GBP/USD: UK/EU Brexit trade deal negotiations are clear weighing on sentiment [Video]

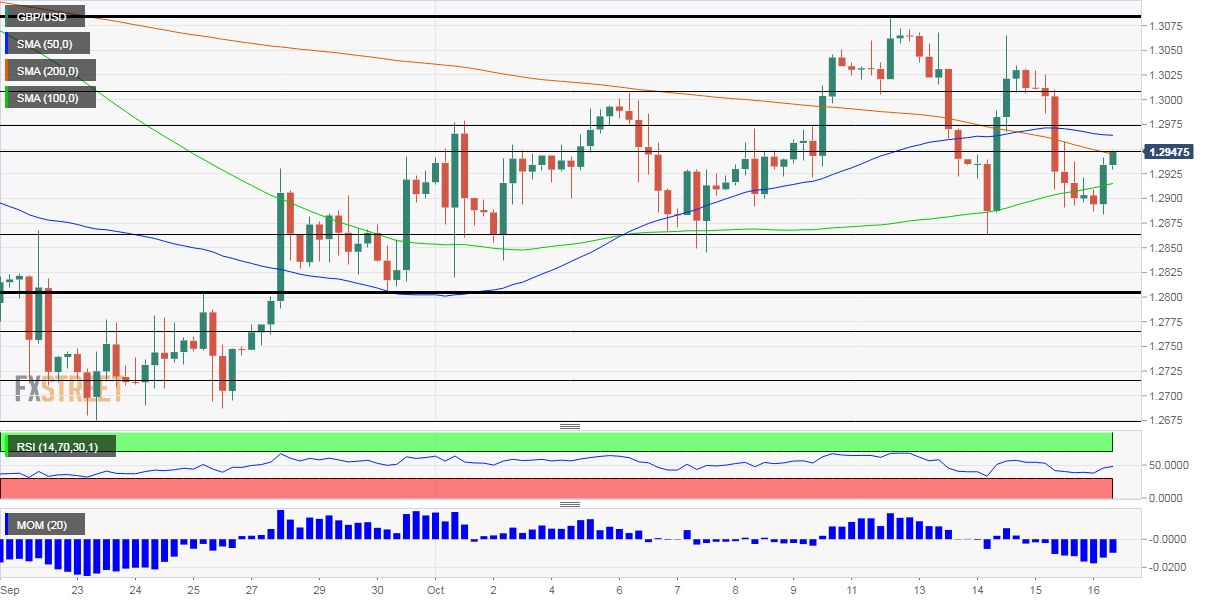

As a three week rally on Cable has moved into reverse, the pressure has turned back towards a test of 1.2845 support. It is notable that intraday volatility on Cable has picked up this week, with larger daily ranges. The Average True Range of 117 pips has been exceeded in each of the past three sessions now (UK/EU Brexit trade deal negotiations are clear weighing on sentiment). Although newsflow is key, we favour selling into intraday strength for pressure on 1.2845. A closing breach would increase downside momentum for a test of 1.2670. Near term rallies into 1.3000/1.3080 continue to struggle. It is also worth noting now the support of a five month uptrend (which links the lows going back to May), which comes in today at 1.2780. Read More...

GBP/USD Forecast: Comeback for cable? Boris' Brexit blink set to outweigh Manchester's mutiny

Should I stay or should I go? That Clash song best described Prime Minister Boris Johnson's dilemma about Brexit talks after a clash with the EU – but it seems he will stay. If the PM resumes talks and is ready to compromise, GBP/USD has room to recover and even rally.

On Thursday, EU leaders allowed for more negotiations – but refused to intensify them. Moreover, they said that the ball is now in Britain's court, triggering angry responses from London. David Frist, Britain's chief negotiator, expressed disappointment. Read More...

GBP/USD analysis: Trades above 1.2900

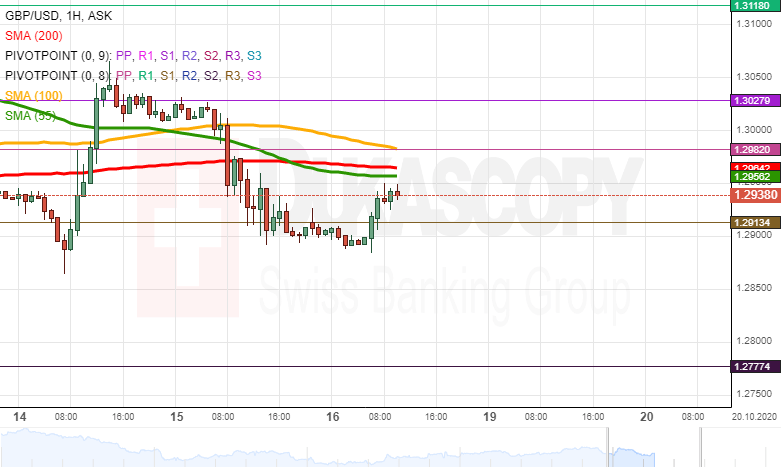

Yesterday, the GBP/USD exchange rate dropped to the 1.2900 level. During today's morning, the rate reversed north.

Given that the currency pair is pressured by the 55-, 100– and 200-hour SMA in the 1.2955/1.2980 range, it is likely that some downside potential could prevail in the market. In the meantime, it is unlikely that bulls could prevail in the market, and the exchange rate could exceed the resistance level formed by the monthly PP located at the 1.3028 mark. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.