.77% | 0.15% | |

| JPY | 0.18% | -0.57% | -0.59% | 0.09% | 0.21% | 0.31% | -0.41% | |

| CAD | 0.07% | -0.65% | -0.63% | -0.09% | 0.17% | 0.15% | -0.48% | |

| AUD | -0.06% | -0.73% | -0.70% | -0.21% | -0.17% | 0.05% | -0.56% | |

| NZD | -0.08% | -0.80% | -0.77% | -0.31% | -0.15% | -0.05% | -0.62% | |

| CHF | 0.50% | -0.16% | -0.15% | 0.41% | 0.48% | 0.56% | 0.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.