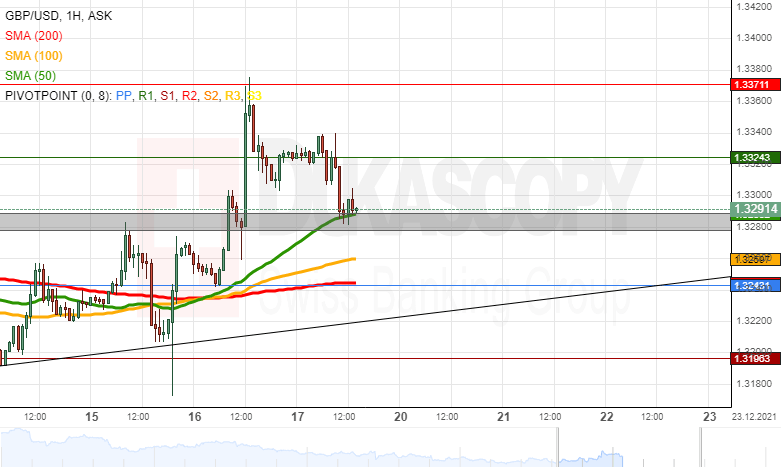

GBP/USD analysis: Retreats to 50-hour SMA

GBP/USD

The GBP/USD jumped on Thursday due to the unexpected Bank of England rate hike at 12:00 GMT. The rate's jump stopped at the weekly R2 simple pivot point at 1.3371. The event was followed by a decline, which on Friday found support in the 50-hour simple moving average and the December high-level zone at 1.3277/1.3288.

In the case of the 50-hour providing enough support for a surge, the GBP/USD could reach for the weekly R1 simple pivot point at 1.3324. Afterward, the 1.3340 might act as resistance. Even higher above, the weekly S2 simple pivot point is located at 1.3371.

Meanwhile, a potential decline of the pair below the 1.3277 level might find support in the 100-hour simple moving average near 1.3260. Below the 100-hour SMA, the 200-hour SMA and the weekly simple pivot point at 1.3243.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.