Pound Sterling Price News and Forecast: GBP corrects against US Dollar amid Iran-Israel conflict

Pound Sterling corrects sharply against US Dollar amid Iran-Israel conflict

The Pound Sterling (GBP) underperforms against its major peers on Friday, except for antipodean currencies, as market sentiment turns risk-averse amid escalating geopolitical tensions in the Middle East.

Israel has announced a war against Iran after striking dozens of targets in the northeast region of Tehran, including nuclear facilities and military bases. Israeli Prime Minister Benjamin Netanyahu has clarified that their military has started the “Operation Rising Lion” to stop Iran from building nuclear warheads, citing that the operation aims to “roll back the Iranian threat to Israel’s very survival”. Read more...

GBP/USD Forecast: Pound Sterling loses bullish momentum on escalating geopolitical tensions

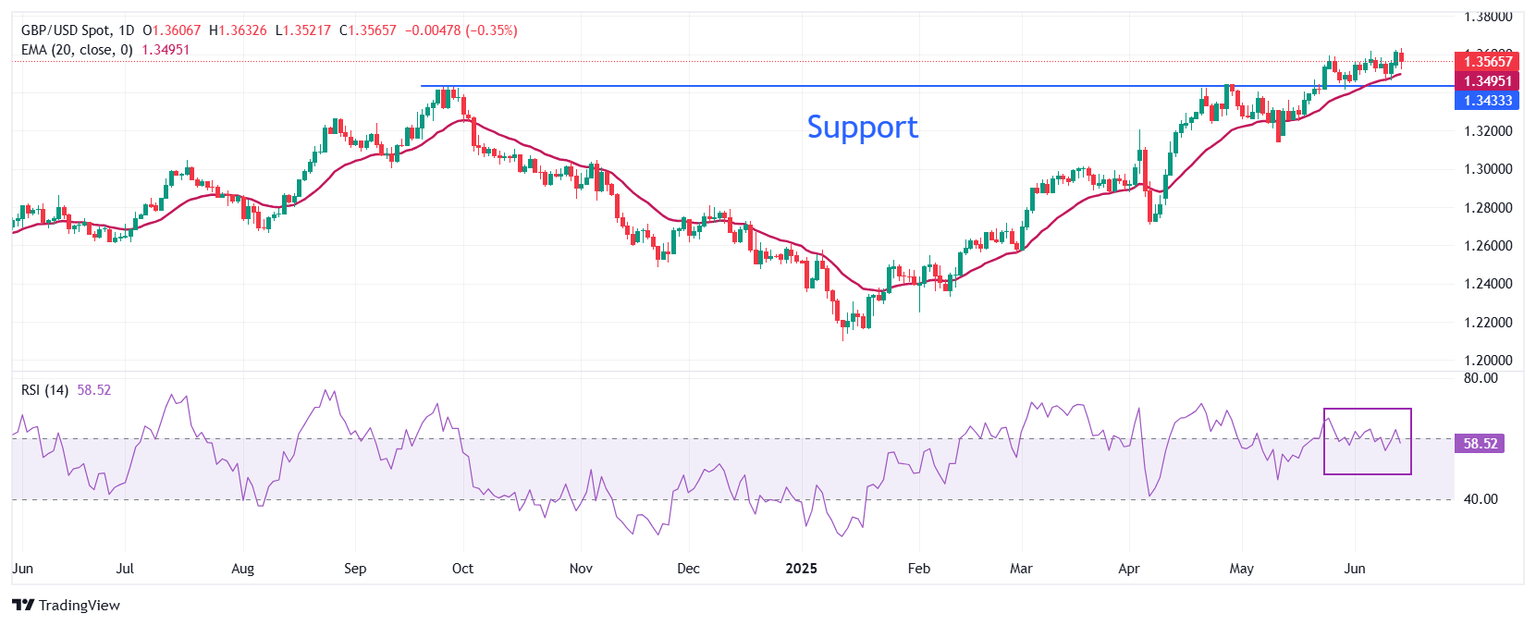

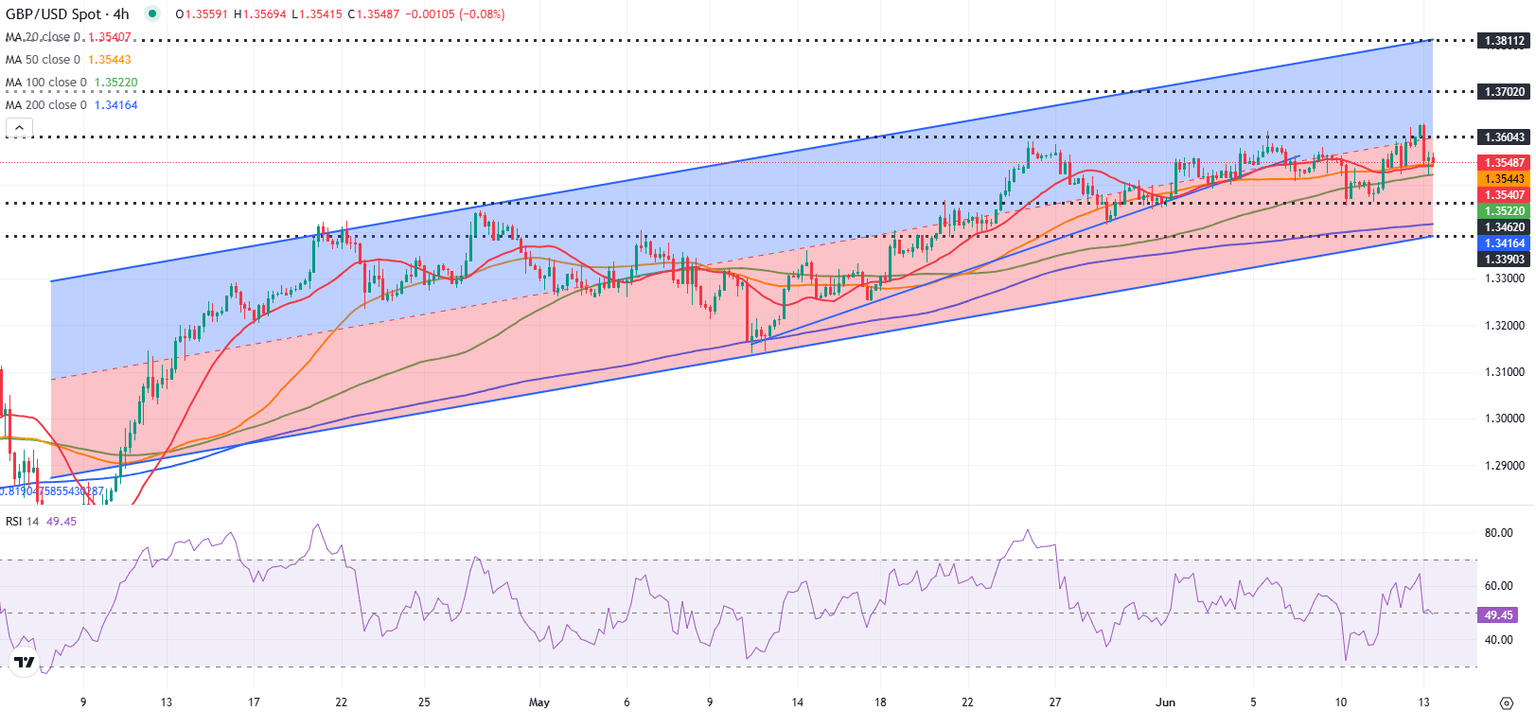

GBP/USD declines sharply and trades below 1.3550 in the European session on Friday after posting its highest daily close since February 2022 on Thursday. The risk-averse market environment could make it difficult for the pair to regain its traction heading into the weekend.

The broad-based selling pressure surrounding the US Dollar (USD) allowed GBP/USD to gather bullish momentum on Thursday. After suffering large losses against its major rivals on weaker-than-expected Consumer Price Index (CPI) figures on Wednesday, the USD continued to weaken on Thursday as the data published by the Department of Labor showed that there were 248,000 Initial Jobless Claims in the week ending June 7, compared to the market forecast of 240,000. Read more...

Author

FXStreet Team

FXStreet