GBP/USD slips slightly despite cooling US inflation, eyes on US PPI

- Core US inflation eases to 3.1% YoY, boosting Fed rate-cut expectations.

- 25% tariffs remain a risk factor; further UK rate cuts could cap Sterling's gains.

- Traders look toward the US PPI on Thursday and the UK GDP release for direction.

The Pound Sterling (GBP) slightly depreciates against the US Dollar (USD) on Wednesday as United States (US) inflation data revealed the disinflation process continued. At the time of writing, the GBP/USD trades at 1.2925, down 0.13%.

Sterling dips to 1.2925 amid cautious market reaction to US CPI report

In February, the US Consumer Price Index (CPI) was below the estimated 0.3% and rose by 0.2% MoM. On a yearly basis, CPI dipped from 3% to 2.8%. Excluding volatile items, the so-called Core CPI expanded by 0.2% MoM, down from 0.4% in January, beneath forecast, and in the twelve months to February, slid from 3.3% to 3.1%.

The GBP/USD pair spiked on the data release but retreated to 1.2920 as traders digested the news.

Although the data was positive, fears of an inflation reacceleration loom due to tariffs imposed on goods imported to the US. Today, 25% tariffs on aluminum and steel are in effect, with no exceptions.

Money market futures traders had priced in 74 basis points of easing by the Federal Reserve (Fed) toward the end of the year. Hence, further GBP/USD upside is seen unless the Bank of England (BoE) cuts rates more aggressively than the Federal Reserve (Fed) or next month’s CPI data comes hotter than the recent one, which would put downward pressure on the pair.

The US economic docket will feature the Producer Price Index (PPI) for the same period as today’s CPI and Initial Jobless Claims data. Traders brace for Gross Domestic Product (GDP) figures in the UK on Friday.

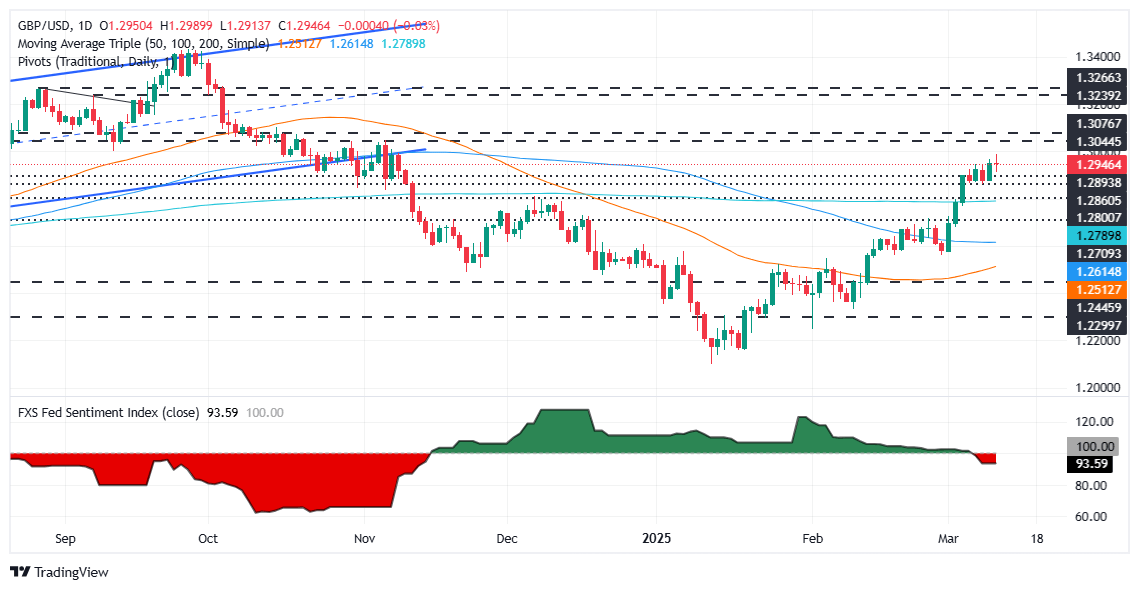

GBP/USD Price Forecast: Technical outlook

GBP/USD is set to continue its uptrend despite Wednesday’s dip in US inflation data. The Relative Strength Index (RSI) shows that buyers are taking a respite, as the RSI is overbought. If the pair clears 1.2950, the next resistance would be 1.3000. Once surpassed, the next stop would be November’s 6 high at 1.3047. However, if GBP/USD turns downward and clears 1.2900, a test of the 200-day Simple Moving Average (SMA) at 1.2790 is on the cards.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | 0.03% | 0.37% | -0.23% | 0.04% | -0.00% | 0.00% | |

| EUR | -0.05% | -0.03% | 0.32% | -0.24% | -0.02% | -0.06% | -0.04% | |

| GBP | -0.03% | 0.03% | 0.35% | -0.25% | 0.00% | -0.03% | -0.02% | |

| JPY | -0.37% | -0.32% | -0.35% | -0.59% | -0.32% | -0.37% | -0.34% | |

| CAD | 0.23% | 0.24% | 0.25% | 0.59% | 0.27% | 0.22% | 0.25% | |

| AUD | -0.04% | 0.02% | -0.01% | 0.32% | -0.27% | -0.04% | 0.00% | |

| NZD | 0.00% | 0.06% | 0.03% | 0.37% | -0.22% | 0.04% | 0.02% | |

| CHF | -0.01% | 0.04% | 0.02% | 0.34% | -0.25% | -0.01% | -0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.