Pound Sterling Price News and Forecast: GBP/USD edges lower and is pressured by a modest USD strength

GBP/USD flirts with daily low around 1.2700 mark, FOMC minutes eyed for fresh impetus

The GBP/USD pair extends the previous day's late pullback from a multi-day peak, around the 1.2735-1.2740 area and remains on the defensive through the Asian session on Wednesday. Spot prices currently trade around the 1.2700 mark as traders await fresh clues about the Federal Reserve's (Fed) future rate-hike path.

Growing acceptance that the US central bank will lift borrowing costs by 25 bps at the end of the July policy meeting remains supportive of elevated US Treasury bond yields. This, in turn, lends some support to the US Dollar (USD) and seems to weigh on the GBP/USD pair. That said, the incoming softer US macro data raises questions over how much headroom the Fed has to continue raising interest rates and holds back the USD bulls from placing aggressive bets. Read more...

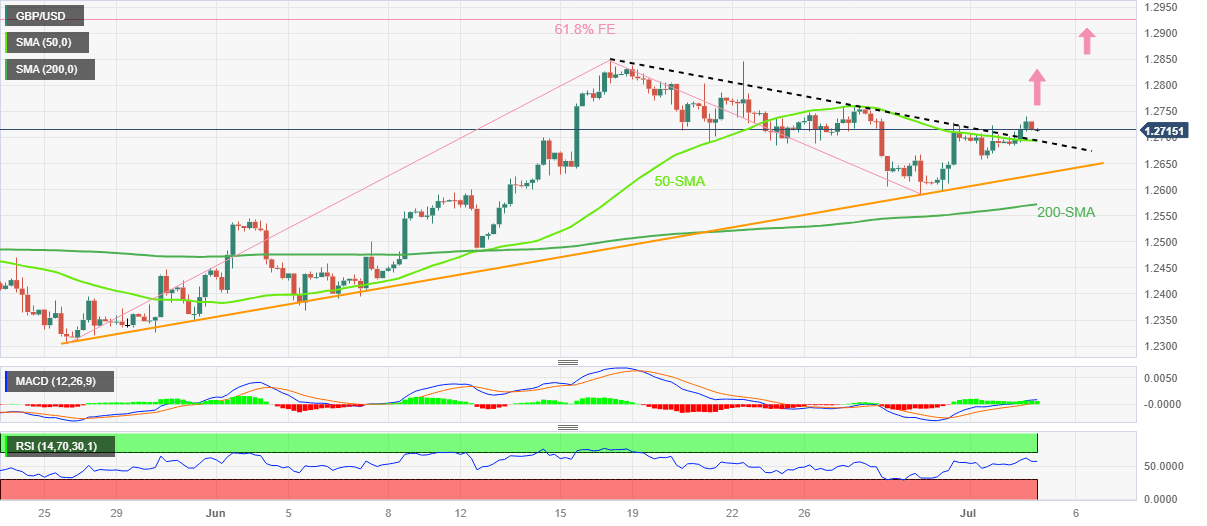

GBP/USD Price Analysis: Cable retreat appears elusive beyond 1.2690 support confluence

GBP/USD bulls take a breather amid the early hours of Wednesday’s Asian session, after refreshing the weekly top around 1.2740 the previous day. That said, the Pound Sterling seesaws near 1.2710-15 by the press time.

Despite the latest inaction, or say a lack of bullish action, the Cable pair remains on the buyer’s radar as it broke the key resistance confluence, now support, comprising the 50-SMA and a downward-sloping trend line from June 16, close to 1.2690. Read more...

Author

FXStreet Team

FXStreet