Pound Sterling clings to gains near 1.2700 on firm Fed rate-cut bets

- The Pound Sterling holds gains near 1.2700 amid cheerful market sentiment.

- UK’s steady wage growth keeps BoE rate-cut context uncertain.

- An expected decline in the US CPI strengthens Fed rate-cut bets for September.

The Pound Sterling (GBP) turns sideways after posting a fresh monthly high near 1.2700 against the US Dollar (USD) in Thursday’s London session. The near-term outlook of the GBP/USD pair is upbeat as uncertainty over the Bank of England (BoE) rate-cut timing has deepened due to stubborn United Kingdom (UK) wage growth. This is a favorable scenario for the Pound Sterling.

UK Average Earnings grew steadily in the three months ending March, raising concerns over progress in inflation declining to the desired rate of 2%. High wage growth feeds service inflation, which has remained a major barrier to progress in the disinflation process.

By the weekend, the UK economic calendar has noting much to offer. Therefore, investors will keenly watch the commentary on interest rates from BoE policymakers: Megan Greene and Catherine Mann, who are scheduled to speak on Thursday and Friday, respectively.

Daily digest market movers: Pound Sterling remains firm amid uncertainty over BoE rate-cuts

- The Pound Sterling trades close to the round-level resistance of 1.2700 against the US Dollar. The GBP/USD pair remains firm as the market sentiment is quite bullish amid strong speculation that the Federal Reserve (Fed) will start lowering interest rates from the September meeting. S&P 500 futures post gains in the European session, exhibiting an improvement in investors’ risk-appetite.

- The CME FedWatch tool shows that the probability of interest rates declining from their current levels in the September meeting has increased to 73% from 69% recorded a week ago. Invertors’ confidence in Fed rate cuts has improved due to soft United States inflation report, easing labor market conditions and stagnant Retail Sales data for April.

- On Wednesday, the US Bureau of Labor Statistics (BLS) reported that annual headline and core Consumer Price Index (CPI) grew at a slower pace of 3.4% and 3.6%, respectively as expected. Fed policymakers mainly focus on the core inflation data for decision-making on interest rates. Though the inflation measure is almost double the required rate of 2%, an expected decline in price pressures has increased investors’ confidence that inflationary pressures will sustainably return to the desired rate of 2%.

- Retail Sales data, a leading indicator of consumer spending that also provides cues about the outlook on inflation, remained unchanged in April but was expected to rise by 0.4%. This has suggested that the inflation outlook has softened.

- Going forward, the next move in the US Dollar will be guided by Fed policymakers’ commentary on the interest rate guidance, with Fed Vice Chair for Supervision Michael Barr, Fed Bank of Philadelphia President Patrick Harker, Fed Bank of Cleveland President Loretta Mester and Fed Bank of Atlanta President Raphael Bostic scheduled to speak on Thursday.

- On the economic data front, investors will focus on the Initial Jobless Claims data for the week ending May 10, which are estimated to have declined to 220K. Last week, individuals claiming jobless benefits were most in eight months at 231K and weighed heavily on the US Dollar.

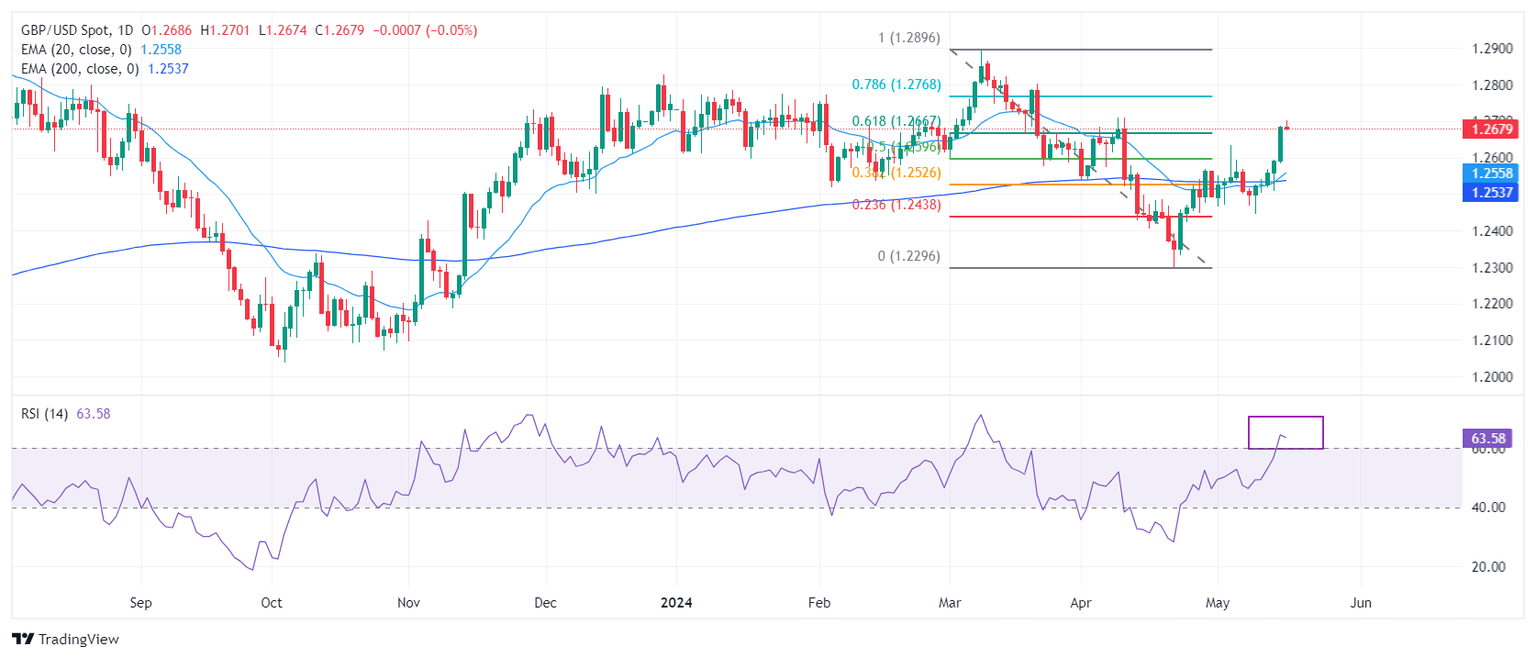

Technical Analysis: Pound Sterling's long-term appeal turns bullish

The Pound Sterling retraces 61.8% of its losses recorded from a 10-month high around 1.2900 marked on March 8. Near and long-term outlook of the GBP/USD pair has turned bullish as it climbs above the 20-day and 200-day Exponential Moving Averages (EMAs), which trade around 1.2565 and 1.2536, respectively.

The 14-period Relative Strength Index (RSI) has shifted into the bullish range of 60.00-80.00, suggesting that the momentum has leaned toward the upside.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Next release: Thu May 16, 2024 12:30

Frequency: Weekly

Consensus: 220K

Previous: 231K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.