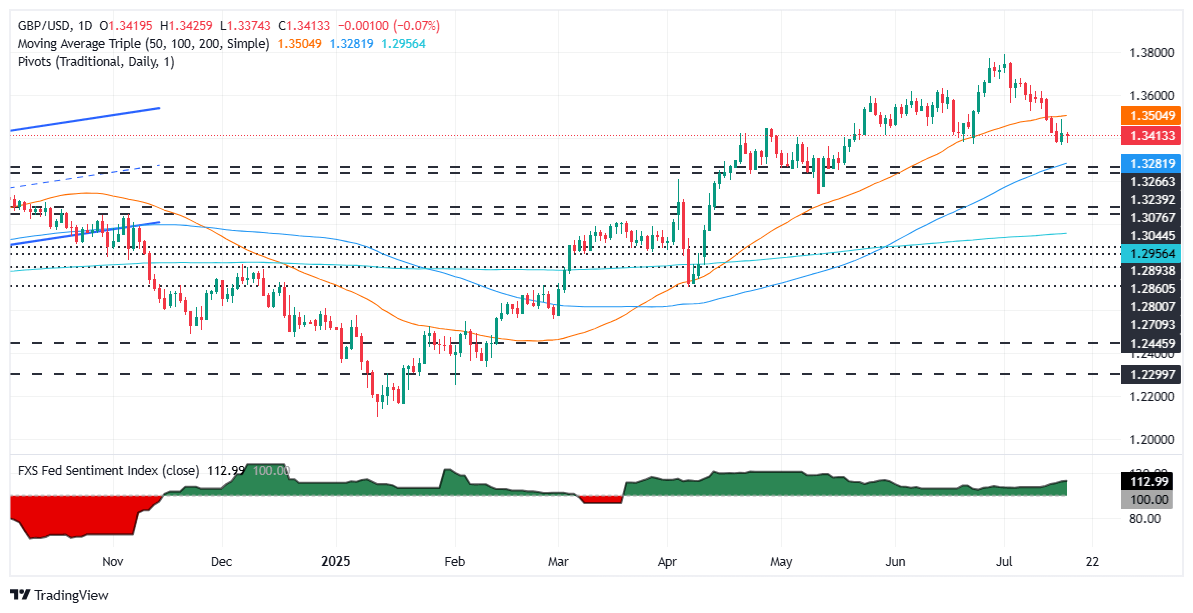

Pound Sterling Price News and Forecast: GBP/USD appreciates as the USD loses ground after the dovish Fedspeak.

GBP/USD rises to near 1.3450 due to improved market sentiment, UoM Consumer Sentiment eyed

GBP/USD gains ground after registering small losses in the previous session, trading around 1.3440 during the Asian hours on Friday. The pair appreciates as the US Dollar (USD) edges lower due to dovish remarks from the Federal Reserve (Fed) officials.

San Francisco Fed President Mary Daly said that expecting two rate cuts this year is a "reasonable" outlook, while warning against waiting too long. Daly added that rates will eventually settle at 3% or higher, which is higher than the pre-pandemic neutral rate. Read more...

GBP/USD halts momentum as markets weigh US Retail Sales, UK labor data

GBP/USD churned around the 1.3400 region on Thursday, grappling with fresh congestion after a brief reprieve from sustained selling pressure. United Kingdom (UK) labor data broadly missed the mark, and US Retail Sales came in stronger than expected.

The UK added 25.9K new unemployment benefits seekers in June, more than expected but still below the previous month’s 33.1K. The UK Unemployment Rate also ticked higher, rising to 4.7% from the previous 4.6%. On the United States (US) side, Producer Price Index (PPI) inflation cooled off faster than expected, further bolstering market confidence that tariff fallout will have less of an impact on inflation than Federal Reserve (Fed) officials are fearing. Read more...

GBP/USD slips on robust US data as Fed rate cut odds fade

GBP/USD drops during the North American session on Thursday. The pair edged down 0.07% following the release of strong US economic data, which boosted the US Dollar (USD) and pushed it to a new July high as it recovers some ground at the beginning of the second half of the month. At the time of writing, the pair trades at 1.3408.

The latest US jobs report, released by the Bureau of Labor Statistics (BLS), revealed that the number of Americans filing for unemployment claims edged lower, indicating that the economy remains solid. Initial Jobless Claims for the week ending July 12 came at 221K, below forecasts of 235K. In addition to that, Retail Sales for June also exceeded estimates of a 0.1% MoM increase and rose by 0.6%. Read more...

Author

FXStreet Team

FXStreet