GBP/USD Forecast: Pound Sterling remains on track to post weekly gains against US Dollar

- GBP/USD clings to weekly gains at around 1.2550 on Friday.

- BoE's Pill said that they can afford to ease off tight monetary policy.

- The US economic docket will feature Manufacturing and Services PMI data ahead of the weekend.

GBP/USD holds steady at around 1.2550 on Friday after posting modest gains on Thursday. The pair's technical outlook suggests that the bullish bias remain intact heading into the weekend.

Upbeat PMI readings from the UK, which showed that the private sector moved back into the expansion territory in early November, helped Pound Sterling stay resilient against its rivals on Thursday. Nevertheless, thin trading conditions on Thanksgiving Day didn't allow GBP/USD to gather bullish momentum.

According to the Financial Times, Bank of England (BoE) Chief Economist Huw Pill said early Friday that the central bank could afford to ease off tight monetary policy. Pill, however, added that they had to resist the temptation to declare victory and move on from the battle against inflation. These comments failed to trigger a noticeable reaction in GBP/USD.

In the second half of the day, S&P Global will release Manufacturing and Services PMI data for the US. Positive surprises in these figures could help the USD hold its ground in the American session. Because bond and stock markets in the US will close early on Black Friday, the reaction to the US data could remain short-lived.

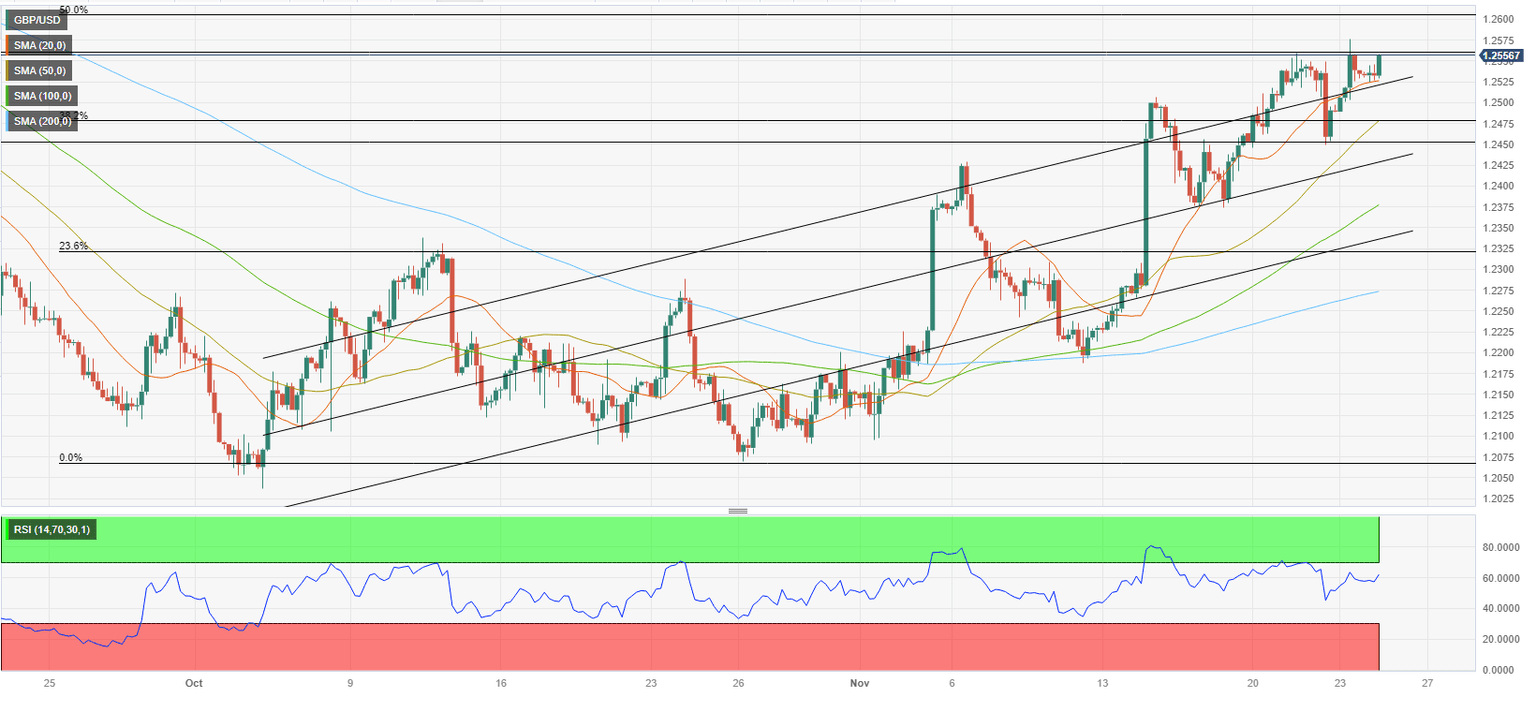

GBP/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart holds comfortably above 50 on Friday and GBP/USD continues to trade above the 20-period Simple Moving Average (SMA), reflecting the bullish bias in the short term.

1.2550 (static level) aligns as a pivot point. Once GBP/USD confirms that level as support, it could target 1.2600 (Fibonacci 50% retracement of the July-October downtrend) and 1.2670 (static level from August).

On the downside, 1.2525 (upper limit of the ascending regression channel) could be seen as first support before 1.2500 (psychological level) and 1.2450 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.