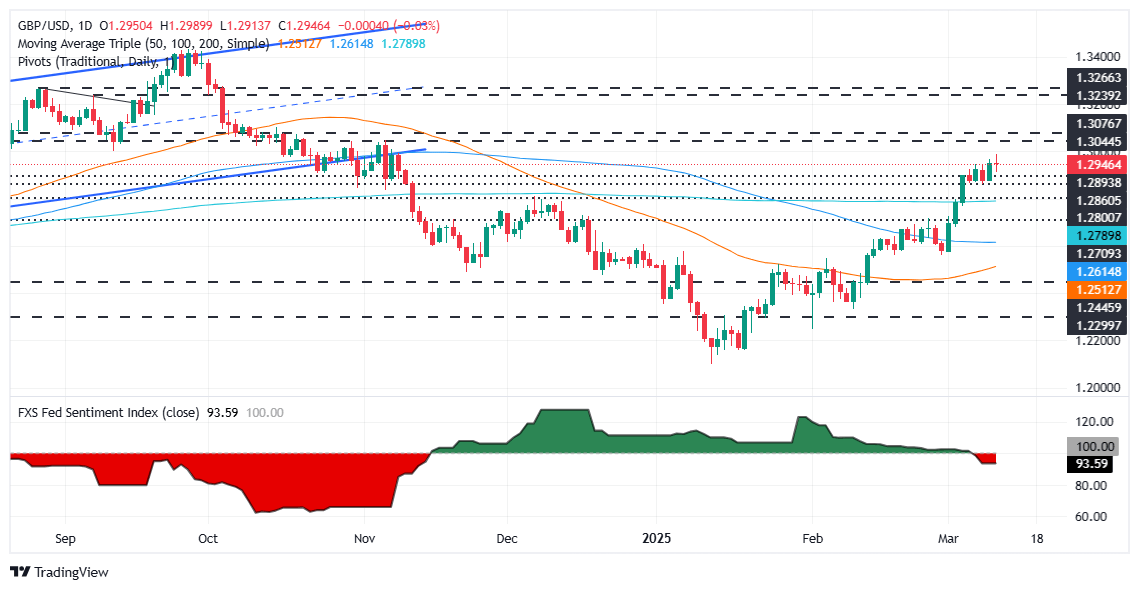

Pound Sterling Price News and Forecast: GBP/USD reached to four-month high of 1.2989 on March 13

GBP/USD maintains position above 1.2950 near four-month highs

GBP/USD attempts to extend its gains for the third successive day, trading around 1.2960 during the Asian session on Thursday. The GBP/USD pair rises as the US Dollar (USD) faces headwinds amid ongoing tariff uncertainty from US President Donald Trump and growing concerns over a potential US recession.

The Greenback may further lose ground as the US inflation cooled more than anticipated in February, raising speculation that the Federal Reserve (Fed) might cut interest rates sooner than expected. Market participants are now awaiting Thursday’s US Producer Price Index (PPI) data and weekly jobless claims for further economic cues. Read more...

GBP/USD holds steady near fresh highs as markets take a breather

GBP/USD cycled near recent highs on Wednesday, building a base near the key 1.3000 handle as markets take a moment after US Consumer Price Index (CPI) inflation chilled even more than expected in February. Markets now await Thursday’s US Producer Price Index (PPI), with key consumer sentiment and consumer inflation expectations due on Friday.

The US imposed a global 25% tariff on all steel and aluminum imported into the US on Wednesday, kicking off the next critical stage of US President Donald Trump’s desire to get into a trade war with all of the US’s allies at once. A recent spat between the US and Canada came to a fizzling close this week after Donald Trump threatened to double metals tariffs on Canada just days before the US’s steel tariffs were slated to come online. After some back-and-forth posturing, both countries settled with the US imposing its “normal” 25% across-the-board tariffs on steel and aluminum, and Canada set to impose its own tariffs on a targeted amount of goods later this week. Read more...

GBP/USD slips slightly despite cooling US inflation, eyes on US PPI

The Pound Sterling (GBP) slightly depreciates against the US Dollar (USD) on Wednesday as United States (US) inflation data revealed the disinflation process continued. At the time of writing, the GBP/USD trades at 1.2925, down 0.13%.

In February, the US Consumer Price Index (CPI) was below the estimated 0.3% and rose by 0.2% MoM. On a yearly basis, CPI dipped from 3% to 2.8%. Excluding volatile items, the so-called Core CPI expanded by 0.2% MoM, down from 0.4% in January, beneath forecast, and in the twelve months to February, slid from 3.3% to 3.1%. Read more...

Author

FXStreet Team

FXStreet