Pound Sterling Price News and Forecast: GBP/USD pares intraday losses to weekly low

GBP/USD Forecast: Bears look to dominate after UK inflation data

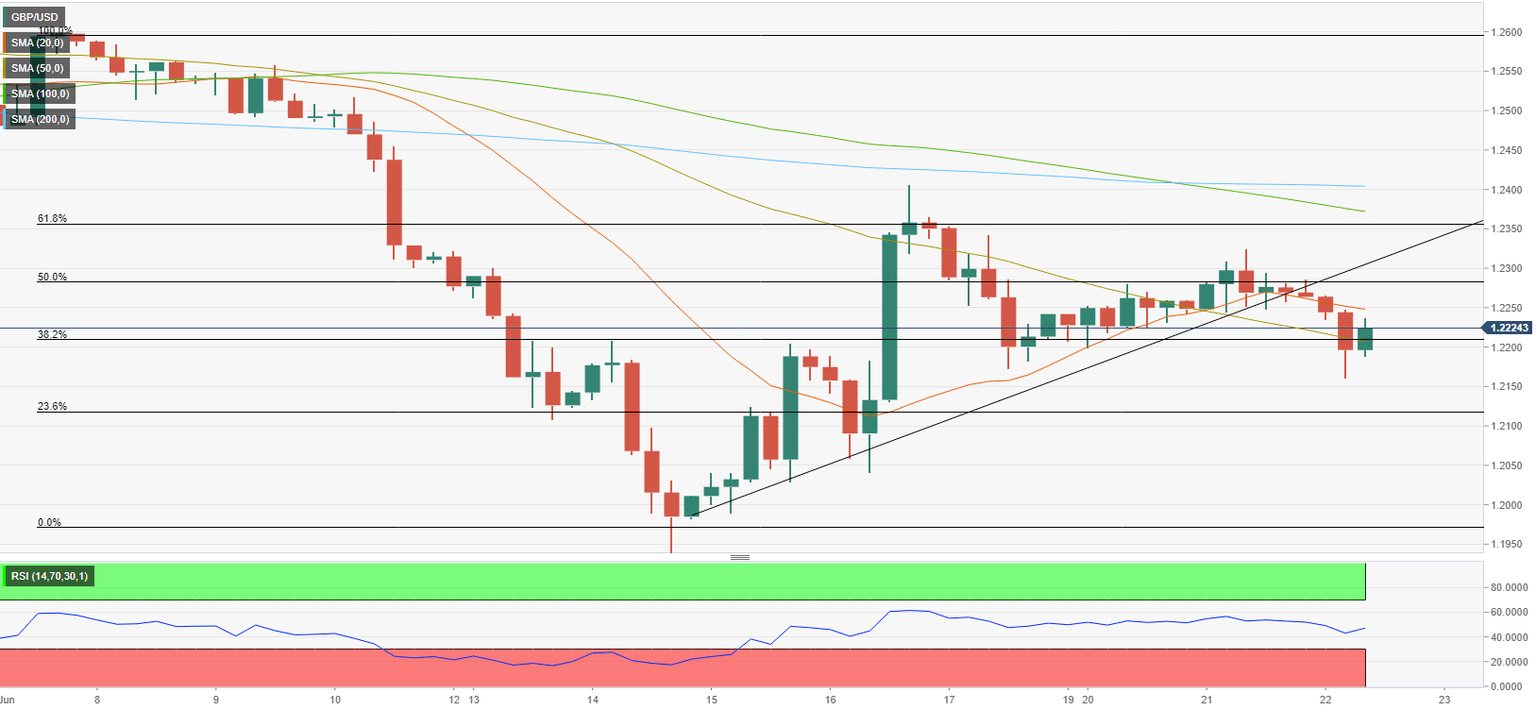

GBP/USD has met fresh bearish pressure early Wednesday and declined below 1.2200. The risk-averse market environment and soft inflation data from the UK weigh on the pair mid-week and the technical outlook suggests that additional losses are likely in the short term.

The UK's Office for National Statistics (ONS) showed on Wednesday that the annual inflation in the UK, as measured by the Consumer Price Index (CPI), edged higher to 9.1% in May as expected. On a positive note, the Core CPI, which excludes volatile food and energy prices, declined to 5.9% on a yearly basis from 6.2% in April. Read more...

GBP/USD pares intraday losses to weekly low, keeps the red ahead of Powell’s testimony

The GBP/USD pair refreshed its weekly low during the early part of the European session, albeit managing to find some support ahead of mid-1.2100s and recovering a few pips thereafter. The pair was last seen trading around the 1.2225-1.2230 region, still down nearly 0.40% for the day.

The US dollar regained positive traction amid growing market acceptance that the Fed would stick to its policy tightening path and raise interest rates at a faster pace to curb soaring inflation. In fact, the markets have been pricing in another 75 bps rate hike at the next FOMC meeting in July. This, along with a fresh wave of the global risk-aversion trade, boosted the safe-haven USD and exerted downward pressure on the GBP/USD pair. Read more...

GBP/USD set to suffer an eventual fall to 1.1500/1.1409 – Credit Suisse

GBP/USD has been unable to sustain its break below the 78.6% retracement of the entire 2020/2021 uptrend at 1.2017. However, strength stays seen as corrective ahead of an eventual fall to 1.1500/1.1409, in the view of analysts at Credit Suisse.

“GBP/USD has been unable to sustain its break below the 78.6% retracement of the entire 2020/2021 uptrend at 1.2017 but with GBP holding a top in Trade Weighted Terms and with the USD also expected to stay strong strength stays seen as corrective and temporary.” Read more...

Author

FXStreet Team

FXStreet