GBP/USD Forecast: Pound needs to clear 1.3370 hurdle to stretch higher

- GBP/USD has gone into a consolidation phase following Thursday's rally.

- BOE hiked its policy rate by 15 basis points as it expects inflation to peak at 6% in April.

- GBP/USD could gather additional bullish momentum if it manages to clear 1.3370.

GBP/USD has gone into a consolidation phase below 1.3350 on Friday after closing the previous three trading days in the positive territory. The British pound gathered strength on Thursday after the Bank of England (BOE) decided to hike its policy rate by 15 basis points but needs to hold above 1.3370 to convince buyers of a steady advance.

In its policy statement, the BOE warned that inflation could hit 6% in April. Following the BOE's policy announcements, "We're concerned about inflation in the medium term. And we're seeing things now that can threaten that. So that's why we have to act," Governor Andrew Bailey explained. Moreover, the bank is worried about wage inflation feeding into more persistent price pressures in 2022.

The CME Group's BOEWatch Tool shows that markets are currently pricing a 60% chance of another 15 basis points rate hike in March.

In the meantime, the data from the UK showed on Friday that Retail Sales increased by 4.7% on a yearly basis in November after declining by 1.5% in October. Nonetheless, investors showed little to no reaction to this reading.

There won't be any high-tier macroeconomic data releases from the US on Friday and investors will keep a close eye on how the pair moves near key technical levels.

GBP/USD Technical Analysis

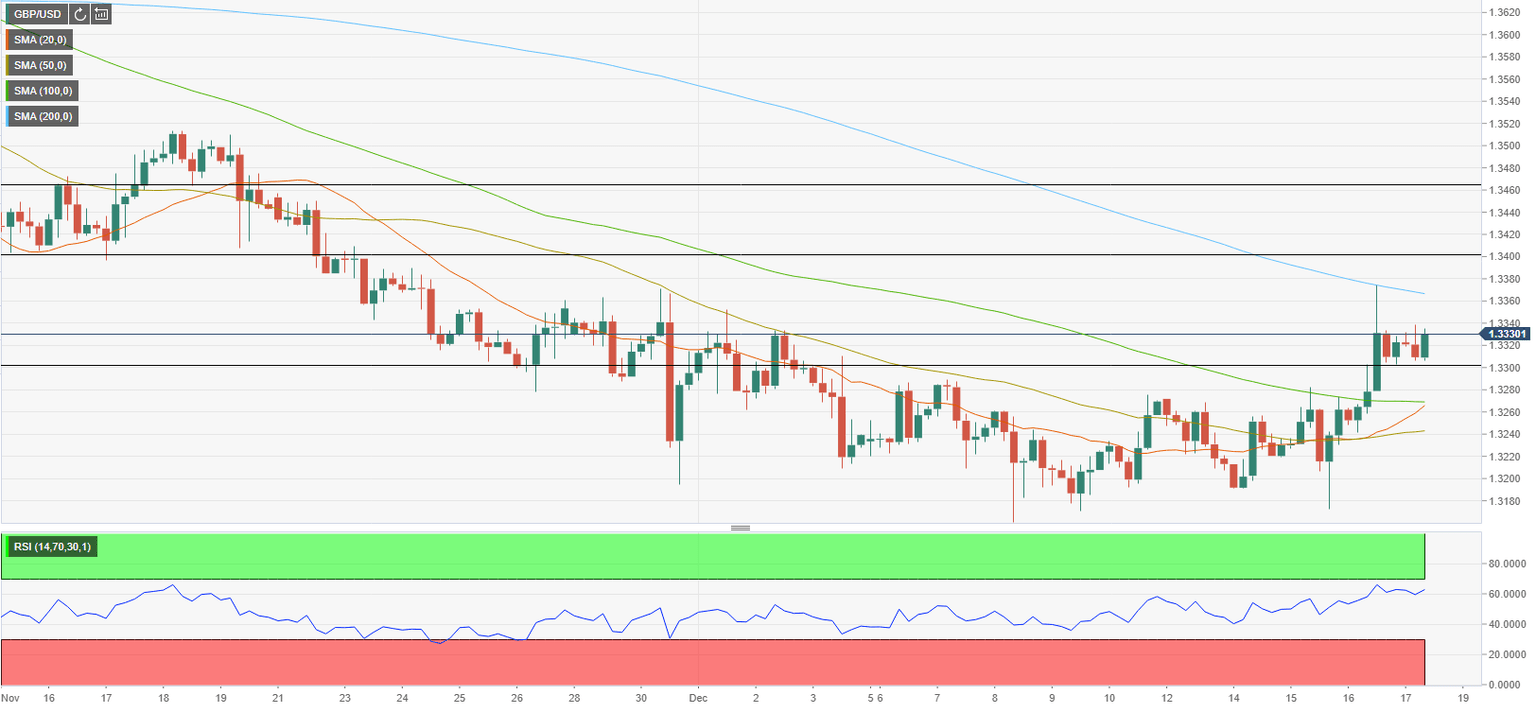

With the initial reaction to the BOE's hawkish policy outlook, GBP/USD jumped to its strongest level since November 24 at 1.3376 but the 200-period SMA on the four-hour chart acted as strong resistance near that level. If buyers manage to flip that level into support, the next target on the upside is located at 1.3400 (psychological level) ahead of 1.3460 (static level).

On the downside, interim support seems to have formed at 1.3300 (static level, psychological level) before 1.3270 (100-period SMA, 20-period SMA) and 1.3240 (50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.