Pound Sterling Price News and Forecast: GBP/USD dovish pivot for sterling

Pound Sterling plummets as soft UK Inflation boosts dovish BoE bets

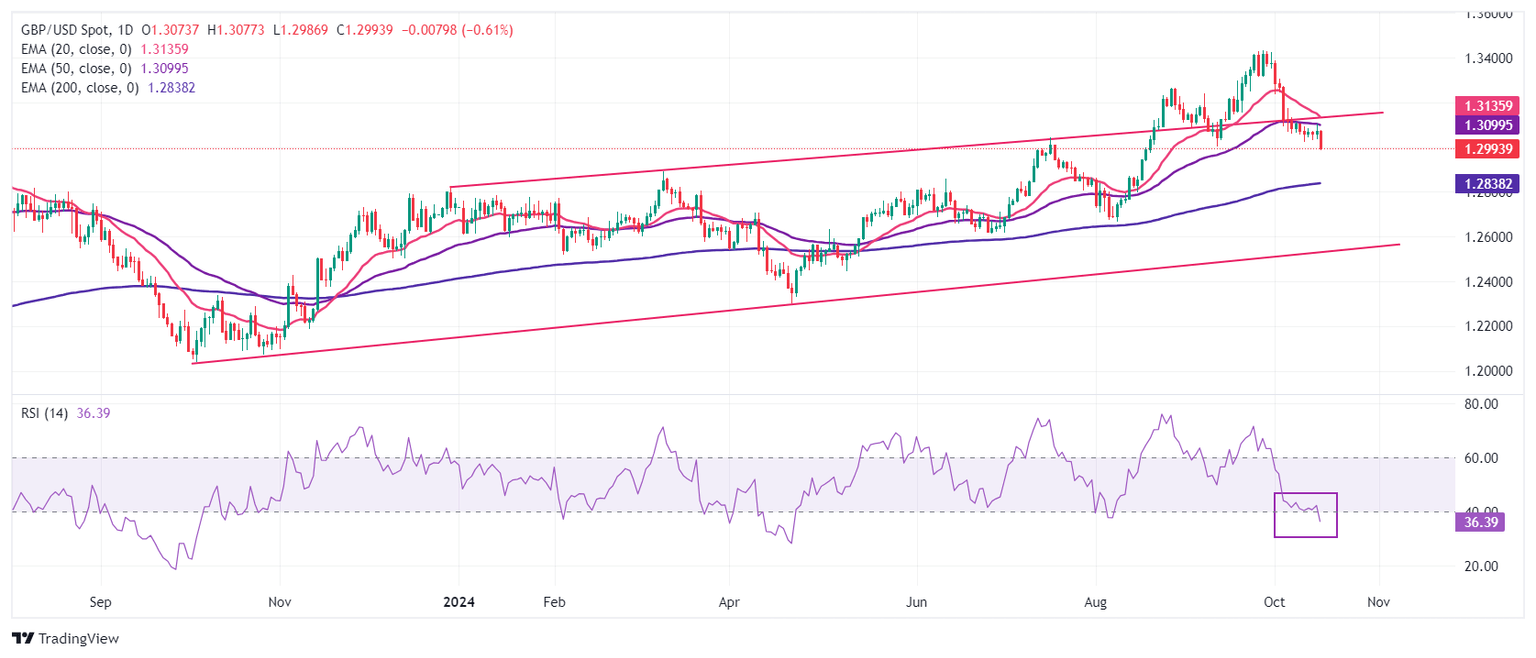

The Pound Sterling (GBP) falls vertically below the psychological support of 1.3000 against the US Dollar (USD) in Wednesday’s London session. The US Dollar stays afloat near a more than two-month high as traders have priced in moderate interest rate cuts from the Federal Reserve (Fed) in the remaining policy meetings this year, with the US Dollar Index (DXY) holding onto gains near 103.30. The Fed started the policy-easing cycle with a larger-than-usual size of 50 basis points (bps) in September. Read more...

GBP: Dovish pivot for sterling – ING

The Pound Sterling (GBP) is trading almost half a percent lower this morning after the September CPI report showed the closely-monitored services inflation falling more than expected from 5.6% to 4.9%, ING’s FX analyst Francesco Pesole notes. Read more...

GBP/USD: 1.3000 seems out of reach for now – UOB Group

There has been no further increase in momentum; a breach of 1.3125 would suggest that 1.3000 is out of reach, UOB Group’s FX analysts Quek Ser Leang and Peter Chia note. Read more...

Author

FXStreet Team

FXStreet