Pound Sterling Price News and Forecast: GBP/USD bearish breakout around the corner

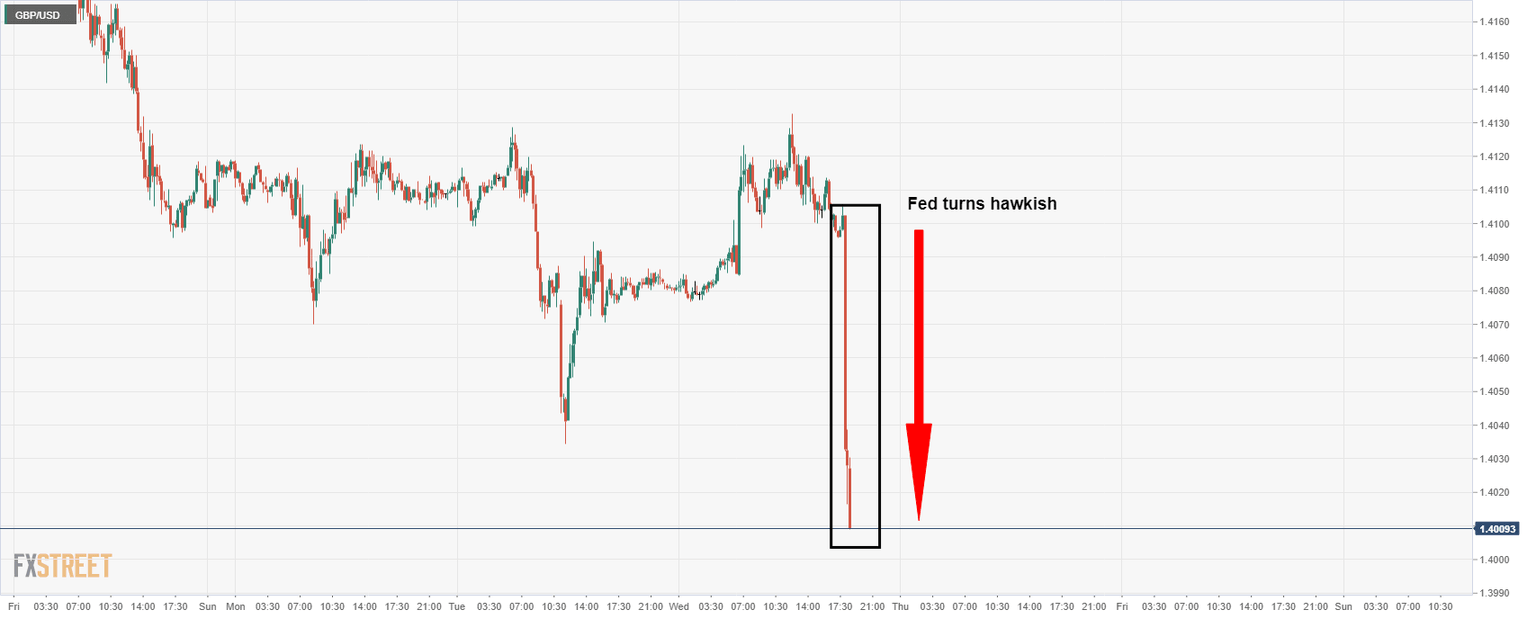

GBP/USD bears jump on Fed's switch to hawkish on inflation risks, target 1.3980

The bears are beating down the bulls as the US Federal Reserve turns more hawkish as they monitor inflation risks that could turn out to be higher and more persistent than they had expected. At the time of writing, GBP/USD is trading at 1.4012, just off its lows of 1.4011 after falling on the day from a high of 1.4132. The has pound dropped around 0.66% vs the US dollar since the Fed's announcements. Read more...

GBP/USD Forecast: Bearish breakout around the corner

The GBP/USD pair advanced during London trading hours, reaching an intraday high of 1.4132, helped by better than anticipated UK inflation data. The Consumer Price Index was up by 2.1% YoY in May, while the core reading hit 2%. The Retail Price Index in the same period hit 3.3% as expected. However, a hawkish US Federal Reserve sent the pair down to 1.3996, its lowest in over a month. Read more...

GBP/USD sideways near 1.4100 ahead of the Fed

Pound holds onto gains across the board ahead of the FOMC statement. US dollar moving sideways, DXY flat around 90.50. The GBP/USD peaked after the beginning of the American session at 1.4132 and quickly pulled back to the 1.4120/1.4100 range. It is moving sideways in the range ahead of the Fed’s decision. Read more...

Author

FXStreet Team

FXStreet