GBP/USD slips on robust US data as Fed rate cut odds fade

- US jobless claims fall to 221K, while retail sales rise 0.6% in June.

- Fed’s Kugler signals no rush to cut rates amid tariff-driven inflation.

- UK labor market cools less than expected, but Sterling remains pressured.

GBP/USD drops during the North American session on Thursday. The pair edged down 0.07% following the release of strong US economic data, which boosted the US Dollar (USD) and pushed it to a new July high as it recovers some ground at the beginning of the second half of the month. At the time of writing, the pair trades at 1.3408.

Cable drops to 1.3408 as jobless claims and retail sales beat forecasts, reinforcing Fed’s steady stance

The latest US jobs report, released by the Bureau of Labor Statistics (BLS), revealed that the number of Americans filing for unemployment claims edged lower, indicating that the economy remains solid. Initial Jobless Claims for the week ending July 12 came at 221K, below forecasts of 235K. In addition to that, Retail Sales for June also exceeded estimates of a 0.1% MoM increase and rose by 0.6%.

The data, along with the rise in consumer prices last week, had slashed the chances for a rate cut by the Federal Reserve (Fed) at the upcoming July meeting.

Fed Governor Adriana Kugler was hawkish, revealing that it is appropriate to keep policy steady “for some time,” given the low unemployment and increasing price pressures from tariffs.

Across the pond, UK jobs data revealed that the labor market is cooling but at a slower rate than foreseen, as the Claimant Count Change in June rose by 25.9K, above the consensus of 17.9K and 33.1K in May.

In the meantime, uncertainty about a possible sacking of Fed Chair Jerome Powell by US President Donald Trump dissipated as he said that he was not planning to fire him, but continued to pressure the Fed to lower interest rates.

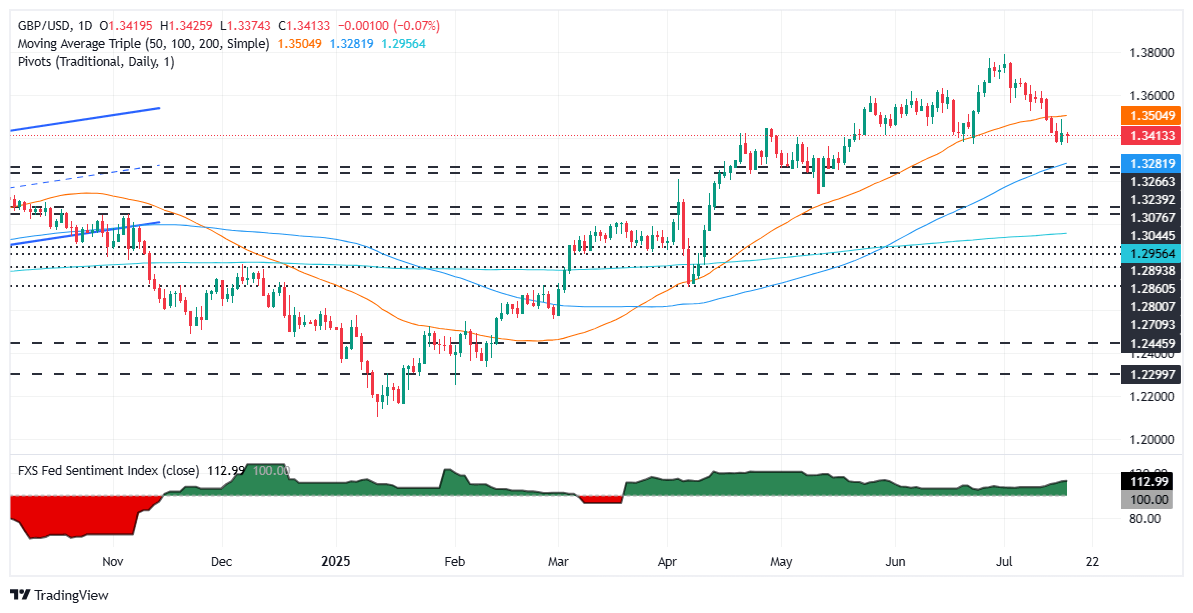

GBP/USD Price Forecast: Technical outlook

GBP/USD remains neutral to downward biased, trading near the lows of the week after reaching a two-day high of 1.3485 on the potential removal of Powell. The Relative Strength Index (RSI) suggests that sellers remain in control, despite buyers' increasing presence near the 1.3400 mark.

If bulls want to regain control, they must claim the 50-day SMA at 1.3500. Otherwise, GBP/USD would continue to edge lower with sellers eyeing 1.3373, the July 17 low, followed by 1.3300 and the 100-day SMA at 1.3278.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.