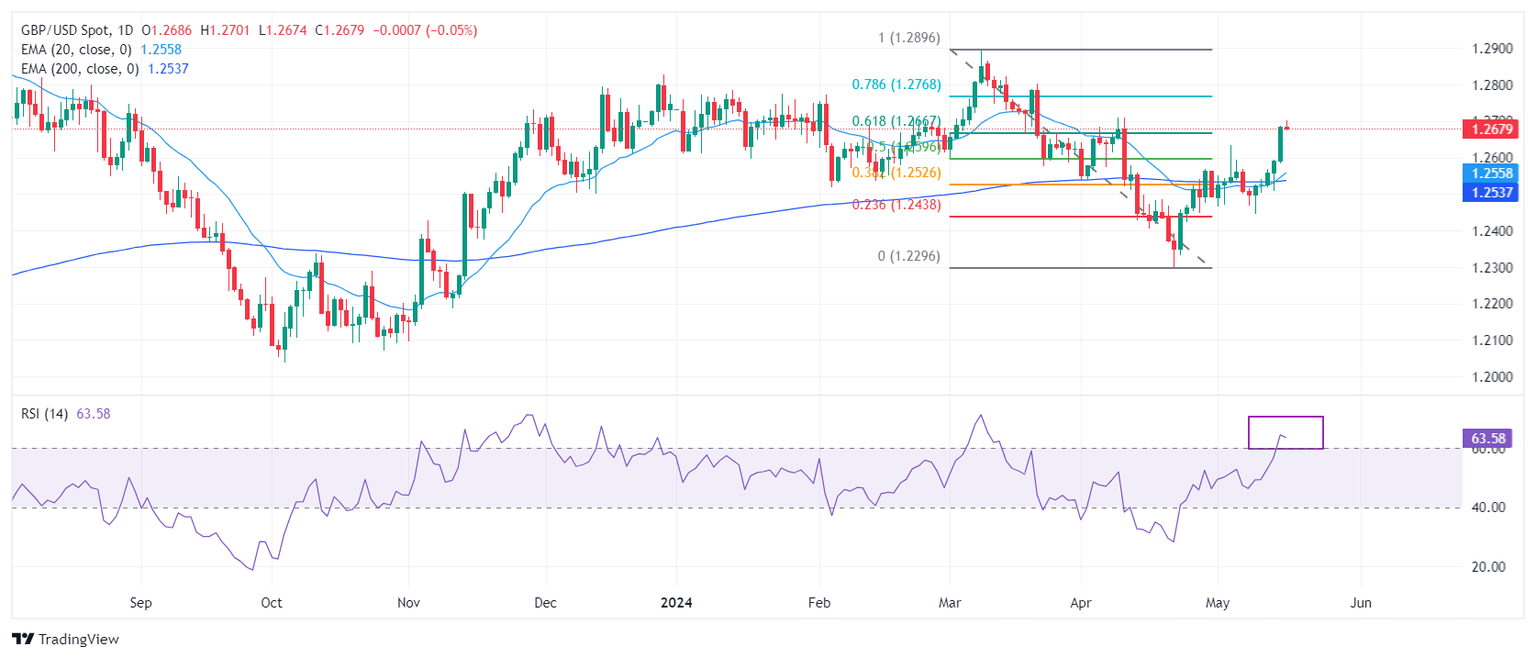

GBP/USD Price Analysis: Cable retreats as buyers struggle to clear 1.2700

The Pound Sterling erased Wednesday’s gains against the US Dollar as investors pushed the major to new weekly highs on the disinflation evolution in the

United States (US). Although investors are pricing 38 basis points rate cuts by the

Federal Reserve toward the end of the year, the Greenback is staging a comeback. The GBP/USD trades at 1.2654, down 0.25%.

Read More...

Pound Sterling clings to gains near 1.2700 on firm Fed rate-cut bets

The Pound Sterling (GBP) turns sideways after posting a fresh monthly high near 1.2700 against the US Dollar (USD) in Thursday’s London session. The near-term outlook of the GBP/USD pair is upbeat as uncertainty over the

Bank of England (BoE) rate-cut timing has deepened due to stubborn United Kingdom (UK) wage growth. This is a favorable scenario for the Pound Sterling.

Read More...

GBP/USD extends its upside above 1.2680 on weaker US Dollar

The

GBP/USD pair extends its upside near 1.2688 on Thursday during the early Asian session. The uptick of the major pair is supported by the weaker Greenback after the release of softer US CPI inflation data. Later in the day, the US Building Permits, Housing Starts, the weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, and Industrial Production will be released. Also, the Federal Reserve’s (Fed) Barr, Harker, Mester, and Bostic are set to speak on Thursday.

Read More...