Pound Sterling Price News and Forecast: GBP/USD holds positive ground below the mid-1.2500s

GBP/USD Forecast: Pound Sterling remains on track to post weekly gains against US Dollar

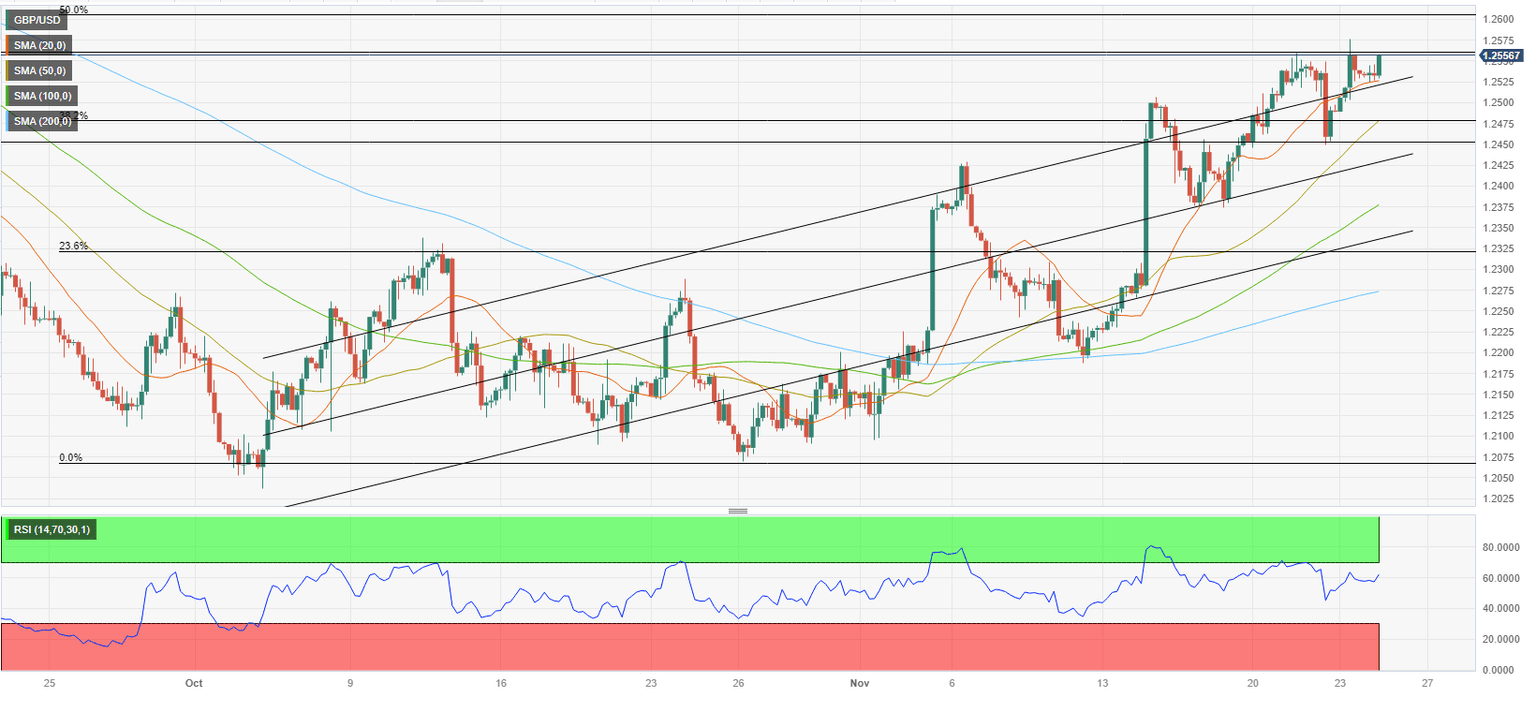

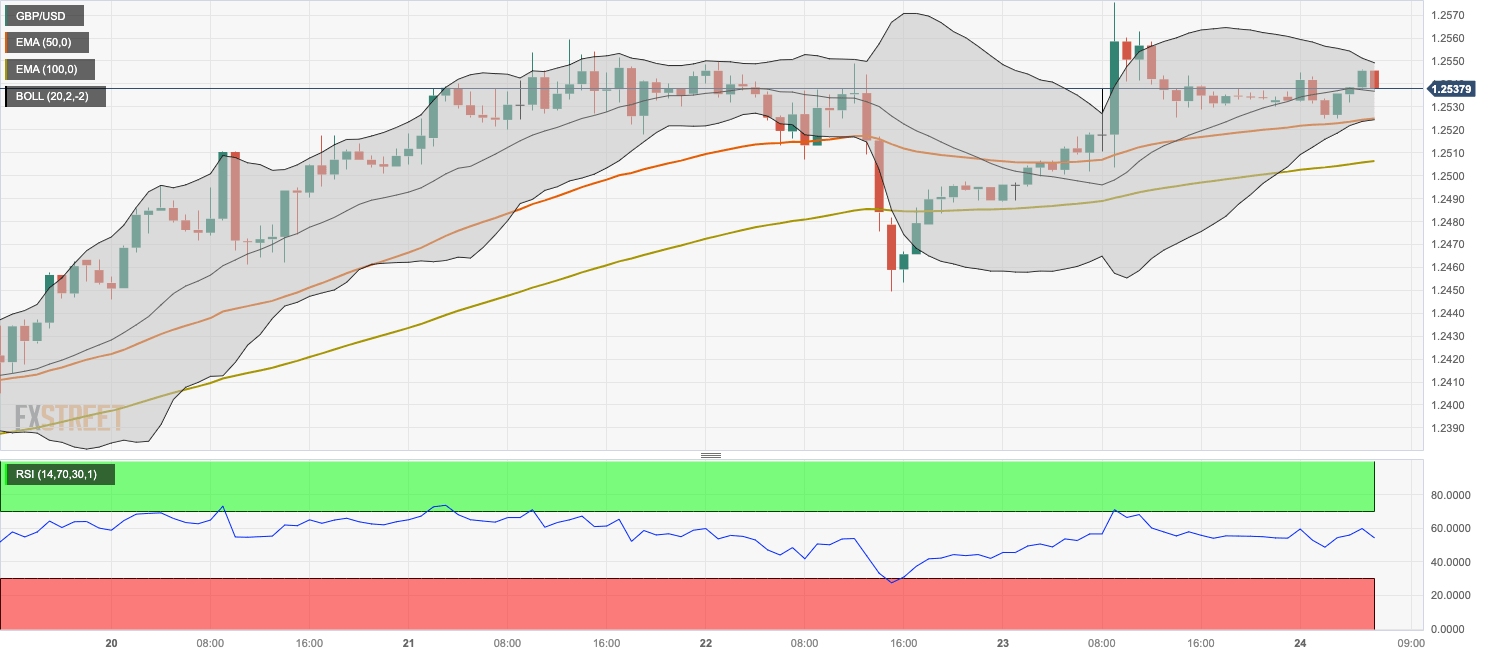

GBP/USD holds steady at around 1.2550 on Friday after posting modest gains on Thursday. The pair's technical outlook suggests that the bullish bias remain intact heading into the weekend.

Upbeat PMI readings from the UK, which showed that the private sector moved back into the expansion territory in early November, helped Pound Sterling stay resilient against its rivals on Thursday. Nevertheless, thin trading conditions on Thanksgiving Day didn't allow GBP/USD to gather bullish momentum. Read more...

GBP/USD Price Analysis: Holds positive ground below the mid-1.2500s, further upside looks favorable

The GBP/USD pair gains ground to a two-month high of 1.2575 and then pulled back to 1.2540 during the Asian trading hours on Friday. The uptick of the pair is supported by the stronger-than-expected UK S&P Global/CIPS PMI data for November. The attention will shift to the US S&P Global PMI data, due later on Friday. Read more...

GBP/USD: Limited upside potential, market has BoE’s rather hesitant approach at back of its mind – Commerzbank

GBP/USD has returned more or less to the levels seen prior to the announcement of renewed tax cuts on Wednesday. Economists at Commerzbank analyze the pair’s outlook. Read more...

Author

FXStreet Team

FXStreet