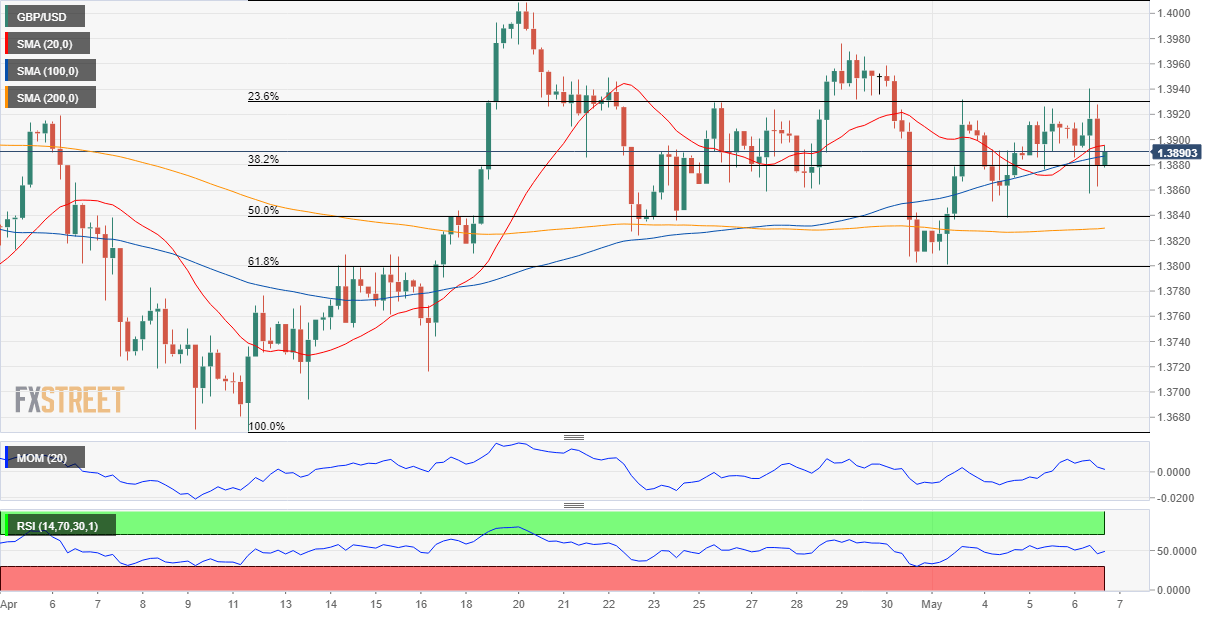

GBP/USD consolidates BOE-led whipsaw around 1.3900 amid easing Brexit fears

GBP/USD stays firm around 1.3900 after a wild Thursday that summed up trading on a negative side. In doing so, the cable pair benefits from the latest Brexit-positive news while waiting for the fresh clues ahead of the US Nonfarm Payrolls (NFP) and recent election results. The Bank of England’s (BOE) revised up the UK’s growth forecasts for 2021 while expecting a pullback in GDP during 2022. The “Old Lady” also sees 2021 inflation averaging 2.5% during the previous day’s announcements.

GBP/USD Forecast: BOE disappoints, pound falls

The GBP/USD pair ends Thursday pretty much unchanged, trading a handful of pips below the 1.3900 figure. The pair seesawed between gains and losses as the Bank of England announced its latest decision on monetary policy. The central bank left the benchmark interest rate unchanged at 0.10% and kept the Asset Purchase Facility steady at £895 billion as widely expected. The BOE also slowed the pace of weekly bond-buying and expects purchases to end around late 2021. Finally, policymakers upwardly revised growth and inflation forecasts, as they now expect the GDP to reach 7.25% in 2021 and 5.75% in 2022 and see 2021 inflation averaging 2.5%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.