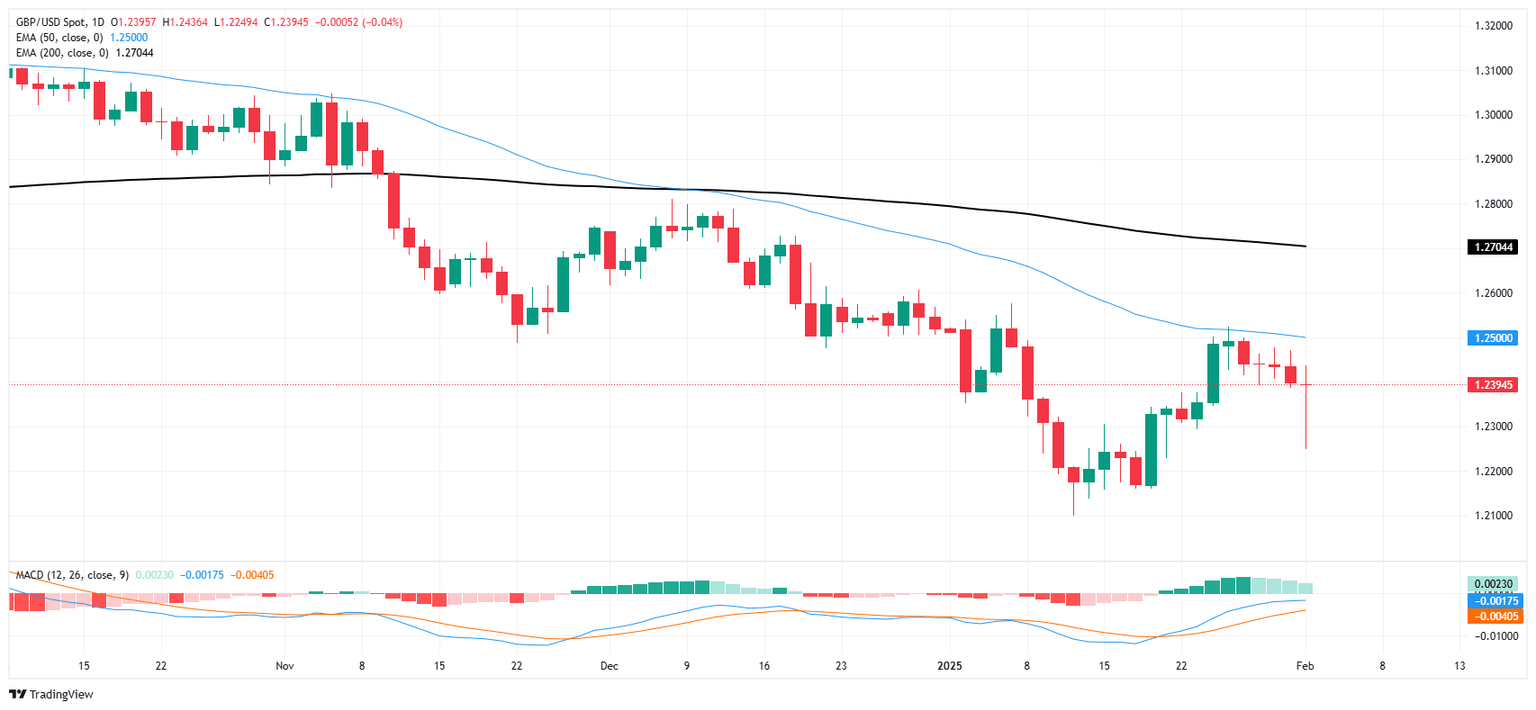

Pound Sterling Price News and Forecast: GBP/USD continues to gain ground amid improved-risk on sentiment

GBP/USD remains above 1.2400, eyes on tariff implementation on China

GBP/USD continues to gain ground for the second successive session, trading around 1.2430 during the Asian hours on Tuesday. The pair improved amid improved risk-on sentiment after US President Donald Trump announced late Monday that he would pause tariffs on Mexico and Canada.

However, market volatility remains a concern, with investors closely monitoring developments in ongoing tariff negotiations. President Trump stated that he would suspend steep tariffs on Mexico and Canada after their leaders agreed to deploy 10,000 soldiers to the US border to combat drug trafficking. The tariffs on Mexico and Canada have been postponed for at least 30 days. Read more...

GBP/USD whipsaws as tariffs come and go

GBP/USD sewered after a batch of fresh tariff threats from US President Donald Trump hit the markets, but plunges across global risk markets clawed back to recover ground after looming US tariffs on Canada and Mexico gave way to 30-day concessions from the Trump administration. Odds of US tariffs on the UK specifically remain limited, and Cable managed to rebound to the 1.2450 region at the tail-end of the Monday trading session.

The Bank of England (BoE) is set to give another rate call later this week, and markets are broadly pricing in another rate cut. The BoE’s Monetary Policy Committee (MPC) is expected to vote eight-to-one on cutting interest rates another quarter-point to 4.5%, with the one holdout expected to vote for holding rates steady for another meeting. Read more...

GBP/USD spins in a giant circle on Monday

GBP/USD roiled on Monday, tumbling 1.5% during the overnight session before recovering back to flat for the day at the 1.2400 handle. Import tariffs from the US brewing into a large-scale global trade war hobbled market sentiment over the weekend.

The US was geared up to impose sweeping import tariffs of 25% on Canada and Mexico, as well as an additional 10% on China, with US President Donald Trump promising to add an additional 10% levy on goods imported from the EU. However, Mexico was able to obtain a one-month reprieve from the US' tariffs, leading investors to hope that the majority of global tariffs will able to be averted by countries acquiescing to whatever Trump demands in exchange for easing tariffs. Donald Trump specifically voiced a desire for "rare earth metals" agreements from Ukraine in exchange for the US' continued help with the Russian invasion, as well as re-floating taking control of the Panama Canal, which is currently owned and controlled by the country of Panama. Read more...

Author

FXStreet Team

FXStreet