GBP/USD Weekly Forecast: Bulls eye 1.3380 after BOE out-hawks Fed, Omicron empowers bears

- GBP/USD has advanced after the BOE surprised with a rate hike, out-hawking the Fed.

- Speculation about central banks, US data and Omicron worries are eyed in the lead up to Christmas.

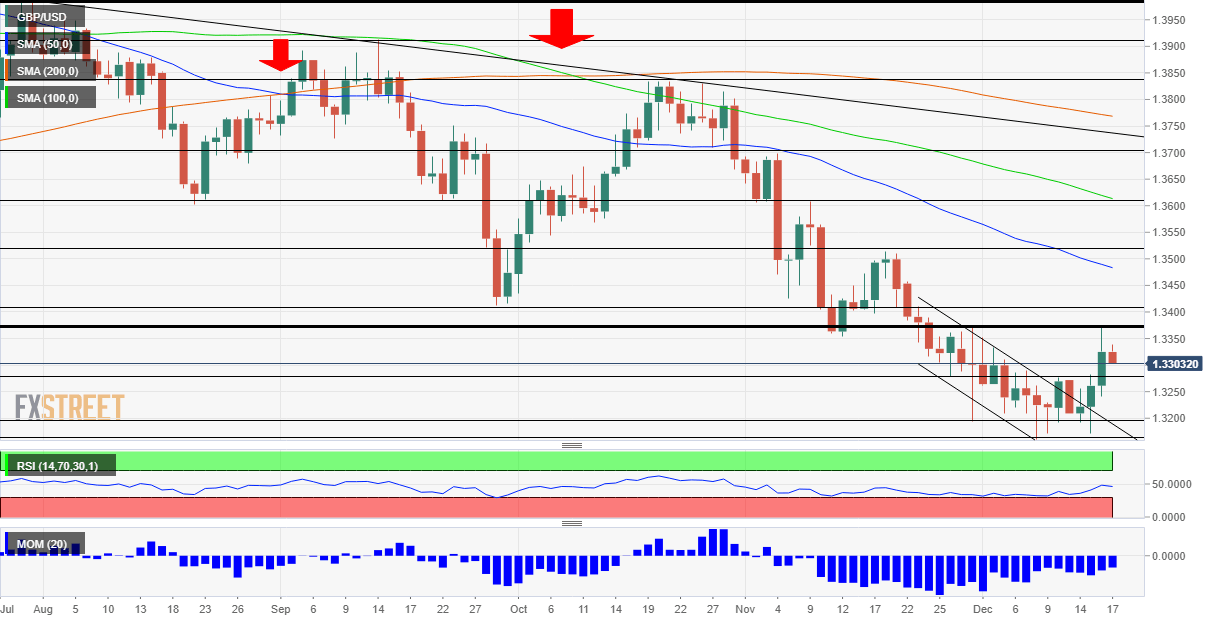

- Mid-December's daily graph shows 1.3380 is a critical level.

They say the Federal Reserve signals, the Bank of England acts. This week the "Old Lady" was the first to move among major central banks in raising borrowing costs, which boosted GBP/USD, outweighing Omicron's fears. Looking ahead, the main factors impacting the pound over Christmas are the virus, final UK GDP, a bulk of US figures and speculation about central banks' next moves.

This week in GBP/USD: BOE surprises with a rate hike

Making Mark Carney "material marriage" – the label "unreliable boyfriend" was first thrown at then-BOE Governor Carney when he was seen as misleading markets about monetary policy. His successor Andrew Bailey seems to have bypassed him easily. After surprising in November by refraining from raising rates, the BOE has shocked markets. It came with little warning – and no press conference.

In following media interviews, Bailey explained the move as reacting to high inflation – 5.1% according to the new read for November – and rising wages. The near-unanimous 8:1 vote added impetus to the surprise, further boosting sterling.

The BOE's communication and impact on markets outshined the Federal Reserve. The world's most powerful central bank guided markets to doubling the pace of tapering and delivered – from $15 to $30 billion. The Fed's balance sheet is now set to stabilize in March.

See BOE Quick Analysis: Bailey's only boyfriend is Powell, Omicron could still hit GBP/USD

What happens in March? On the one hand, the Washington-based institution's projections point to three hikes in 2022, which was more than projected. On the other hand, Fed Chair Powell seemed reluctant to increase borrowing costs so early, opening the door to reducing the balance sheet. That prevented the dollar from rising too quickly.

Fed Quick Analysis: Hawks shift to three hikes in 2022, King dollar to end 2021 on top

Other figures also favored the pound – Britain's retail sales surprised to the upside with 1.4% in November while Americans slowed down their shopping spree, expanding expenditure by only 0.3%, weaker than estimated.

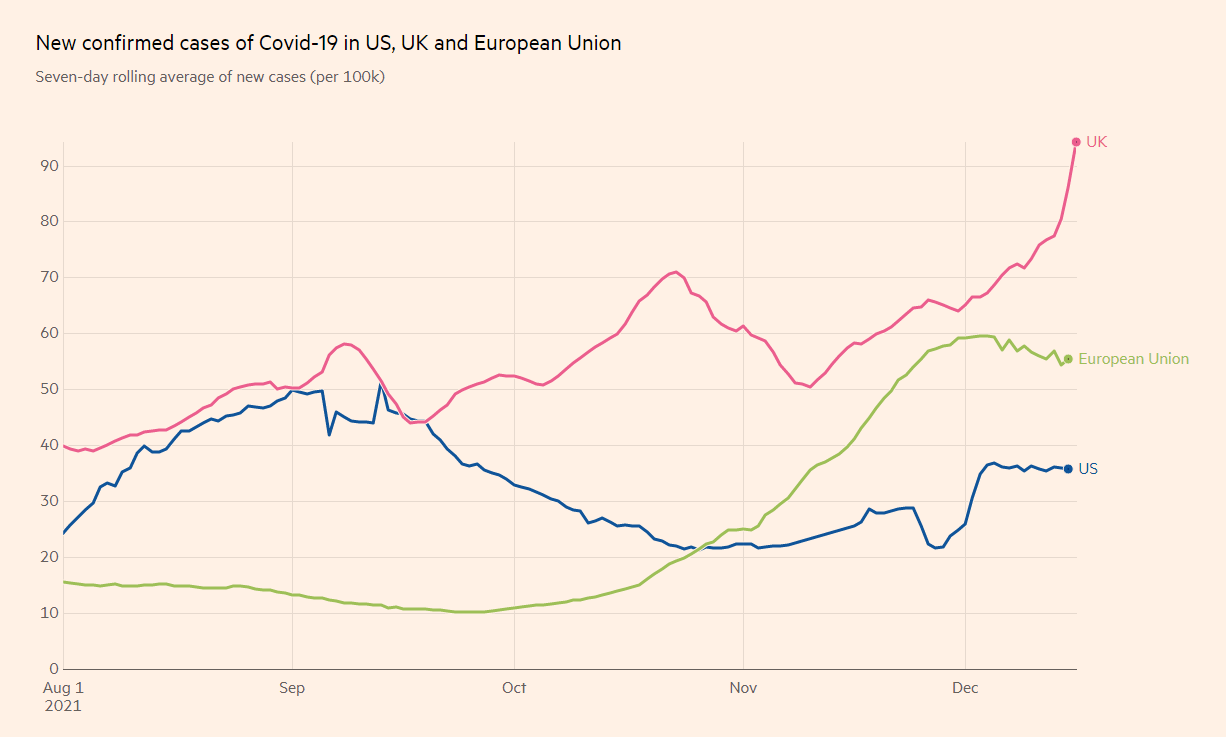

The rapid spread of the Omicron variant in the UK and elsewhere had a mixed effect on markets. There are no doubts about the strain's high contagion, but hope about lower severity and sufficient efficacy of booster shots to cope with it continue emerging.

Sterling was hurt more by the politics of dealing with the virus than its spread. Prime Minister Boris Johnson faced the largest rebellion of his Conservative Party so far in his premiership when passing new restrictions, while other scandals also hurt his authority.

UK events: Omicron, GDP and BOE speculation

No fewer than 88,000 covid cases were reported on Thursday in Britain, a new high, breaking the record set just on Wednesday. Contrary to the cheerful PM, top health officials such as Chris Witty painted a grim picture of hospitals filling up in the lead to Christmas.

Reports about fewer people on the streets – without new restrictions – could worsen and weigh on sterling. The festive season could further be hit by growing pressure on the National Health Service. The worst-case scenario is if health officials demand new restrictions and the government lacks the will or capacity to pass them.

UK covid cases are surging:

Source: FT

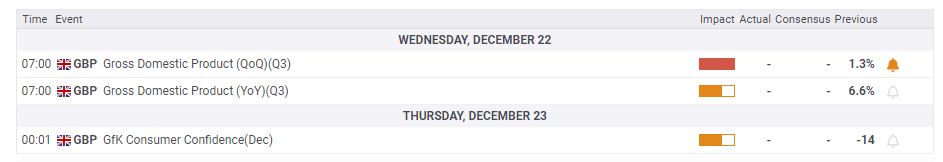

The economic calendar features an updated read on third-quarter Gross Domestic Product (GDP). The first print came out at 1.3%, and similar statistics are likely now.

Markets will likely be more focused on any media appearances by Bank of England officials regarding future moves. Huw Pill, the BOE's Chief Economist, signaled more increases are coming, and additional comments in that vein could boost the pound.

Here is the list of UK events from the FXStreet calendar:

US Events: Last data points before Christmas

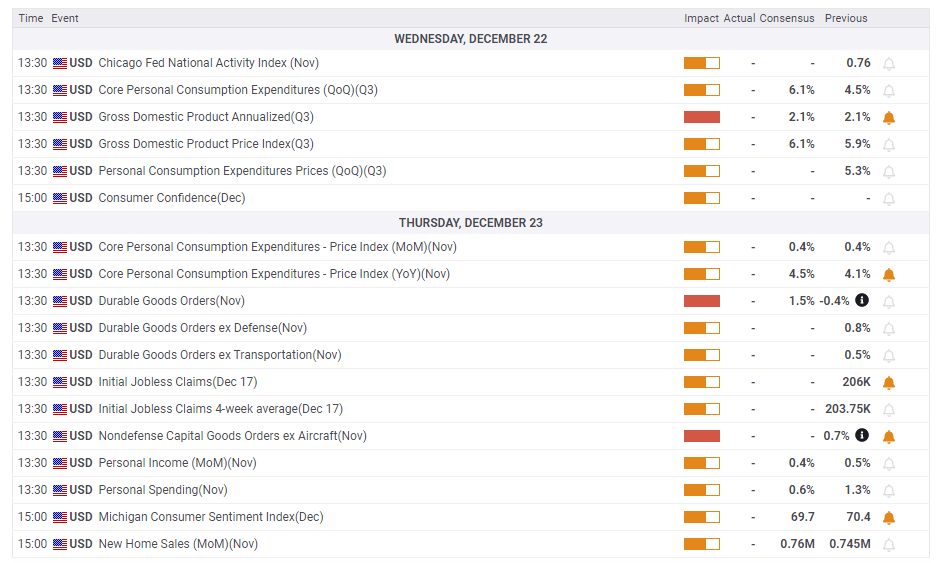

The Federal Reserve has left a clear message, and data now returns to the forefront. Final GDP figures for the third quarter will likely confirm a relatively low level of expansion, only 2.1%, before a more robust ending to the year.

Durable Goods Sales data for November will likely have more impact. Is investment still growing at a rapid pace? The nondefense ex-air figure – the core of the core – is of higher importance.

Another market-moving release is Core PCE – the Fed's preferred inflation gauge. It already hit 4.1% in October, double the bank's target and a 4.5% print is on the cards for November. Personal Income, Personal Spending, New Home Sales, and weekly jobless claims are all of interest.

With so many figures released at once, their impact is more pronounced if they all point in one direction – either painting a rosy picture or a darker one. So far, most economic indicators for the fourth quarter have been upbeat – so these pre-Christmas releases could provide reasons to be cheerful.

While Omicron may now hit the US, America's economic sensitivity to the virus is minor compared to that of the UK. Lower levels of shopping might be seen ahead of Christmas, but that could result from the earlier expenditure.

President Joe Biden still aims to pass his Build Back Better expenditure plans before the holidays, but that seems more complicated by the day. Markets see an eventual deal and do not react to day-by-day political headlines unless a final agreement between Democrats is reached.

Here are the upcoming top US events this week:

GBP/USD technical analysis

Pound/dollar has recovered, but bears remain in the lead. While downside momentum has waned – and cable broke above the downtrend channel – the pair has created a double-top at 1.3380, which is critical for further recovery. Bears still benefit from the fact that GBP/USD trades well below the 50, 100 and 200-day Simple Moving Averages (SMAs).

Beyond 1.3380, the next cap is 1.3405, a support line from the autumn. It is followed by 1.3515, which held back a recovery attempt in mid-November.

Some support is at 1.3280, a mid-December resistance line, followed by 1.32, a swing low from November. The 2021 trough of 1.3175 is critical downside support.

GBP/USD sentiment

Sterling's advantage may erode if British hospitals fill up. The dollar could gradually advance in response to encouraging US data. All in all, there is more room for the downside than for the upside.

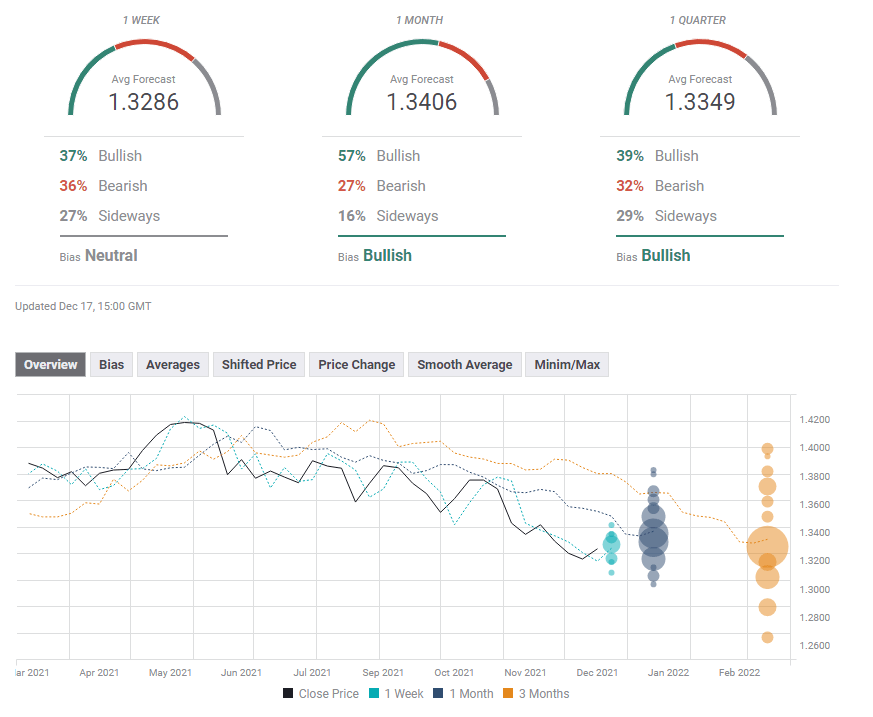

The FXStreet Forecast Poll is showing that the week leading up to Christmas could see some range trading, while GBP/USD could advance later on, especially in the medium-term. Targets have been upgraded following the BOE's surprise rate hike.

Related reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.