Pound Sterling Price News and Forecast: British Pound – A silent power among the majors

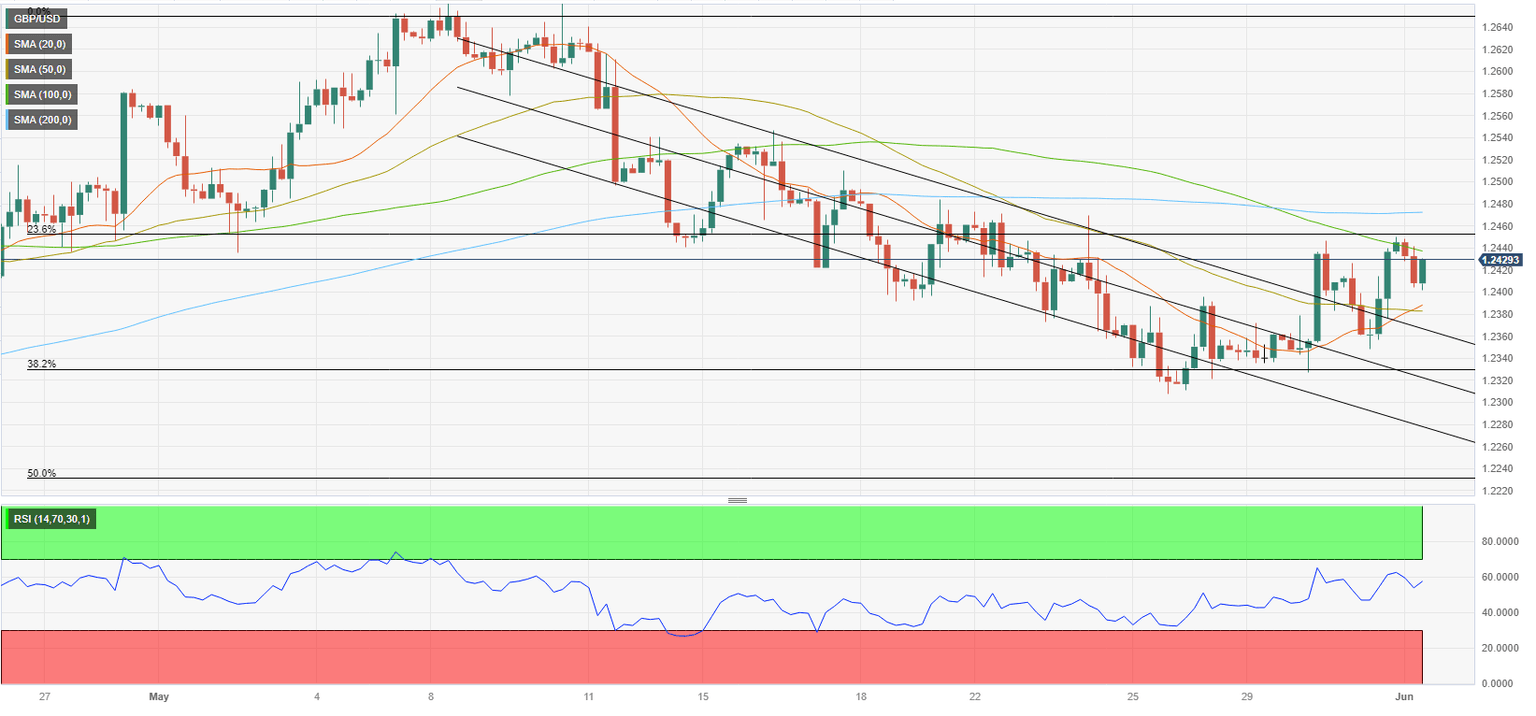

GBP/USD Forecast: Pound Sterling eyes additional gains above1.2450

GBP/USD has lost its traction and retreated toward 1.2400 after having closed the first three trading days of the week in positive territory. 1.2440/50 area aligns as key resistance and buyers could take action once that level is confirmed as support.

GBP/USD stayed under bearish pressure and dropped to the 1.2350 area in the first half of the day on Wednesday with safe-haven flows providing a boost to the US Dollar (USD). In the late American session, however, the USD lost its strength on improving risk mood after the US House of Representatives passed a bill to suspend the debt-ceiling through January 1, 2025. Moreover, dovish comments from Federal Reserve (Fed) officials put additional weight on the USD's shoulders. Read more ...

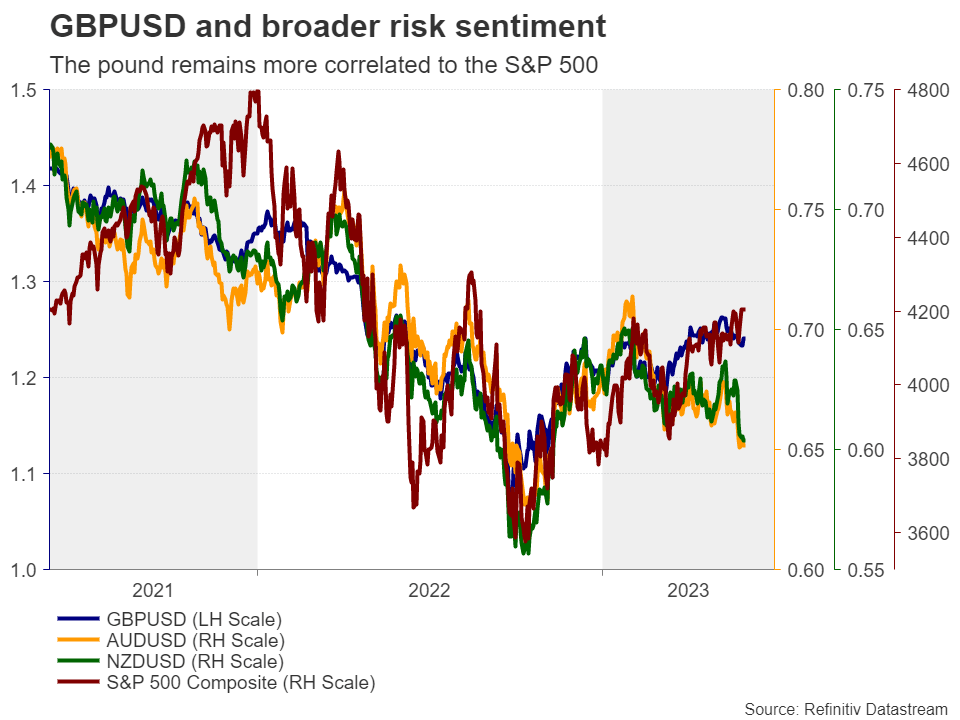

British Pound: A silent power among the majors

Despite coming under some pressure against its US counterpart lately, the British pound remains the best performing currency year-to-date. Will it continue performing well henceforth? With underlying inflation creeping up again in April, investors are hoping that the Bank of England will intensify its efforts to bring it to heel. But will policymakers rise to the occasion?

With the BoE abandoning its recession call and signaling that they will not hesitate to raise rates further should inflation pressures persist, market participants remained convinced that officials could deliver two more quarter-point increases by the end of the year. Read more ...

GBP/USD retreats from over one-week high, slides back closer to 1.2400 amid stronger USD

The GBP/USD pair continues with its struggle to move back above the 50-day Simple Moving Average (SMA) and attracts some sellers near the 1.2450 area, or over a one-week high touched earlier this Thursday. The pair drops to a fresh daily low, around the 1.2415-1.2410 region during the early part of the European session and for now, seems to have snapped a four-day winning streak.

Following the overnight modest pullback from its highest level since mid-March, the US Dollar (USD) regains positive traction amid a goodish pickup in the US Treasury bond yields. This, in turn, is seen as a key factor exerting some downward pressure on the GBP/USD pair. That said, a combination of factors might hold back the USD bulls from placing aggressive bets, warranting caution before confirming that the pair's recent bounce from the 1.2300 neighbourhood, or its lowest level since early April, has run out of steam. Read more ...

Author

FXStreet Team

FXStreet