Pound Sterling Price News and Forecast: GBP/USD bulls eye 1.3380 after BOE out-hawks Fed

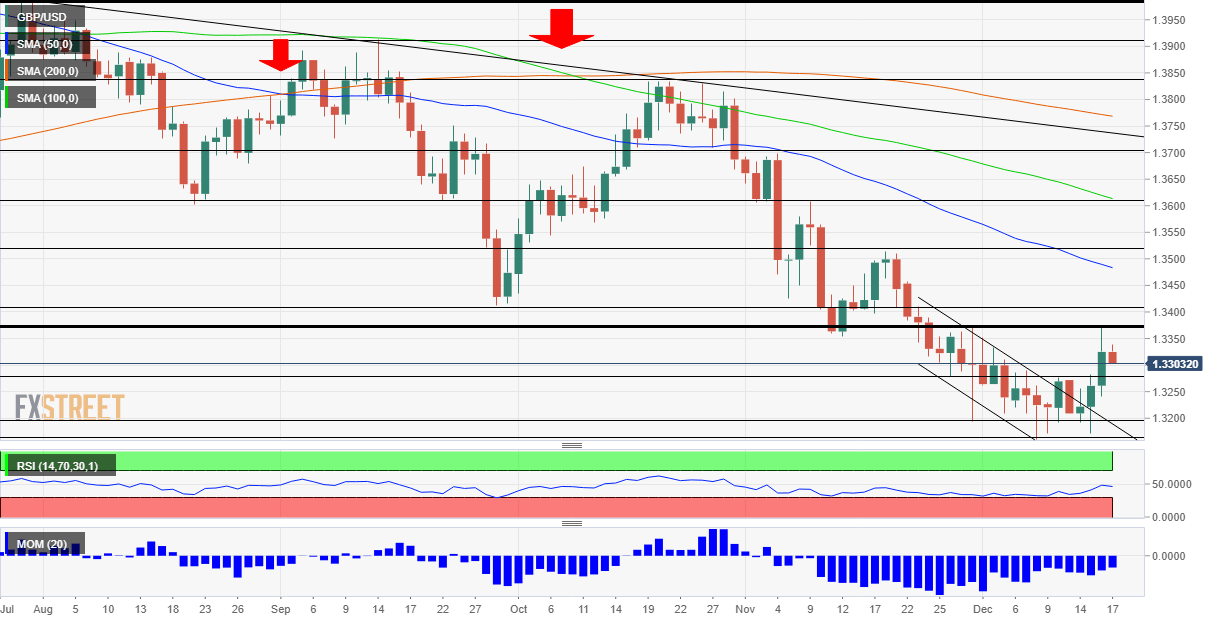

GBP/USD Weekly Forecast: Bulls eye 1.3380 after BOE out-hawks Fed, Omicron empowers bears

They say the Federal Reserve signals, the Bank of England acts. This week the "Old Lady" was the first to move among major central banks in raising borrowing costs, which boosted GBP/USD, outweighing Omicron's fears. Looking ahead, the main factors impacting the pound over Christmas are the virus, final UK GDP, a bulk of US figures and speculation about central banks' next moves. Read more...

GBP/USD Forecast: Pound needs to clear 1.3370 hurdle to stretch higher

GBP/USD has gone into a consolidation phase below 1.3350 on Friday after closing the previous three trading days in the positive territory. The British pound gathered strength on Thursday after the Bank of England (BOE) decided to hike its policy rate by 15 basis points but needs to hold above 1.3370 to convince buyers of a steady advance. In its policy statement, the BOE warned that inflation could hit 6% in April. Following the BOE's policy announcements, "We're concerned about inflation in the medium term. And we're seeing things now that can threaten that. So that's why we have to act," Governor Andrew Bailey explained. Moreover, the bank is worried about wage inflation feeding into more persistent price pressures in 2022. Read more...

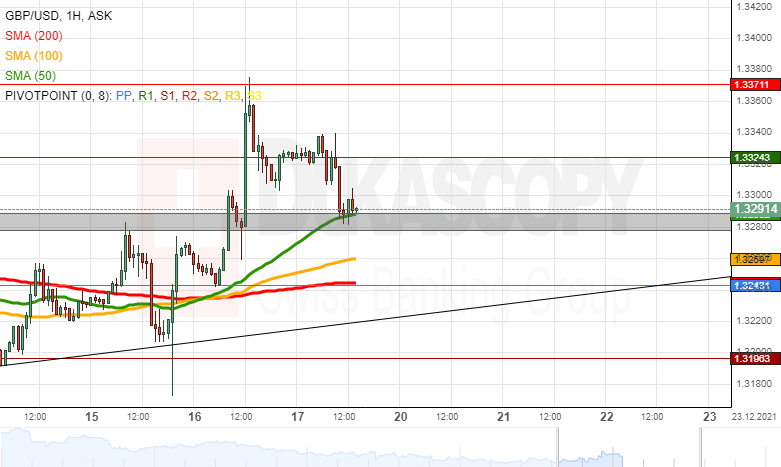

GBP/USD analysis: Retreats to 50-hour SMA

The GBP/USD jumped on Thursday due to the unexpected Bank of England rate hike at 12:00 GMT. The rate's jump stopped at the weekly R2 simple pivot point at 1.3371. The event was followed by a decline, which on Friday found support in the 50-hour simple moving average and the December high-level zone at 1.3277/1.3288. In the case of the 50-hour providing enough support for a surge, the GBP/USD could reach for the weekly R1 simple pivot point at 1.3324. Afterward, the 1.3340 might act as resistance. Even higher above, the weekly S2 simple pivot point is located at 1.3371. Read more...

Author

FXStreet Team

FXStreet